Question: PLEASE HELP QUESTION 2 (a) Calculate the annual returns and standard deviation of annual returns for the following portfolio. Assume that a correlation coefficient of

PLEASE HELP

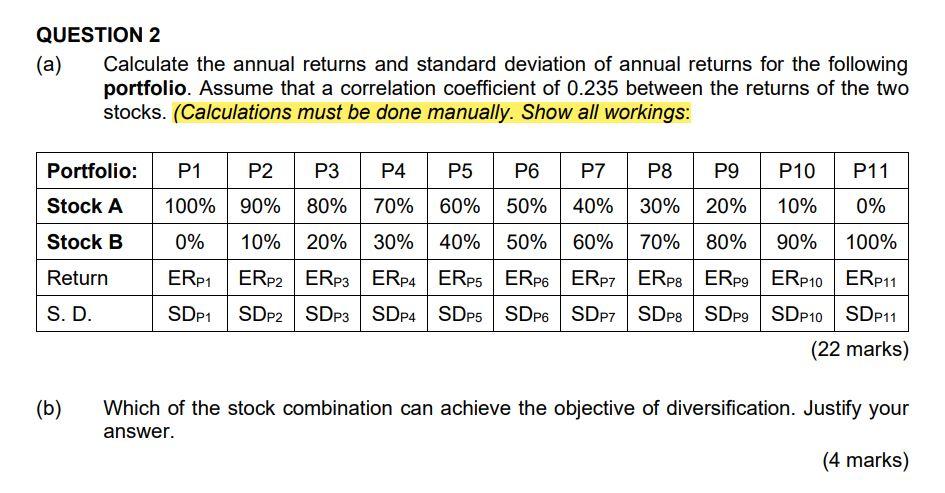

QUESTION 2 (a) Calculate the annual returns and standard deviation of annual returns for the following portfolio. Assume that a correlation coefficient of 0.235 between the returns of the two stocks. (Calculations must be done manually. Show all workings: Portfolio: Stock A Stock B 70% 60% P1 P2 P3 P4 P5 P6 P7 P8 P9 P10 P11 100% 90% 80% 50% 40% 30% 20% 10% 0% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% ERP1 ERP2 ERP ERP4 ERP ERP ERP ERP ERP, ERP10 ERP11 SDP1 SDp2 SDP3 SDp4 SDP5 SDP6 SDp7 SDP8 SDp9 SDP10 SDp11 (22 marks) Return S. D. (b) Which of the stock combination can achieve the objective of diversification. Justify your answer. (4 marks) QUESTION 2 (a) Calculate the annual returns and standard deviation of annual returns for the following portfolio. Assume that a correlation coefficient of 0.235 between the returns of the two stocks. (Calculations must be done manually. Show all workings: Portfolio: Stock A Stock B 70% 60% P1 P2 P3 P4 P5 P6 P7 P8 P9 P10 P11 100% 90% 80% 50% 40% 30% 20% 10% 0% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% ERP1 ERP2 ERP ERP4 ERP ERP ERP ERP ERP, ERP10 ERP11 SDP1 SDp2 SDP3 SDp4 SDP5 SDP6 SDp7 SDP8 SDp9 SDP10 SDp11 (22 marks) Return S. D. (b) Which of the stock combination can achieve the objective of diversification. Justify your answer. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts