Question: Please help .... .... Required information [The following information applies to the questions displayed below.] The first production department of Stone Incorporated reports the following

Please help .... ....

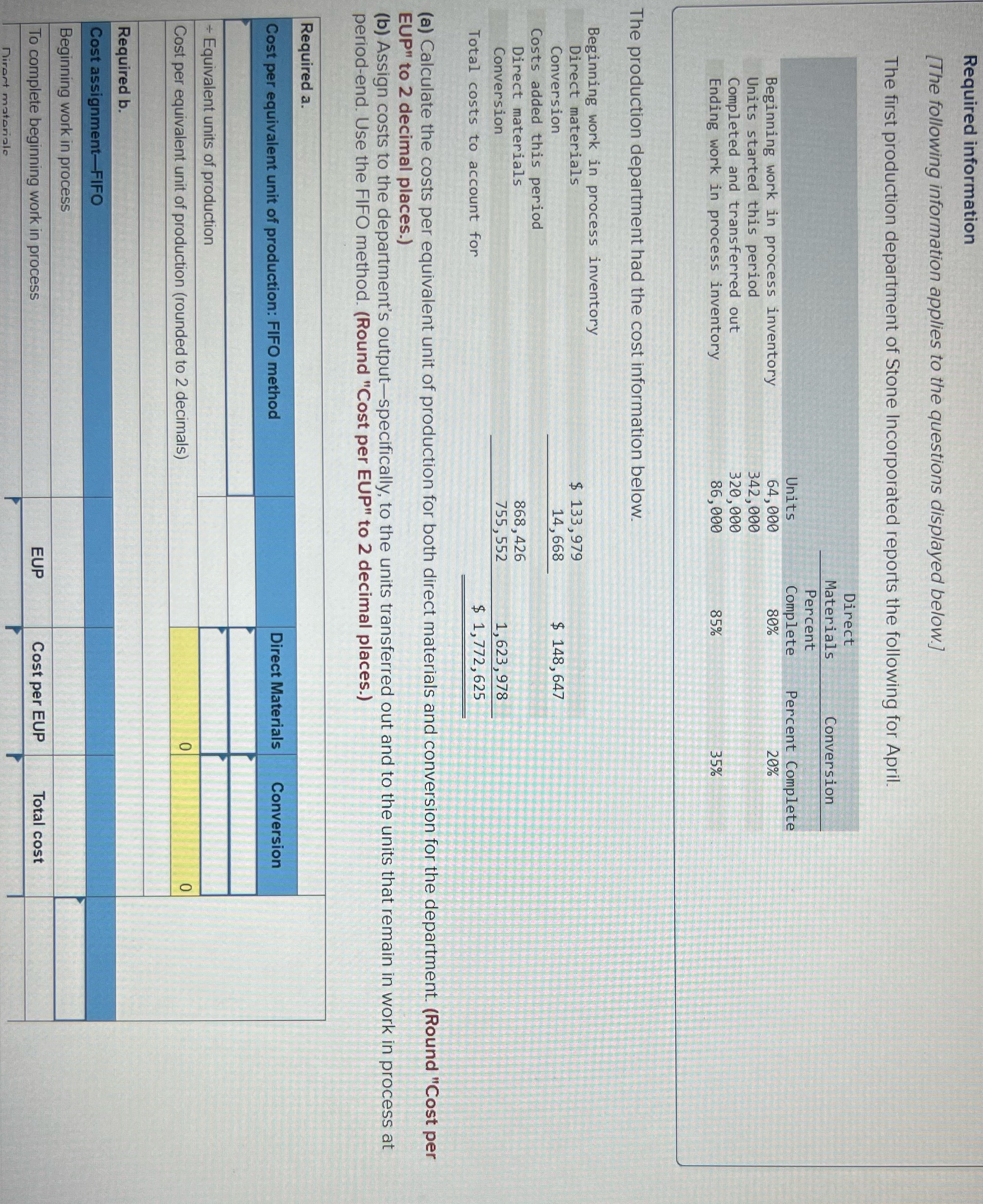

Required information [The following information applies to the questions displayed below.] The first production department of Stone Incorporated reports the following for April. Direct Materials Conversion Percent Units Complete Percent Complete Beginning work in process inventory 64, 000 80% 20% Units started this period 342, 000 Completed and transferred out 320, 000 Ending work in process inventory 86, 000 85% 35% The production department had the cost information below. Beginning work in process inventory Direct materials $ 133,979 Conversion 14, 668 $ 148, 647 Costs added this period Direct materials 868, 426 Conversion 755, 552 1, 623, 978 Total costs to account for $ 1, 772, 625 (a) Calculate the costs per equivalent unit of production for both direct materials and conversion for the department. (Round "Cost per EUP" to 2 decimal places.) (b) Assign costs to the department's output-specifically, to the units transferred out and to the units that remain in work in process at period-end. Use the FIFO method. (Round "Cost per EUP" to 2 decimal places.) Required a. Cost per equivalent unit of production: FIFO method Direct Materials Conversion + Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) O Required b. Cost assignment-FIFO Beginning work in process To complete beginning work in process EUP Cost per EUP Total cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts