Question: please help!! QUESTION 3 Which account should be credited if partners make an additional investment into the business? Net Income Account Partner's Drawing Account Partners

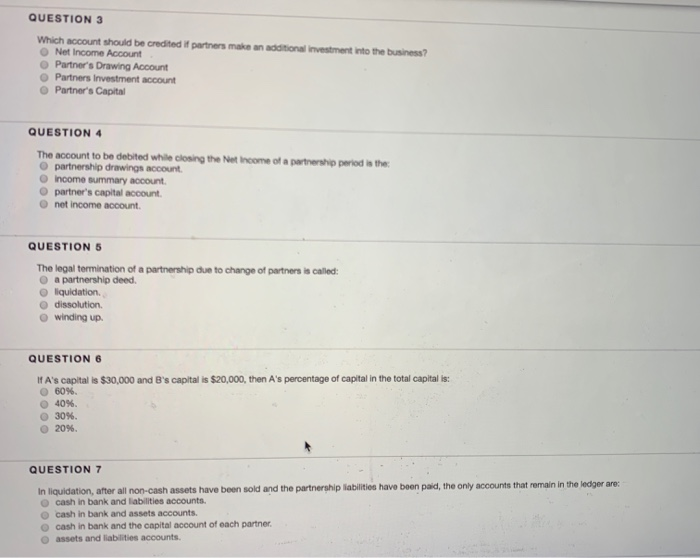

QUESTION 3 Which account should be credited if partners make an additional investment into the business? Net Income Account Partner's Drawing Account Partners Investment account Partner's Capital QUESTION 4 The account to be debited while closing the Net Income of a partnership period is the partnership drawings account incomo summary account partner's capital account net income account QUESTIONS The legal termination of a partnership due to change of partners is called: a partnership deed. liquidation dissolution winding up QUESTION 6 If A's capital is $30,000 and B's capital is $20,000, then A's percentage of capital in the total capital is: 60%. 40%. 30%. 20%. QUESTION 7 In liquidation, after all non-cash assets have been sold and the partnership liabilities have been paid, the only accounts that remain in the ledger are: cash in bank and liabilities accounts. cash in bank and assets accounts. cash in bank and the capital account of each partner. assets and liabilities accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts