Question: please help RIIULIWA Quiz Instructions D Question 1 10 pts On journal paper, prepare year-end adjustments for the following independent items. OMIT EXPLANATIONS. UPLOAD YOUR

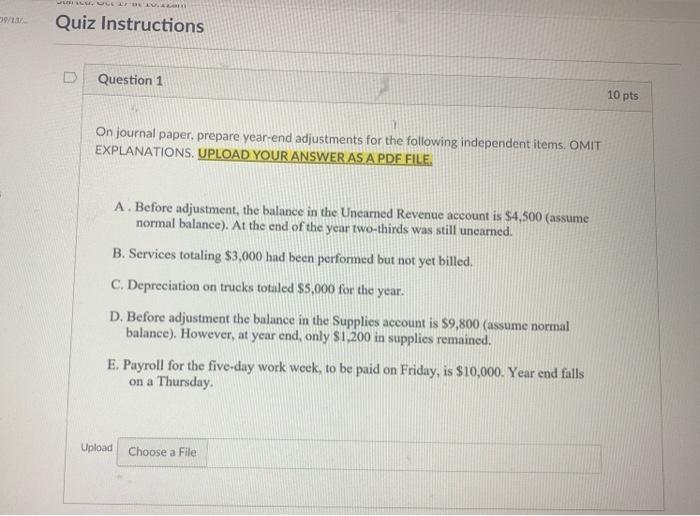

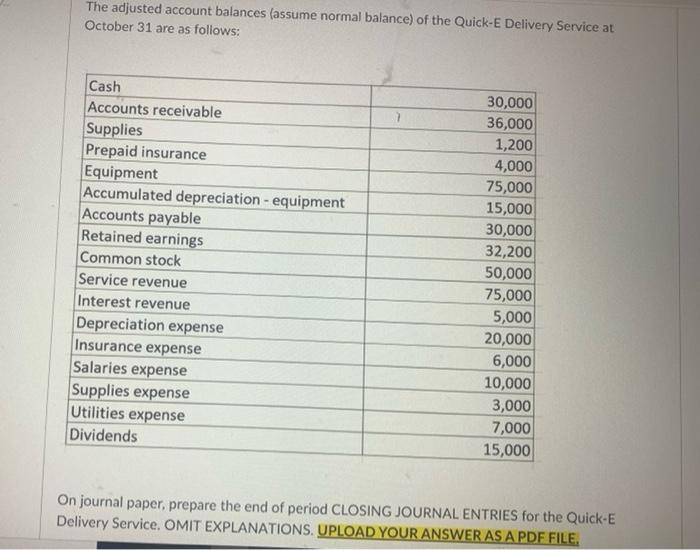

RIIULIWA Quiz Instructions D Question 1 10 pts On journal paper, prepare year-end adjustments for the following independent items. OMIT EXPLANATIONS. UPLOAD YOUR ANSWER AS A PDF FILE A. Before adjustment, the balance in the Uneared Revenue account is $4.500 (assume normal balance). At the end of the year two-thirds was still uneared. B. Services totaling $3,000 had been performed but not yet billed. C. Depreciation on trucks totaled $5,000 for the year. D. Before adjustment the balance in the Supplies account is $9,800 (assume normal balance). However, at year end, only $1,200 in supplies remained. E. Payroll for the five-day work week, to be paid on Friday, is $10,000. Year end falls on a Thursday Upload Choose a File The adjusted account balances (assume normal balance) of the Quick-E Delivery Service at October 31 are as follows: Cash Accounts receivable Supplies Prepaid insurance Equipment Accumulated depreciation - equipment Accounts payable Retained earnings Common stock Service revenue Interest revenue Depreciation expense Insurance expense Salaries expense Supplies expense Utilities expense Dividends 30,000 36,000 1,200 4,000 75,000 15,000 30,000 32,200 50,000 75,000 5,000 20,000 6,000 10,000 3,000 7,000 15,000 On journal paper, prepare the end of period CLOSING JOURNAL ENTRIES for the Quick-E Delivery Service. OMIT EXPLANATIONS. UPLOAD YOUR ANSWER AS A PDF FILE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts