Question: Please help questions 9 and 10 by Excel, including the screenshots from the Excel please. 8. The closing prices for stocks ABC and XYZ last

Please help questions 9 and 10 by Excel, including the screenshots from the Excel please.

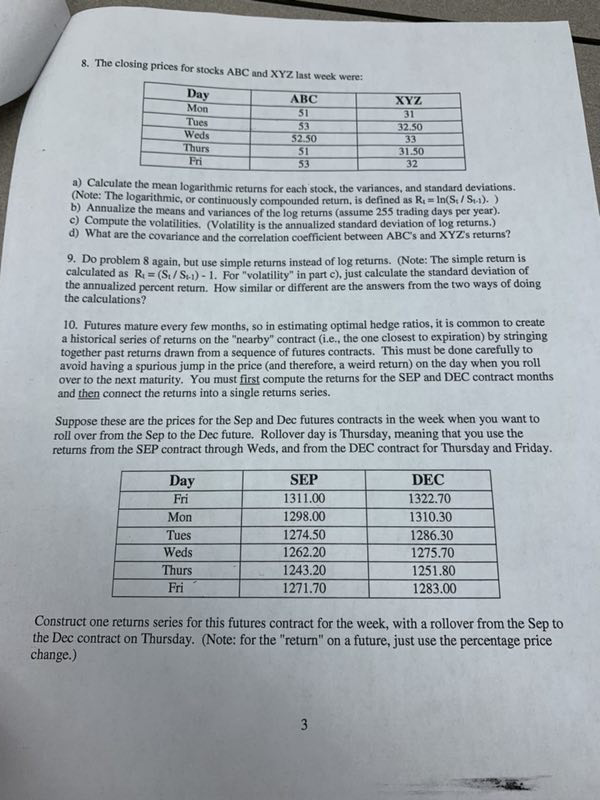

8. The closing prices for stocks ABC and XYZ last week were: ay Mon ABC 53 52.50 51 53 XYZ 32.50 31.50 Weds Thurs Fri 32 a) Calculate the mean logarithmic returns for each stock, the variances, and standard deviations. Note: The logarithmic, or continuously compounded return, is defined as R In(S/Si). ) ) Annualize the means and variances of the log returns (assume 255 trading days per year). c) Compute the volatilities. (Volatility is the annualized standard deviation of log returns.) d) What are the covariance and the correlation coefficient between ABC's and XYZ's returns? 9. Do problem 8 again, but use simple returns instead of log returns. (Note: The simple return is calculated as R (S/Si)-1. For "volatility" in part e), just calculate the standard deviation of the annualized percent return. the calculations? How similar or different are the answers from the two ways of doing 10. Futures mature every few months, so in estimating optimal hedge ratios, it is common to create a historical series of returns on the "nearby" contract (i.e, the one closest to expiration) by stringing together past returns drawn from a sequence of futures contracts. This must be done carefully to avoid having a spurious jump in the price (and therefore, a weird return) on the day when you roll over to the next maturity. You must first compute the returns for the SEP and DEC contract months and then connect the returns into a single returns series. Suppose these are the prices for the Sep and Dec futures contracts in the week when you want to roll over from the Sep to the Dec future. Rollover day is Thursday, meaning that you use the returns from the SEP contract through Weds, and from the DEC contract for Thursday and Friday. Day Fri Mon Tues Weds Thurs Fri SEP 1311.00 1298.00 1274.50 1262.20 1243.20 1271.70 DEC 1322.70 1310.30 1286.30 1275.70 1251.80 1283.00 Construct one returns series for this futures contract for the week, with a rollover from the Sep to the Dec contract on Thursday. (Note: for the "return" on a future, just use the percentage price change.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts