Question: Please help QUESTION 4 GrowCorp is considering launching a new product called the GrowWidget. After extensive market research, you have determined that sales of GrowWidgets

Please help

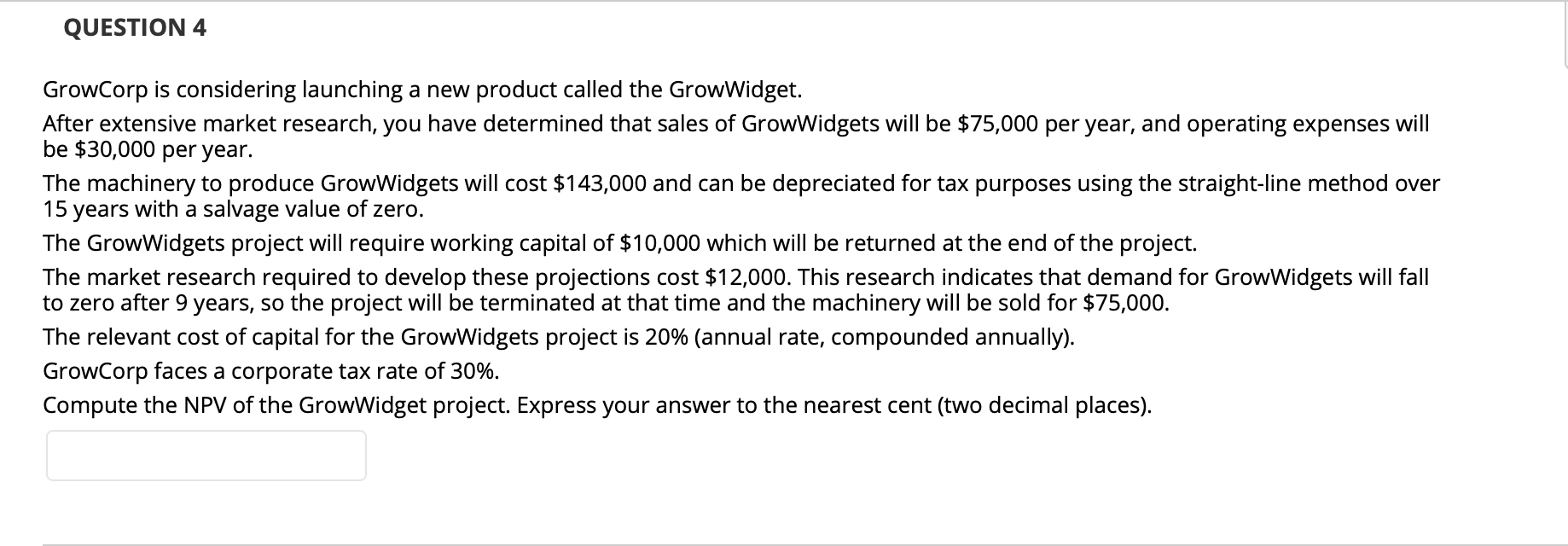

QUESTION 4 GrowCorp is considering launching a new product called the GrowWidget. After extensive market research, you have determined that sales of GrowWidgets will be $75,000 per year, and operating expenses will be $30,000 per year. The machinery to produce GrowWidgets will cost $143,000 and can be depreciated for tax purposes using the straight-line method over 15 years with a salvage value of zero. The GrowWidgets project will require working capital of $10,000 which will be returned at the end of the project. The market research required to develop these projections cost $12,000. This research indicates that demand for GrowWidgets will fall to zero after 9 years, so the project will be terminated at that time and the machinery will be sold for $75,000. The relevant cost of capital for the GrowWidgets project is 20% (annual rate, compounded annually). GrowCorp faces a corporate tax rate of 30%. Compute the NPV of the GrowWidget project. Express your answer to the nearest cent (two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts