Question: please help questions #1-3 QUESTION 1 12 points Save Answer A European call option written on one share of Ponce de Leon Foods, Inc. has

please help questions #1-3

please help questions #1-3

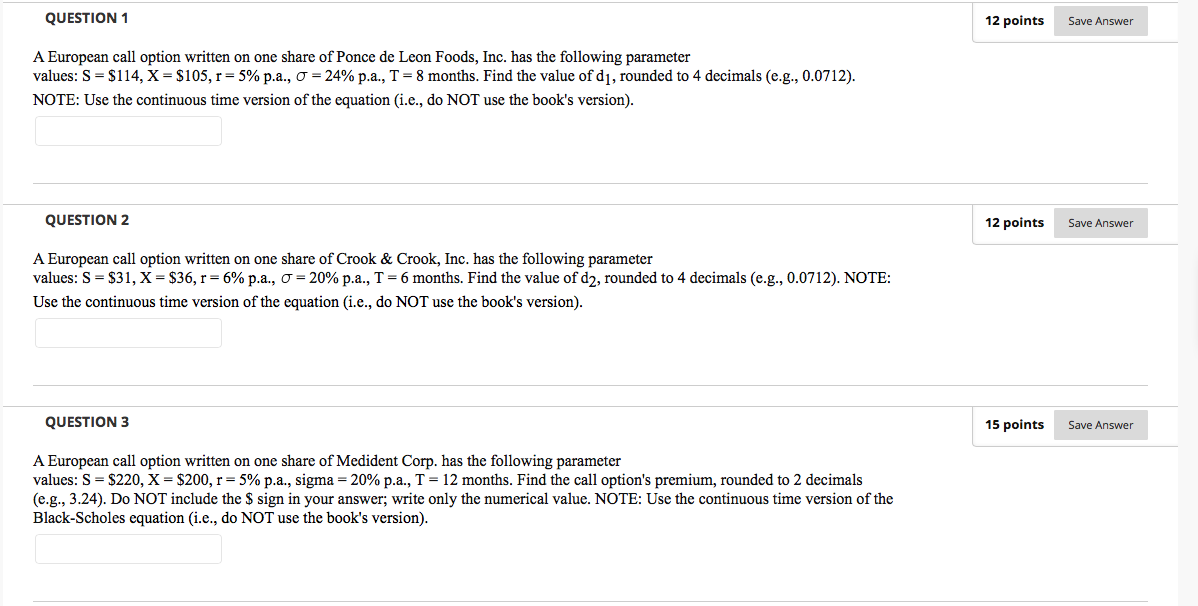

QUESTION 1 12 points Save Answer A European call option written on one share of Ponce de Leon Foods, Inc. has the following parameter values: S = $114, X = $105, r = 5% p.a., 0 = 24% p.a., T = 8 months. Find the value of d1, rounded to 4 decimals (e.g., 0.0712). NOTE: Use the continuous time version of the equation (i.e., do NOT use the book's version). QUESTION 2 12 points Save Answer A European call option written on one share of Crook & Crook, Inc. has the following parameter values: S = $31, X = $36, r = 6% p.a., o = 20% p.a., T = 6 months. Find the value of d2, rounded to 4 decimals (e.g., 0.0712). NOTE: Use the continuous time version of the equation (i.e., do NOT use the book's version). QUESTION 3 15 points Save Answer A European call option written on one share of Medident Corp. has the following parameter values: S = $220, X = $200, r = 5% p.a., sigma = 20% p.a., T = 12 months. Find the call option's premium, rounded to 2 decimals (e.g., 3.24). Do NOT include the $ sign in your answer; write only the numerical value. NOTE: Use the continuous time version of the Black-Scholes equation (i.e., do NOT use the book's version). QUESTION 1 12 points Save Answer A European call option written on one share of Ponce de Leon Foods, Inc. has the following parameter values: S = $114, X = $105, r = 5% p.a., 0 = 24% p.a., T = 8 months. Find the value of d1, rounded to 4 decimals (e.g., 0.0712). NOTE: Use the continuous time version of the equation (i.e., do NOT use the book's version). QUESTION 2 12 points Save Answer A European call option written on one share of Crook & Crook, Inc. has the following parameter values: S = $31, X = $36, r = 6% p.a., o = 20% p.a., T = 6 months. Find the value of d2, rounded to 4 decimals (e.g., 0.0712). NOTE: Use the continuous time version of the equation (i.e., do NOT use the book's version). QUESTION 3 15 points Save Answer A European call option written on one share of Medident Corp. has the following parameter values: S = $220, X = $200, r = 5% p.a., sigma = 20% p.a., T = 12 months. Find the call option's premium, rounded to 2 decimals (e.g., 3.24). Do NOT include the $ sign in your answer; write only the numerical value. NOTE: Use the continuous time version of the Black-Scholes equation (i.e., do NOT use the book's version)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts