Question: please help Return to go 3 1.66 points Exercise 5-6A (Algo) Effect of recovering a receivable previously written off LO 5-1 The accounts receivable balance

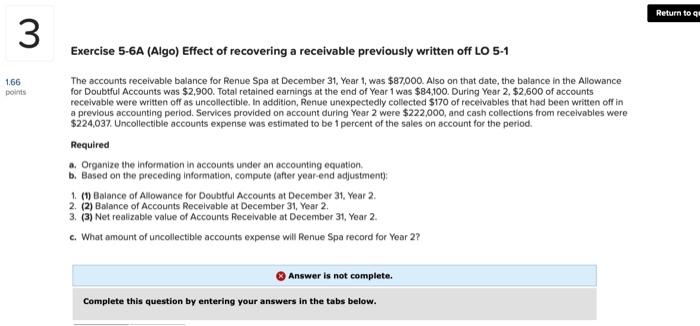

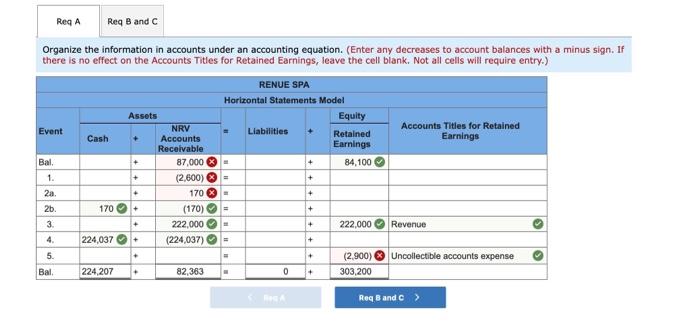

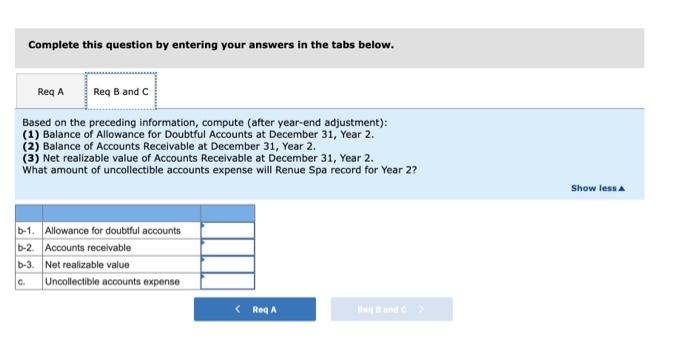

Return to go 3 1.66 points Exercise 5-6A (Algo) Effect of recovering a receivable previously written off LO 5-1 The accounts receivable balance for Renue Spa at December 31, Year 1, was $87000. Also on that date, the balance in the Allowance for Doubtful Accounts was $2,900. Total retained earnings at the end of Year 1 was $84,100. During Year 2. $2,600 of accounts receivable were written off as uncollectible. In addition, Renue unexpectedly collected $170 of receivables that had been written off in a previous accounting period. Services provided on account during Year 2 were $222,000, and cash collections from receivables were $224,037. Uncollectible accounts expense was estimated to be percent of the sales on account for the period. Required a. Organize the information in accounts under an accounting equation, b. Based on the preceding Information, compute (after year-end adjustment): 1. (1) Balance of Allowance for Doubtful Accounts at December 31. Year 2 2. (2) Balance of Accounts Receivable at December 31, Year 2 3. (3) Net realizable value of Accounts Receivable at December 31, Year 2. c. What amount of uncollectible accounts expense will Renue Spa record for Year 2? Answer is not complete. Complete this question by entering your answers in the tabs below. Req A Reg B and C - + + Organize the information in accounts under an accounting equation. (Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank. Not all cells will require entry.) RENUE SPA Horizontal Statements Model Assets Equity Event NRV Liabilities Accounts Titles for Retained Cash Accounts Retained Earnings Receivable Earnings Bal. 87,000 - 84,100 (2.600) - . 170 2b. 170 (170) 222.000 222.000 Revenue 224,037 (224,037) 5 (2.900) Uncollectible accounts expense Bal 224,207 82,363 0 303,200 RoqB and c> 1 + - + o + ! | n | v | wr + + + + . + Complete this question by entering your answers in the tabs below. Rega Reg B and C Based on the preceding information, compute (after year-end adjustment): (1) Balance of Allowance for Doubtful Accounts at December 31, Year 2. (2) Balance of Accounts Receivable at December 31, Year 2. (3) Net realizable value of Accounts Receivable at December 31, Year 2. What amount of uncollectible accounts expense will Renue Spa record for Year 2? Show less -1. Allowance for doubtful accounts 5-2 Accounts receivable 1-3. Net realizable value Uncollectible accounts expense c.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts