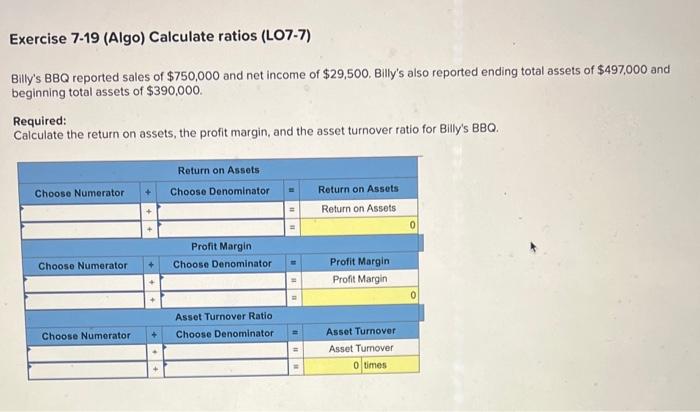

Question: please help quick Exercise 7-19 (Algo) Calculate ratios (LO7-7) Billy's BBQ reported sales of $750,000 and net income of $29,500. Billy's also reported ending total

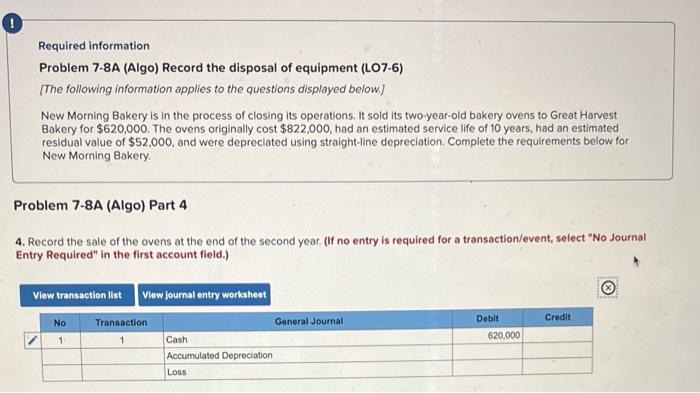

Exercise 7-19 (Algo) Calculate ratios (LO7-7) Billy's BBQ reported sales of $750,000 and net income of $29,500. Billy's also reported ending total assets of $497,000 and beginning total assets of $390,000. Required: Calculate the return on assets, the profit margin, and the asset turnover ratio for Billy's BBQ. Required information Problem 7-8A (Algo) Record the disposal of equipment (LO7-6) [The following information applies to the questions displayed below.] New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $620,000. The ovens originally cost $822,000, had an estimated service life of 10 years, had an estimated residual value of $52,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. roblem 7-8A (Algo) Part 4 Record the sale of the ovens at the end of the second year. (If no entry is required for a transaction/event, select "No Journal intry Required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts