Question: *** PLEASE HELP!!! *** Question 4 (20 points) For the below Income Statement and Balance Sheet, you are to match the Available Choices with the

*** PLEASE HELP!!! ***

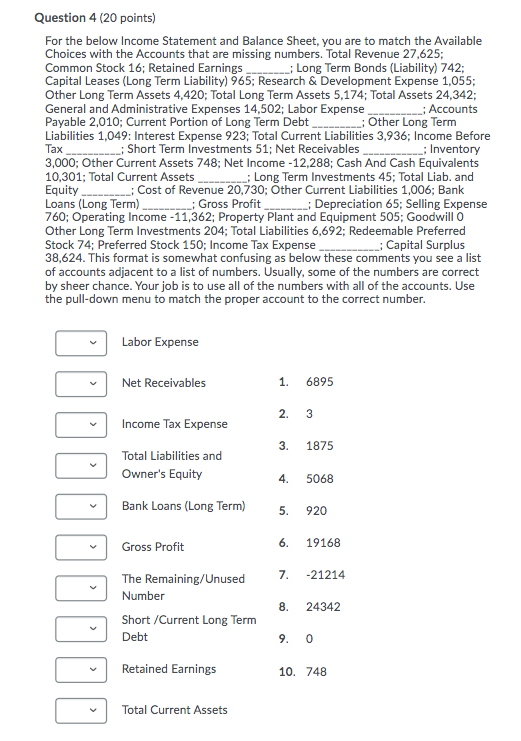

Question 4 (20 points) For the below Income Statement and Balance Sheet, you are to match the Available Choices with the Accounts that are missing numbers. Total Revenue 27,625; Common Stock 16; Retained Earnings i Long Term Bonds (Liability) 742; Capital Leases (Long Term Liability) 965; Research & Development Expense 1,055; Other Long Term Assets 4,420; Total Long Term Assets 5,174; Total Assets 24,342; General and Administrative Expenses 14,502; Labor Expense : Accounts Payable 2,010; Current Portion of Long Term Debt ; Other Long Term Liabilities 1,049: Interest Expense 923; Total Current Liabilities 3,936; Income Before Tax ; Short Term Investments 51; Net Receivables ; Inventory 3,000; Other Current Assets 748; Net Income -12,288; Cash And Cash Equivalents 10,301; Total Current Assets ; Long Term Investments 45; Total Liab. and Equity _ Cost of Revenue 20,730; Other Current Liabilities 1,006; Bank Loans (Long Term) ; Gross Profit -; Depreciation 65; Selling Expense 760; Operating Income -11,362; Property Plant and Equipment 505; Goodwill o Other Long Term Investments 204; Total Liabilities 6,692; Redeemable Preferred Stock 74; Preferred Stock 150; Income Tax Expense ; Capital Surplus 38,624. This format is somewhat confusing as below these comments you see a list of accounts adjacent to a list of numbers. Usually, some of the numbers are correct by sheer chance. Your job is to use all of the numbers with all of the accounts. Use the pull-down menu to match the proper account to the correct number. Labor Expense Net Receivables 1. 6895 2. 3 Income Tax Expense 3. 1875 Total Liabilities and Owner's Equity 4. 5068 Bank Loans (Long Term) 5. 920 6. Gross Profit 19168 7. -21214 The Remaining/Unused Number Short/Current Long Term Debt 8. 24342 9.0 Retained Earnings 10. 748 Total Current Assets Question 4 (20 points) For the below Income Statement and Balance Sheet, you are to match the Available Choices with the Accounts that are missing numbers. Total Revenue 27,625; Common Stock 16; Retained Earnings i Long Term Bonds (Liability) 742; Capital Leases (Long Term Liability) 965; Research & Development Expense 1,055; Other Long Term Assets 4,420; Total Long Term Assets 5,174; Total Assets 24,342; General and Administrative Expenses 14,502; Labor Expense : Accounts Payable 2,010; Current Portion of Long Term Debt ; Other Long Term Liabilities 1,049: Interest Expense 923; Total Current Liabilities 3,936; Income Before Tax ; Short Term Investments 51; Net Receivables ; Inventory 3,000; Other Current Assets 748; Net Income -12,288; Cash And Cash Equivalents 10,301; Total Current Assets ; Long Term Investments 45; Total Liab. and Equity _ Cost of Revenue 20,730; Other Current Liabilities 1,006; Bank Loans (Long Term) ; Gross Profit -; Depreciation 65; Selling Expense 760; Operating Income -11,362; Property Plant and Equipment 505; Goodwill o Other Long Term Investments 204; Total Liabilities 6,692; Redeemable Preferred Stock 74; Preferred Stock 150; Income Tax Expense ; Capital Surplus 38,624. This format is somewhat confusing as below these comments you see a list of accounts adjacent to a list of numbers. Usually, some of the numbers are correct by sheer chance. Your job is to use all of the numbers with all of the accounts. Use the pull-down menu to match the proper account to the correct number. Labor Expense Net Receivables 1. 6895 2. 3 Income Tax Expense 3. 1875 Total Liabilities and Owner's Equity 4. 5068 Bank Loans (Long Term) 5. 920 6. Gross Profit 19168 7. -21214 The Remaining/Unused Number Short/Current Long Term Debt 8. 24342 9.0 Retained Earnings 10. 748 Total Current Assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts