Question: Please help Question 2 (32 marks) Northshore Securities is a prime broker that services many institutional investment clients. Northshore pro- vides services ranging from script

Please help

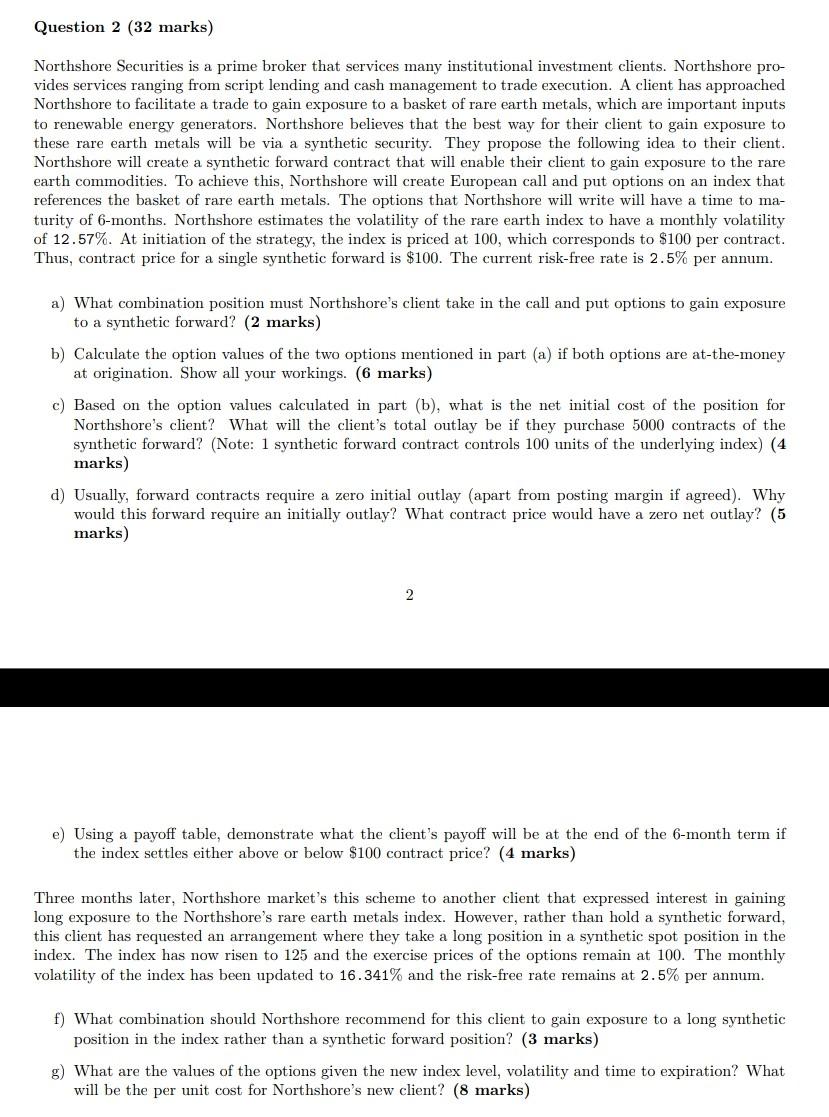

Question 2 (32 marks) Northshore Securities is a prime broker that services many institutional investment clients. Northshore pro- vides services ranging from script lending and cash management to trade execution. A client has approached Northshore to facilitate a trade to gain exposure to a basket of rare earth metals, which are important inputs to renewable energy generators. Northshore believes that the best way for their client to gain exposure to these rare earth metals will be via a synthetic security. They propose the following idea to their client. Northshore will create a synthetic forward contract that will enable their client to gain exposure to the rare earth commodities. To achieve this, Northshore will create European call and put options on an index that references the basket of rare earth metals. The options that Northshore will write will have a time to ma- turity of 6-months. Northshore estimates the volatility of the rare earth index to have a monthly volatility of 12.57%. At initiation of the strategy, the index is priced at 100, which corresponds to $100 per contract. Thus, contract price for a single synthetic forward is $100. The current risk-free rate is 2.5% per annum. a) What combination position must Northshore's client take in the call and put options to gain exposure to a synthetic forward? (2 marks) b) Calculate the option values of the two options mentioned in part (a) if both options are at-the-money at origination. Show all your workings. (6 marks) c) Based on the option values calculated in part (b), what is the net initial cost of the position for Northshore's client? What will the client's total outlay be if they purchase 5000 contracts of the synthetic forward? (Note: 1 synthetic forward contract controls 100 units of the underlying index) (4 marks) d) Usually, forward contracts require a zero initial outlay (apart from posting margin if agreed). Why would this forward require an initially outlay? What contract price would have a zero net outlay? (5 marks) 2 e) Using a payoff table, demonstrate what the client's payoff will be at the end of the 6-month term if the index settles either above or below $100 contract price? (4 marks) Three months later, Northshore market's this scheme to another client that expressed interest in gaining long exposure to the Northshore's rare earth metals index. However, rather than hold a synthetic forward, this client has requested an arrangement where they take a long position in a synthetic spot position in the index. The index has now risen to 125 and the exercise prices of the options remain at 100. The monthly volatility of the index has been updated to 16.341% and the risk-free rate remains at 2.5% per annum. f) What combination should Northshore recommend for this client to gain exposure to a long synthetic position in the index rather than a synthetic forward position? (3 marks) g) What are the values of the options given the new index level, volatility and time to expiration? What will be the per unit cost for Northshore's new client? (8 marks) Question 2 (32 marks) Northshore Securities is a prime broker that services many institutional investment clients. Northshore pro- vides services ranging from script lending and cash management to trade execution. A client has approached Northshore to facilitate a trade to gain exposure to a basket of rare earth metals, which are important inputs to renewable energy generators. Northshore believes that the best way for their client to gain exposure to these rare earth metals will be via a synthetic security. They propose the following idea to their client. Northshore will create a synthetic forward contract that will enable their client to gain exposure to the rare earth commodities. To achieve this, Northshore will create European call and put options on an index that references the basket of rare earth metals. The options that Northshore will write will have a time to ma- turity of 6-months. Northshore estimates the volatility of the rare earth index to have a monthly volatility of 12.57%. At initiation of the strategy, the index is priced at 100, which corresponds to $100 per contract. Thus, contract price for a single synthetic forward is $100. The current risk-free rate is 2.5% per annum. a) What combination position must Northshore's client take in the call and put options to gain exposure to a synthetic forward? (2 marks) b) Calculate the option values of the two options mentioned in part (a) if both options are at-the-money at origination. Show all your workings. (6 marks) c) Based on the option values calculated in part (b), what is the net initial cost of the position for Northshore's client? What will the client's total outlay be if they purchase 5000 contracts of the synthetic forward? (Note: 1 synthetic forward contract controls 100 units of the underlying index) (4 marks) d) Usually, forward contracts require a zero initial outlay (apart from posting margin if agreed). Why would this forward require an initially outlay? What contract price would have a zero net outlay? (5 marks) 2 e) Using a payoff table, demonstrate what the client's payoff will be at the end of the 6-month term if the index settles either above or below $100 contract price? (4 marks) Three months later, Northshore market's this scheme to another client that expressed interest in gaining long exposure to the Northshore's rare earth metals index. However, rather than hold a synthetic forward, this client has requested an arrangement where they take a long position in a synthetic spot position in the index. The index has now risen to 125 and the exercise prices of the options remain at 100. The monthly volatility of the index has been updated to 16.341% and the risk-free rate remains at 2.5% per annum. f) What combination should Northshore recommend for this client to gain exposure to a long synthetic position in the index rather than a synthetic forward position? (3 marks) g) What are the values of the options given the new index level, volatility and time to expiration? What will be the per unit cost for Northshore's new client? (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts