Question: PLEASE HELP QUICKLY! TIMED REPSONSE LESS THAN 20 MINUTES PLEASE Jordan Inc has the following balance sheet and income statement data: The new CFO thinks

PLEASE HELP QUICKLY! TIMED REPSONSE LESS THAN 20 MINUTES PLEASE

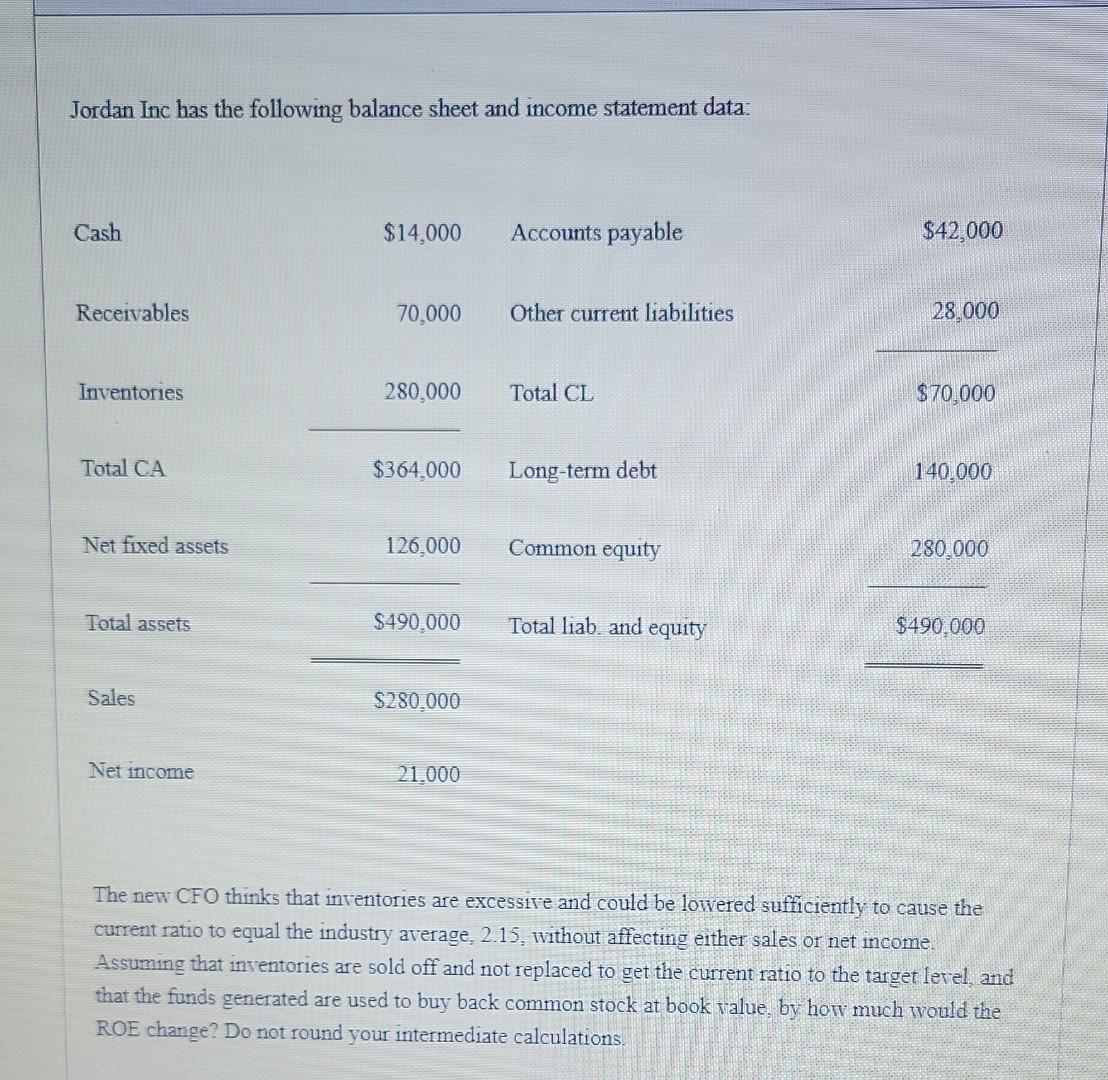

Jordan Inc has the following balance sheet and income statement data: The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average, 2.15 , without affecting either sales or net income. Assuming that inventories are sold off and not replaced to get the current ratio to the target letel, and that the funds generated are used to buy back common stock at book value, by how much would the ROE change? Do not round your intermediate calculations. The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average, 2.15 , without affecting either sales or net income. Assuming that inventories are sold off and not replaced to get the current ratio to the target level, and that the funds generated are used to buy back common stock at book value, by how much would the ROE change? Do not round your intermediate calculations. 24.08% 19.50% 29.86% 29.38% 25.04%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts