Question: Please help! Question 4: The AB partnership has the following items of income and expense for the taxable year (see table below). a. Divide the

Please help!

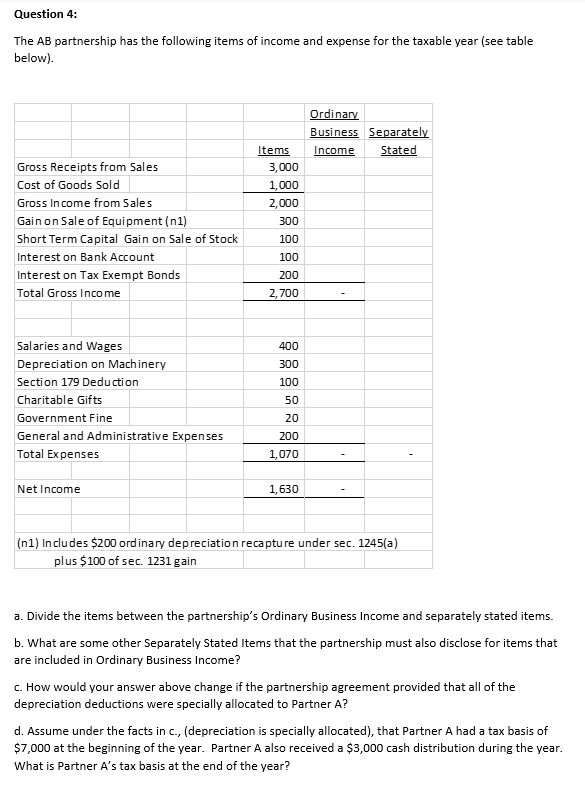

Question 4: The AB partnership has the following items of income and expense for the taxable year (see table below). a. Divide the items between the partnership's Ordinary Business Income and separately stated items. b. What are some other Separately Stated Items that the partnership must also disclose for items that are included in Ordinary Business Income? c. How would your answer above change if the partnership agreement provided that all of the depreciation deductions were specially allocated to Partner A? d. Assume under the facts in c., (depreciation is specially allocated), that Partner A had a tax basis of $7,000 at the beginning of the year. Partner A also received a $3,000 cash distribution during the year. What is Partner A's tax basis at the end of the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts