Question: Please help Roundtree Software is going public using an auction IPO. The firm has received the following bids: Number of Shares Price ($) 14.40 14.20

Please help

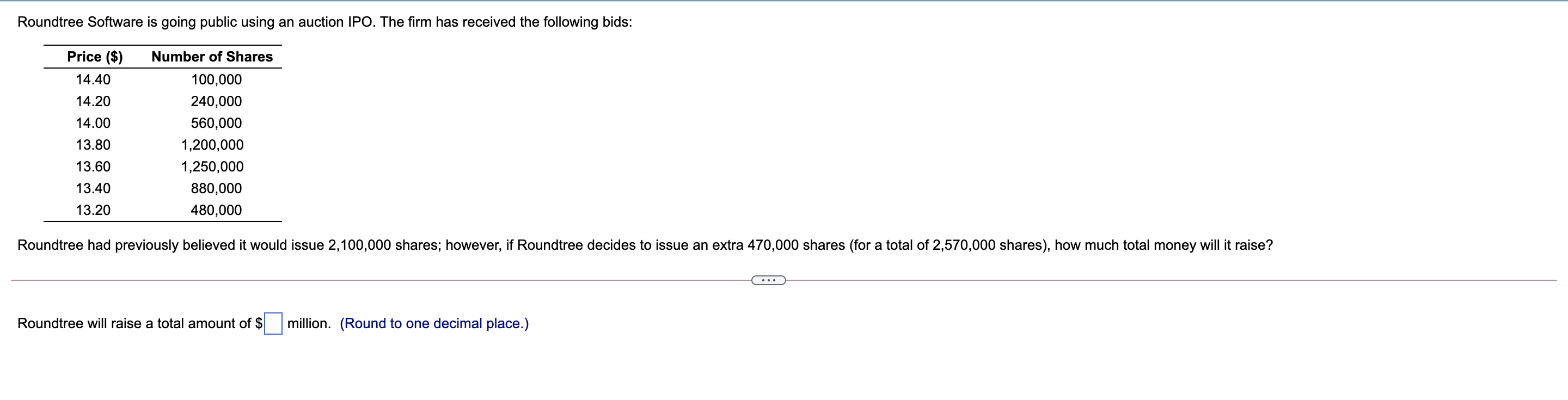

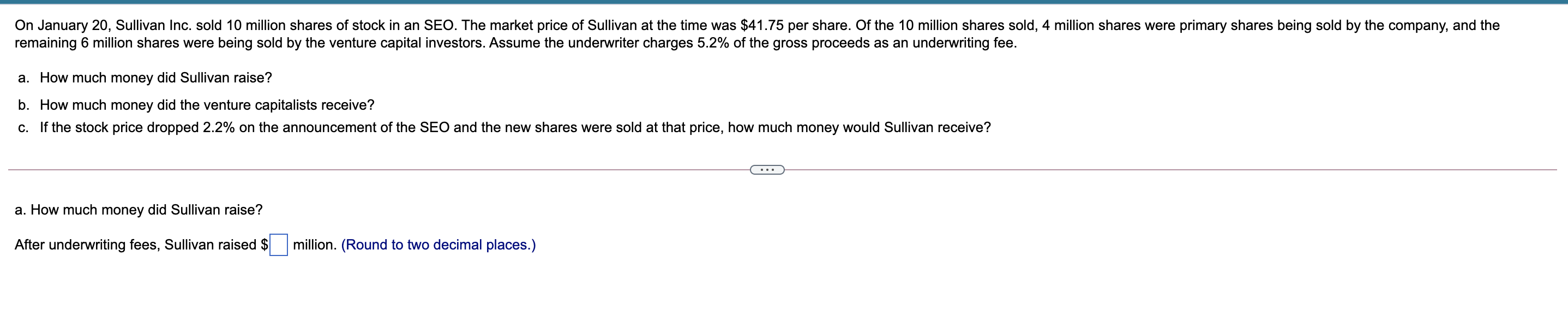

Roundtree Software is going public using an auction IPO. The firm has received the following bids: Number of Shares Price ($) 14.40 14.20 14.00 13.80 100,000 240,000 560,000 1,200,000 1,250,000 880,000 480,000 13.60 13.40 13.20 Roundtree had previously believed it would issue 2,100,000 shares; however, if Roundtree decides to issue an extra 470,000 shares (for a total of 2,570,000 shares), how much total money will it raise? Roundtree will raise a total amount of $ million. (Round to one decimal place.) On January 20, Sullivan Inc. sold 10 million shares of stock in an SEO. The market price of Sullivan at the time was $41.75 per share. Of the 10 million shares sold, 4 million shares were primary shares being sold by the company, and the remaining 6 million shares were being sold by the venture capital investors. Assume the underwriter charges 5.2% of the gross proceeds as an underwriting fee. a. How much money did Sullivan raise? b. How much money did the venture capitalists receive? C. If the stock price dropped 2.2% on the announcement of the SEO and the new shares were sold at that price, how much money would Sullivan receive? a. How much money did Sullivan raise? After underwriting fees, Sullivan raised $ million. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts