Question: Please help Refer to the interactive below: Tax Burden Off SETTINGS Reset . GRAPH Tax Burden ($) Price Tax imposed on: Supply Demand 90 $90.00

Please help

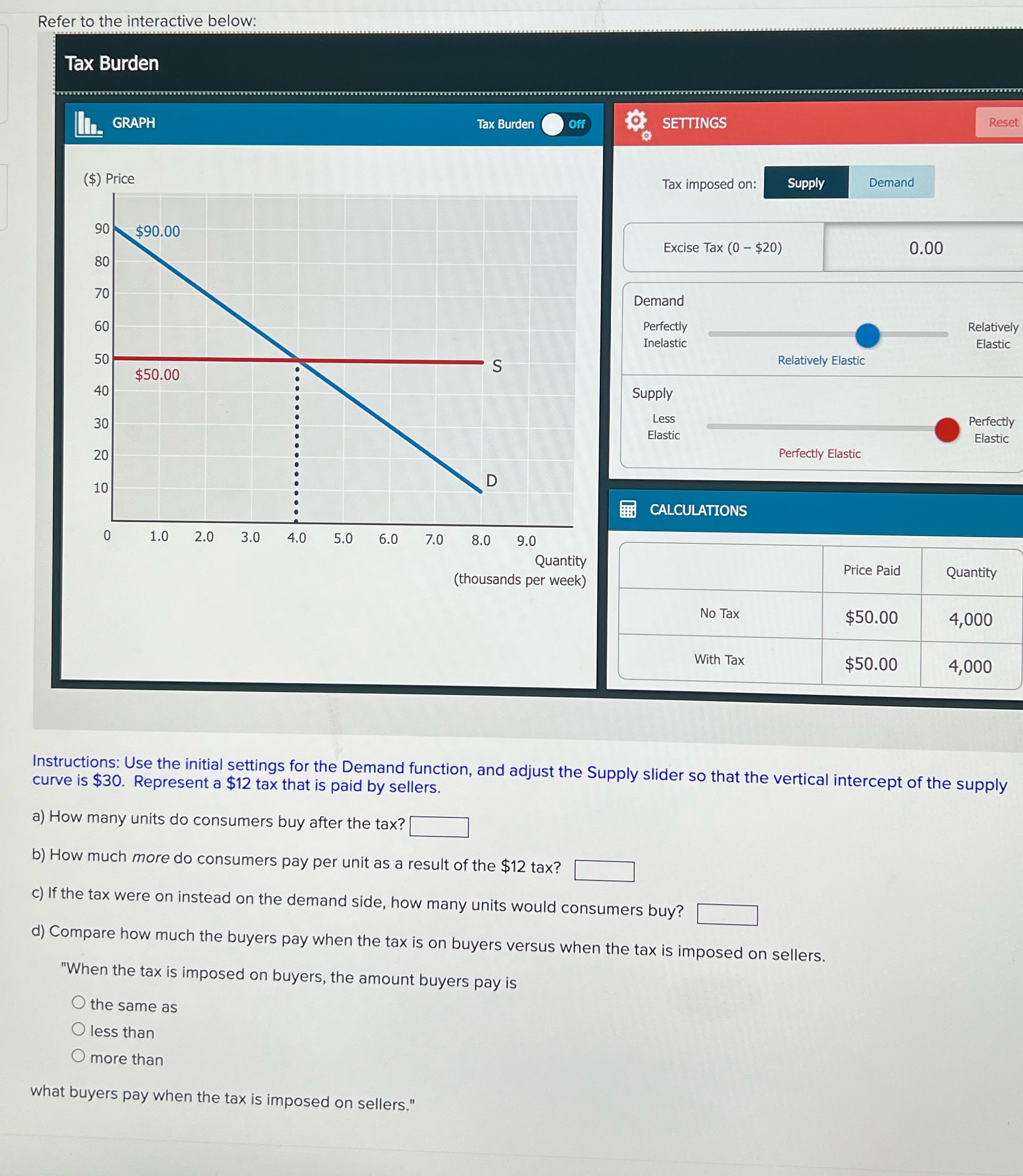

Refer to the interactive below: Tax Burden Off SETTINGS Reset . GRAPH Tax Burden ($) Price Tax imposed on: Supply Demand 90 $90.00 Excise Tax (0 - $20) 0.00 70 Demand Perfectly Relatively 60 Inelastic Elastic 50 Relatively Elastic S $50.00 40 Supply Less Perfectly 30 Elastic Elastic Perfectly Elastic 20 10 BEEN CALCULATIONS 0 1.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 Quantity Price Paid Quantity (thousands per week) No Tax $50.00 4,000 With Tax $50.00 4,000 Instructions: Use the initial settings for the Demand function, and adjust the Supply slider so that the vertical intercept of the supply curve is $30. Represent a $12 tax that is paid by sellers. a) How many units do consumers buy after the tax? b) How much more do consumers pay per unit as a result of the $12 tax? c) If the tax were on instead on the demand side, how many units would consumers buy? d) Compare how much the buyers pay when the tax is on buyers versus when the tax is imposed on sellers. 'When the tax is imposed on buyers, the amount buyers pay is O the same as O less than O more than what buyers pay when the tax is imposed on sellers."

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts