Question: please help ! Requlred Information Exercise 13-9 Analyzing risk and capital structure LO P3 [The following information applies to the questions displayed below.) Simon Company's

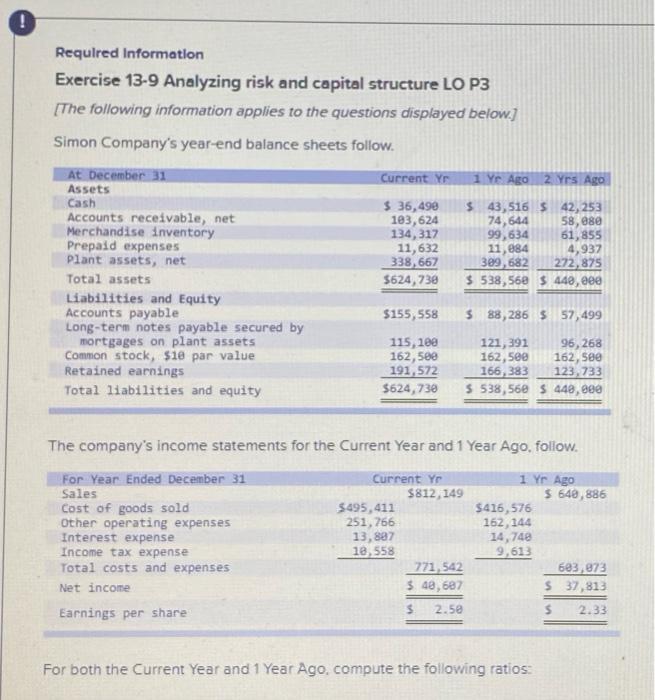

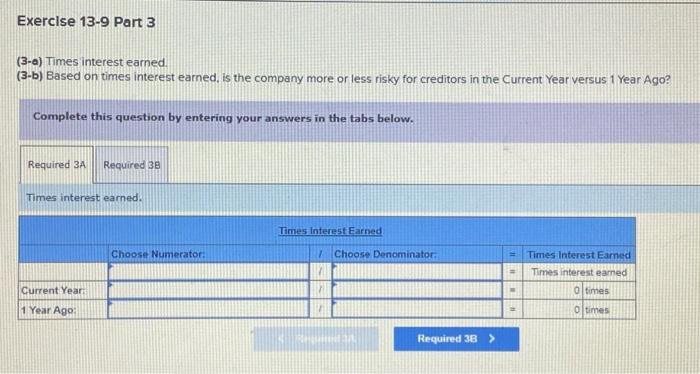

! Requlred Information Exercise 13-9 Analyzing risk and capital structure LO P3 [The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. Current Yr 1 Ye Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 36,490 103,624 134, 317 11,632 338,667 5624,730 $ 43, 516 5 42, 253 74,644 58, 680 99,634 61,855 11,884 4,937 309,682 272,875 $ 538, 562 5448, eee $155,558 $ 88,286 $ 57,499 115, 100 162,580 191,572 $624,730 121, 391 96,268 162,500 162, see 166,383 123,733 5 538,560 S 448,888 The company's income statements for the current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Yr $812,149 $495,411 251,766 13,897 18,558 271,542 $ 48,687 $ 2.50 1 Yr Ago $ 648, 886 $416,576 162, 144 14,748 9,613 603,872 $ 37,813 $ 2.33 For both the Current Year and 1 Year Ago, compute the following ratios: Exercise 13-9 Part 3 (3-a) Times interest earned. (3-b) Based on times interest earned, is the company more or less risky for creditors in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. Required 3A Required 38 Times interest earned: Times Interest Earned Choose Numerator: Choose Denominator. Times Interest Earned Times interest earned Current Year O times 1 Year Ago O times Required 3B >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts