Question: please help question number three; compute for discount yield, Yield to Maturity, Holding Period Yield & Capital Gain Yield. I have done the rest but

please help question number three; compute for discount yield, Yield to Maturity, Holding Period Yield & Capital Gain Yield. I have done the rest but those i am stuck. This question is not intended for assignment but for personal knowledge.

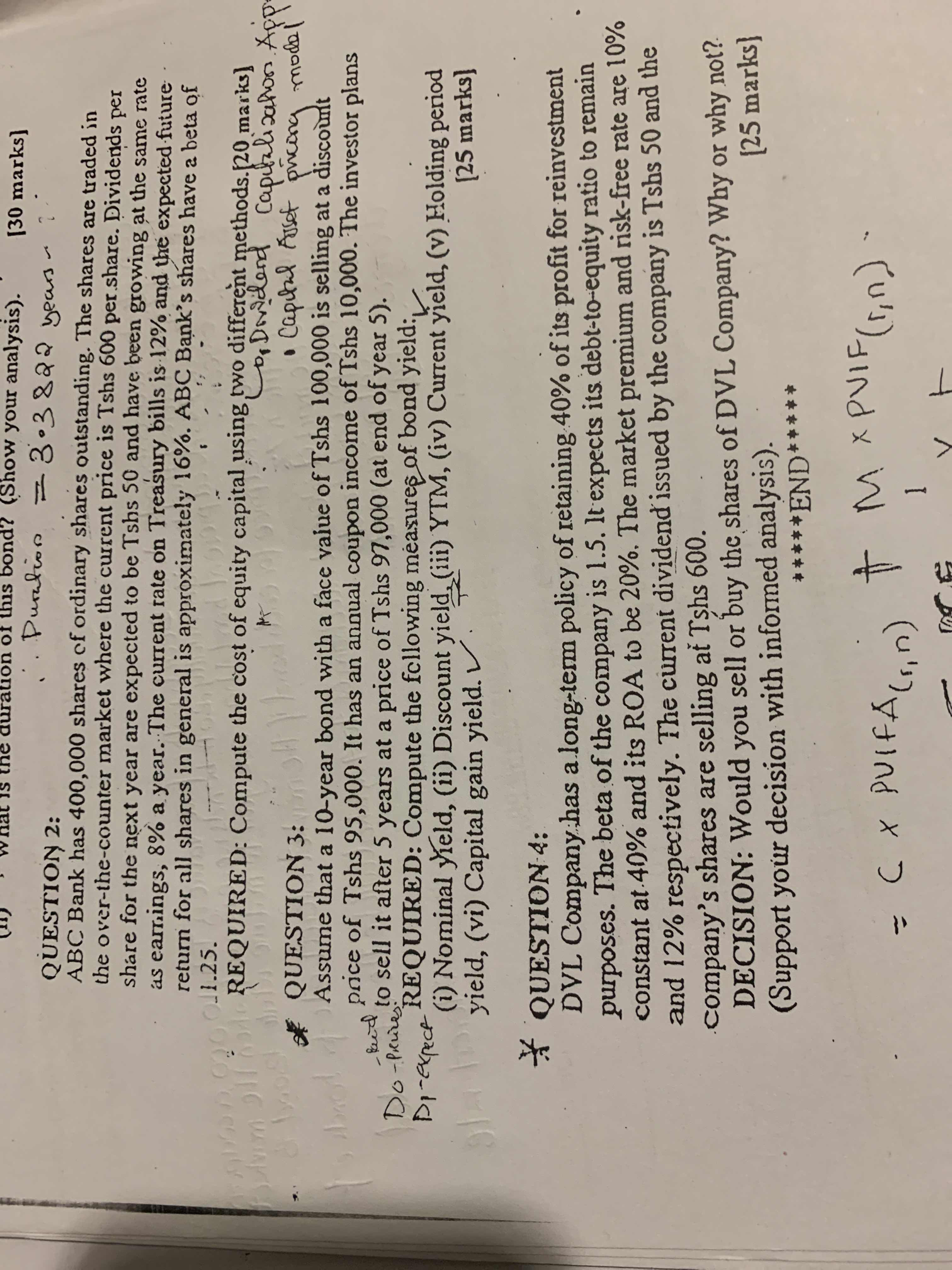

ration of this bond? (Show your analysis). . Duration = 3.3822 years - [30 marks] QUESTION 2: ABC Bank has 400,000 shares of ordinary shares outstanding. The shares are traded in the over-the-counter market where the current price is Tshs 600 per share. Dividends per share for the next year are expected to be Tshs 50 and have been growing at the same rate as earnings, 8% a year. The current rate on Treasury bills is 12% and the expected future return for all shares in general is approximately 16%. ABC Bank's shares have a beta of 190 0 020 0.1.25. REQUIRED: Compute the cost of equity capital using two different methods.[20 marks] QUESTION 3: D, Dividend capitalization App . Capital Asset pricing model Assume that a 10-year bond with a face value of Tshs 100,000 is selling at a discount price of Tshs 95,000. It has an annual coupon income of Tshs 10,000. The investor plans Do - Prices . to sell it after 5 years at a price of Tshs 97,000 (at end of year 5). DI-expect REQUIRED: Compute the following measures of bond yield: (i) Nominal yield, (ii) Discount yield, (iii) YTM, (iv) Current yield, (v) Holding period yield, (vi) Capital gain yield. . [25 marks] QUESTION 4: DVL Company has a long-term policy of retaining 40% of its profit for reinvestment purposes. The beta of the company is 1.5. It expects its debt-to-equity ratio to remain constant at.40% and its ROA to be 20%. The market premium and risk-free rate are 10% and 12% respectively. The current dividend issued by the company is Tshs 50 and the company's shares are selling at Tshs 600. DECISION: Would you sell or buy the shares of DVL Company? Why or why not? (Support your decision with informed analysis). [25 marks] * * *#*END* ***# = C X PUIFA (s.n ) M X PVIF ( in )