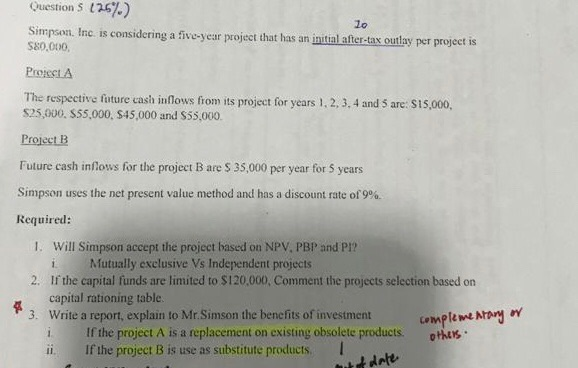

Question: please help Question 5 13.5%) lo Simpsen, Inc is considering a five-year project that has an initial after-tax outlay per project is The respective future

Question 5 13.5%) lo Simpsen, Inc is considering a five-year project that has an initial after-tax outlay per project is The respective future cash nflows from its project for years 1, 2. 3. 4 and 5 are: S15.000. S25,000. S55,000, $45,000 and $55,000 Project B Future cash inflows for the project B are S 35,000 per year for S years Simpson uses the net present value method and has a discount rate of 9%. Required: Will Simpson accept the project based on NPV, PBP and P!? 1. i Mutually exclusive Vs Independent projects 2. If the capital funds are limited to $120,000, Comment the projects selection based on a capital rationing table 3. Write a report, explain to Mr.Simson the benefits of investmentmplewt Arary i If the project A is a replacement on existing obsolete products. othes i. If the project B is use as substitute products

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts