Question: please help quickly with these accounting questions. will give thumbs up! Taylor Company received a $20,000 advance payment during the year on services to be

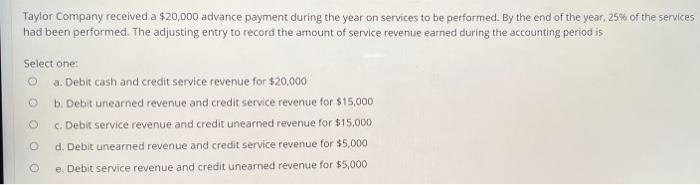

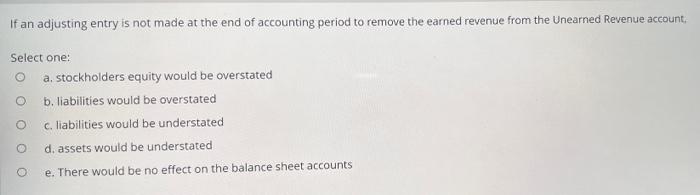

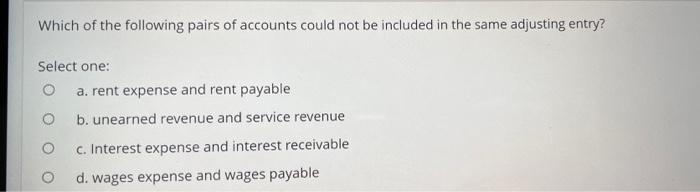

Taylor Company received a $20,000 advance payment during the year on services to be performed. By the end of the year, 25% of the services had been performed. The adjusting entry to record the amount of service revenue earned during the accounting period is Select one: O a. Debit cash and credit service revenue for $20,000 b. Debit unearned revenue and credit service revenue for $15,000 c. Debit service revenue and credit unearned revenue for $15,000 O d. Debit unearned revenue and credit service revenue for $5,000 e. Debit service revenue and credit unearned revenue for $5,000 If an adjusting entry is not made at the end of accounting period to remove the earned revenue from the Unearned Revenue account, Select one: O a. stockholders equity would be overstated O b. liabilities would be overstated O c. liabilities would be understated d. assets would be understated e. There would be no effect on the balance sheet accounts O Which of the following pairs of accounts could not be included in the same adjusting entry? Select one: O a. rent expense and rent payable O b. unearned revenue and service revenue c. Interest expense and interest receivable d. wages expense and wages payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts