Question: Please help Sameer and Sami are two partners in partnerships divided profit & loss 5:3 respectively , at the year ended 2018 the net income

Please help

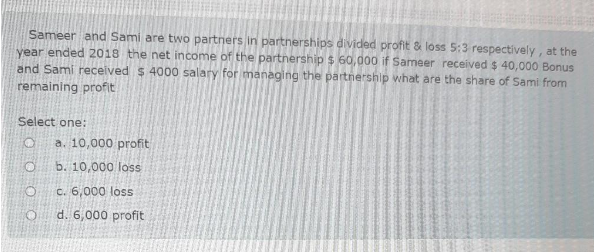

Sameer and Sami are two partners in partnerships divided profit & loss 5:3 respectively , at the year ended 2018 the net income of the partnership $ 60,000 if Sameer received $ 40,000 Bonus and Sami received $ 4000 salary for managing the partnership what are the share of Sami from remaining profit Select one: a. 10,000 profit b. 10,000 loss O c. 6,000 loss O d. 6,000 profitIF A & B are two partner, A partner 15,000 capital and the same amount for B . they agree to enter new partner C what are the amount should C pay for having 50% of capital Select one: O a. 20,000 O b. 40,000 C. 30,000 O d. 15,000 In partnership liquidation the first cash distribution should be made for Select one: O a, partner capital b. Liquidation expenses O c. loan to bank O d. loan to partner

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts