Question: please help! question example Savo HW Score: 0%, 0 of 7 pts Homework: Chapter 14 Homework 3 of 7 (0 complete) P14-9 (similar to) Score:

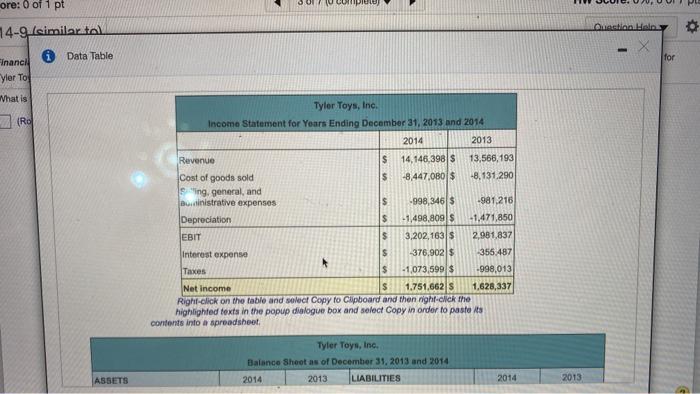

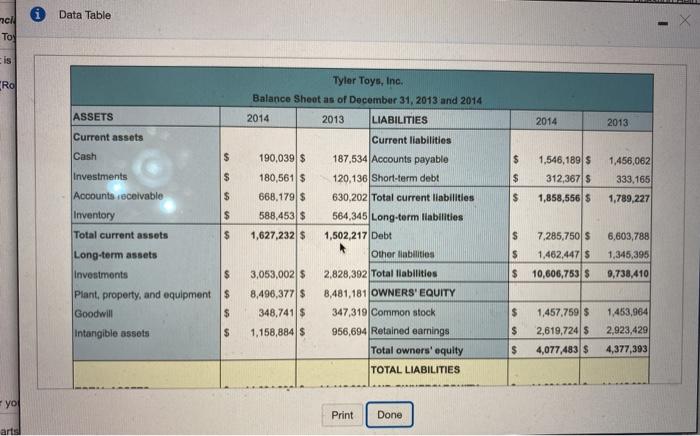

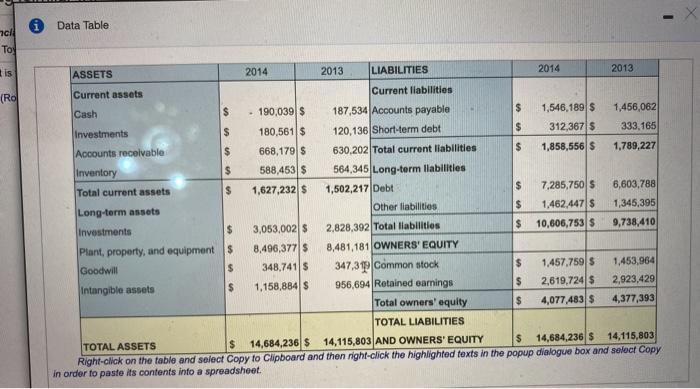

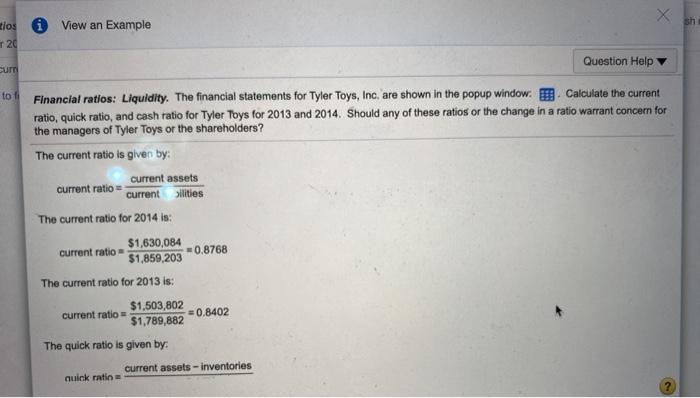

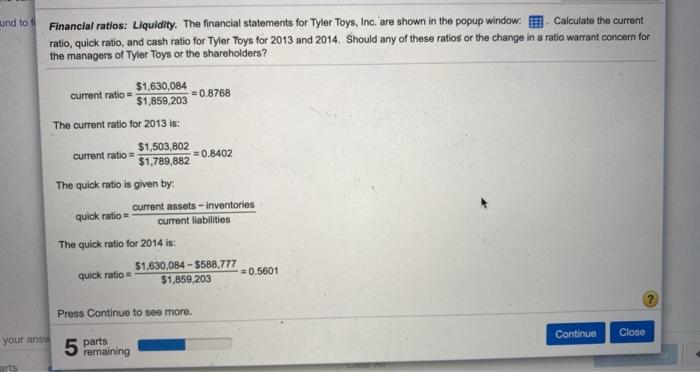

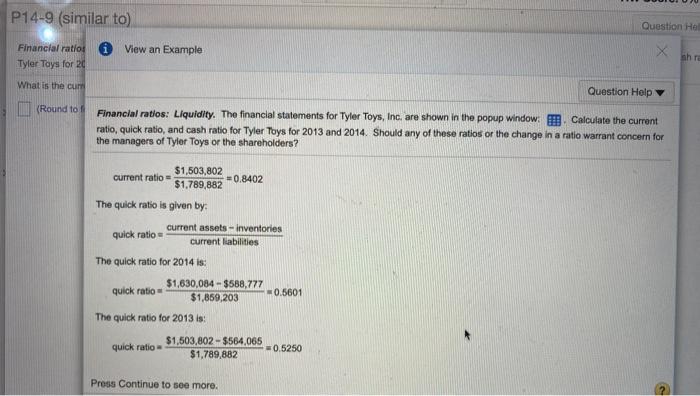

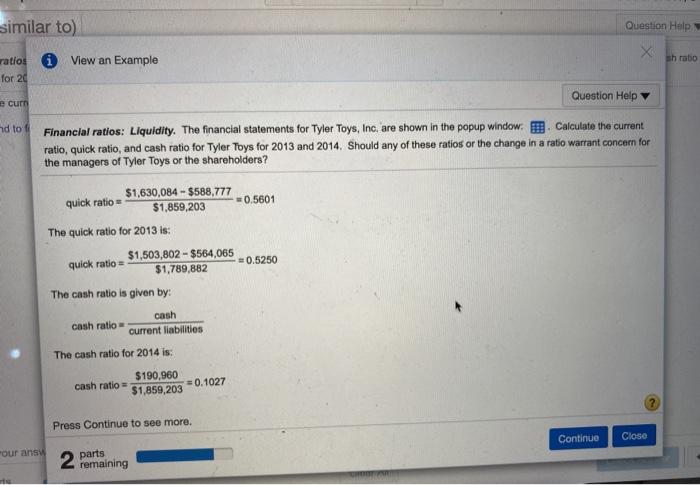

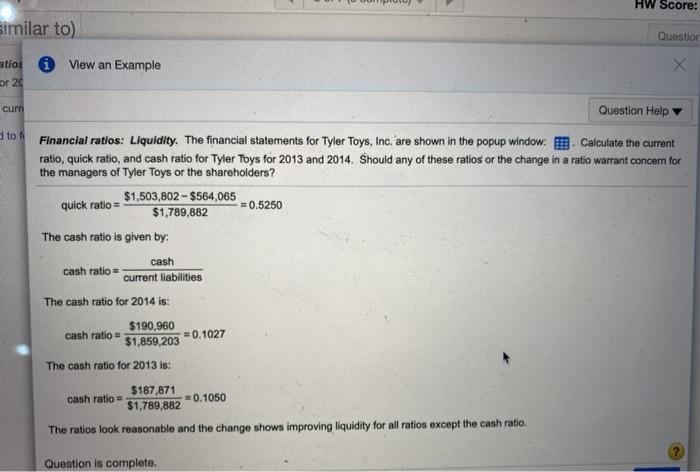

Savo HW Score: 0%, 0 of 7 pts Homework: Chapter 14 Homework 3 of 7 (0 complete) P14-9 (similar to) Score: 0 of 1 pt Question Help Financial ratios: Liquidity. The financial statements for Tyler Toys, Inc. are shown in the popup window: Calculate the current ratio, quick ratio, and cash ratio for Tyler Toys for 2013 and 2014. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? What is the current ratio for 2014? (Round to four decimal place) O 01 ore: 0 of 1 pt 14-9.Isimilar tal O Data Table Question ban X - for Financi yler Top What is Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue $ 14,146,398$ 13,566,193 Cost of goods sold s -8.447.000 $ -8,131.290 19"ing general, and Binistrative expenses $ -998,3461$ -981,218 Depreciation $ -1,498,8091 -1.471,850 EBIT $ 3,202, 1635 2,981,837 Interest expense $ -376,902 $ 356.487 Taxes $ -1,073,599 $ -998,013 Net Income s 1.751,6625 1,628,337 Right click on the table and select Copy to clipboard and then night-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet Tyler Toys, Inc. Balance Sheet as of December 31, 2013 and 2014 2014 2013 LIABILITIES ASSETS 2014 2013 Data Table cl Toy Ro Tyler Toys, Inc. Balance Sheet as of December 31, 2013 and 2014 2014 2013 LIABILITIES ASSETS 2014 2013 Current assets Cash 190,039 $ $ 1.456,062 $ 1,546,189 $ 312,367 $ 1,858,556 $ 333,165 1,789,227 $ 180,561 $ 668,179 $ 588,453 $ 1,627,232 $ $ Investments $ Accounts receivable $ Inventory $ Total current assets $ Long-term assets Investments $ Plant, property, and equipment S Goodwill $ Intangible assets Current liabilities 187,534 Accounts payable 120,136 Short-term debt 630,202 Total current liabilities 564,345 Long-term liabilities 1,502,217 Debt Other liabilities 2,828,392 Total liabilities 8,481,181 OWNERS' EQUITY 347,319 Common stock 956,694 Retained earnings Total owners' equity TOTAL LIABILITIES $ 7.285,750 $ 1,462,447 S 10,606,753 S 6,603, 788 1,345,395 9,738,410 $ 3,053,002 $ 8,496,377 $ 348,741 $ 1,158,884 $ $ $ 1,457,759 $ 2,619,724 $ 4,077,483 $ 1.453,964 2,923,429 4,377,393 $ yol Print Done arts i Data Table cl Toy lis (RO ASSETS 2014 2013 LIABILITIES 2014 2013 Current assets Current liabilities Cash 190,039 $ 187,534 Accounts payable 1,546,189 $ 1,456,062 Investments 180,561 $ 120,136 Short-term debt $ 312,367 $ 333,165 Accounts receivable 668,179 $ 630,202 Total current liabilities $ 1,858,556 $ 1,789,227 Inventory 588,453 $ 564,345 Long-term Ilabilities Total current assets 1,627,232 $ 1,502,217 Debt $ 7,285,750 $ 6,603,788 Long-term assets Other liabilities $ 1,462,447 $ 1,345,395 Investments $ 3,053,002 $ 2,828,392 Total liabilities $ 10,606,7535 9,738,410 Plant, property, and equipment ($ 8,496,377 $ 8,481,181 OWNERS' EQUITY Goodwill $ 348.741 $ 347.39 Common stock $ 1,457,759 $ 1,453,964 Intangible assets $ 1,158,884 S 956,694 Retained earnings $ 2,619,7245 2,923,429 Total owners' equity $ 4,077.483 S 4,377,393 TOTAL LIABILITIES TOTAL ASSETS $ 14,684,236 $ 14,115,803 AND OWNERS' EQUITY $ 14,684,236 $ 14,115,803 Right click on the table and select Copy to clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet. X i View an Example sh tios r20 Question Help eur to Financial ratios: Liquidity. The financial statements for Tyler Toys, Inc, are shown in the popup window. I. Calculate the current ratio, quick ratio, and cash ratio for Tyler Toys for 2013 and 2014. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? The current ratio is given by: current assets current ratio currentilities The current ratio for 2014 is: $1,630,084 current ratio 0.8768 $1,859,203 The current ratio for 2013 is: $1,503,802 current ratio = +0.8402 $1,789,882 The quick ratio is given by: current assets - inventories quick ratin und to Financial ratios: Liquidity. The financial statements for Tyler Toys, Inc. are shown in the popup window. Calculate the current ratio, quick ratio, and cash ratio for Tyler Toys for 2013 and 2014. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? $1,630,084 current ratio $1,859,203 =0.8768 The current ratio for 2013 is: $1,503,802 current ratio = 0.8402 $1,789,882 The quick ratio is given by: current assets - Inventories current liabilities The quick ratio for 2014 is: $1,630,084 - $588,777 quick ratio =0.5601 $1,859,203 quick ratio Press Continue to see more. Continue Close your ans parts 5 remaining arts P14-9 (similar to) Question He Financial ratioti View an Example Tyler Toys for 20 hr What is the curr Question Help I (Round to Financial ratios: Liquidity. The financial statements for Tyler Toys, Inc. are shown in the popup window. Calculate the current ratio, quick ratio, and cash ratio for Tyler Toys for 2013 and 2014. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? $1,503,802 current ratio = +0.8402 $1,789,882 The quick ratio is given by: current assets - inventories quick ratio current liabilities The quick ratio for 2014 is: $1,630,084 - $588,777 quick ratio 0.5601 $1,859,203 The quick ratio for 2013 is: $1,503,802 - $564,065 quick ratio =0.5250 $1,789,882 Press Continue to see more. similar to) Question Help i View an Example shrabo ratios for 20 Question Help cum hd to Financial ratios: Liquidity. The financial statements for Tyler Toys, Inc. are shown in the popup window. Calculate the current ratio, quick ratio, and cash ratio for Tyler Toys for 2013 and 2014. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? $1,630,084 - $588,777 quick ratio =0.5601 $1,859,203 The quick ratio for 2013 is: quick ratio $1,503,802 - $564,065 *0.5250 $1,789,882 The cash ratio is given by: cash cash ratio- current liabilities The cash ratio for 2014 is: $190,960 cash ratio $1,859,203 0.1027 Press Continue to see more. Continue Close Pour ans parts 2 remaining HW Score: Similar to) Question 0 View an Example antios or 20 curn to Question Help Financial ratios: Liquidity. The financial statements for Tyler Toys, Inc. are shown in the popup window. . Calculate the current ratio, quick ratio, and cash ratio for Tyler Toys for 2013 and 2014. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? $1,503,802 - $564,065 quick ratio = $1,789,882 = 0.5250 The cash ratio is given by: cash cash ratio = current liabilities The cash ratio for 2014 is: $190,960 cash ratio = 0.1027 $1,859,203 The cash ratio for 2013 is: $187,871 cash ratio = -0.1050 $1,789,882 The ratios look reasonable and the change shows improving liquidity for all ratios except the cash ratio. Question is complete

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts