Question: please help Question 3: Sun Trading Bhd. purchased a building at the beginning of 2016 at a price of RM600,000. Sun occupied half of the

please help

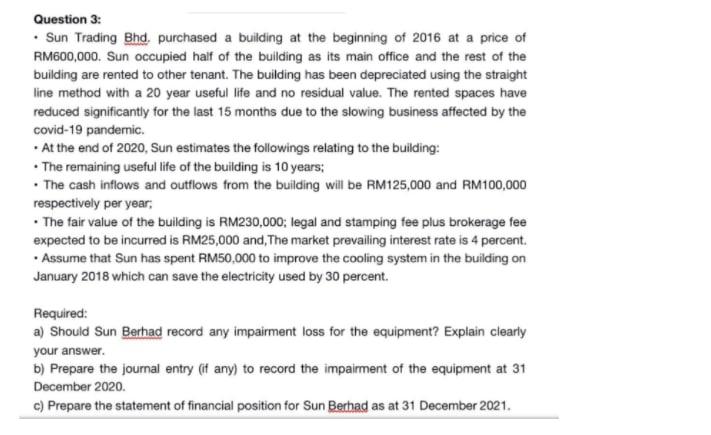

Question 3: Sun Trading Bhd. purchased a building at the beginning of 2016 at a price of RM600,000. Sun occupied half of the building as its main office and the rest of the building are rented to other tenant. The building has been depreciated using the straight line method with a 20 year useful life and no residual value. The rented spaces have reduced significantly for the last 15 months due to the slowing business affected by the covid-19 pandemnic. At the end of 2020, Sun estimates the followings relating to the building: . The remaining useful life of the building is 10 years; The cash inflows and outflows from the building will be RM125,000 and RM100,000 respectively per year; The fair value of the building is RM230,000; legal and stamping fee plus brokerage fee expected to be incurred is RM25,000 and, The market prevailing interest rate is 4 percent Assume that Sun has spent RM50,000 to improve the cooling system in the building on January 2018 which can save the electricity used by 30 percent. Required: a) Should Sun Berhad record any impairment loss for the equipment? Explain clearly your answer. b) Prepare the journal entry (if any) to record the impairment of the equipment at 31 December 2020. c) Prepare the statement of financial position for Sun Berhad as at 31 December 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts