Question: Please help! score on work to date 24.1150 Point 48.22 Comprehensive Problem 8-85 (O 8-1, LO 8-2, LO 8-3, LO 84. LO 8-5) Algo) The

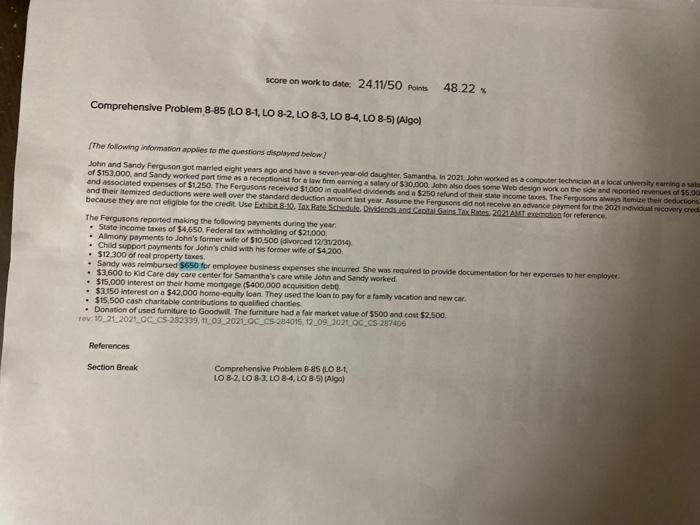

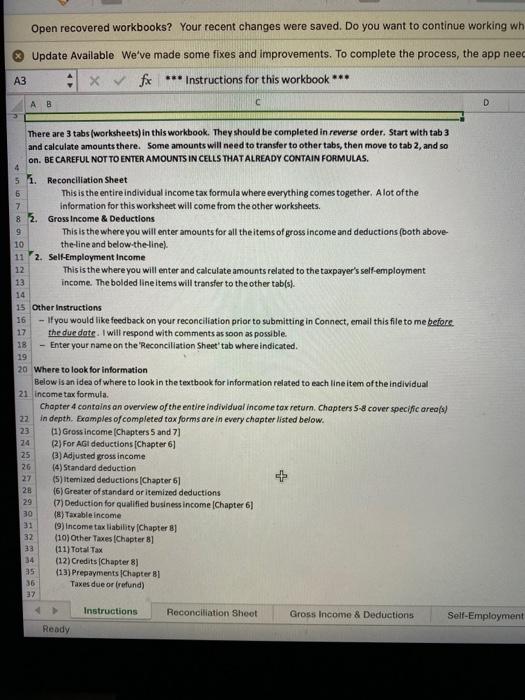

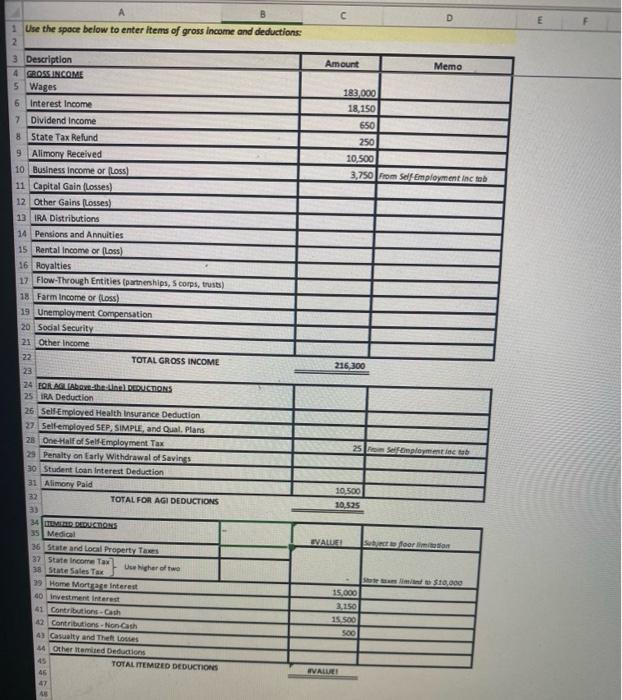

score on work to date 24.1150 Point 48.22 Comprehensive Problem 8-85 (O 8-1, LO 8-2, LO 8-3, LO 84. LO 8-5) Algo) The following information applies to the questions displayed below! John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha in 2021 worked as a computer technician a local university earning asal of $153.000, and Sandy worked part time as a receptionist for a law firm earning asalary of $30.000. John so does some Web design work on the side and reported revenues of $5,00 and associated expenses of $1250. The Fergusons received $1000 in qualified dividends and a $250 refund of the state income taxes. The Fergusons where their deductions and their itemized deductions were well over the standard deduction amount last year. Assume the Fergusons did not receive an advance payment for the 2021 individual recovery cred because they are not eligible for the credit Use Ext. Tax Rate Schede Dividends and Contains the Rates 2021 ANT on for reference The Fergusons reported making the following payments during the year State income taxes of $4,650. Federal tax withholding of $21000 Alimony payments to John's former wife of $10,500 divorced 12/3/2014) Child support payments for John's child with his former wife of $4200 512 300 of real property taxes Sandy was reimbursed $650 for employee business expenses she incurred. She was required to provide documentation for her expenses to her employer $3,600 to Kid Care day care center for Samantha's care while John and Sandy worked $15,000 interest on their home mortgage (5400,000 acquisition debit) $3,150 interest on a $42.000 home-equity loan. They used the loan to pay for a family vacation and new car $15,500 cash charitable contributions to qualified charities Donation of used furniture to Goodwill. The furniture had a fair market value of $500 and cost $2.500 rev 10.21.20210C CS-282339, 1103 202LOC_CS-284015. 12_09_2021 OC_CS-207406 References Section Break Comprehensive Problem 8-85 (LO 8-1, LO 8-2, LO 8-3, LO 84,LO 8-5) [Algol Open recovered workbooks? Your recent changes were saved. Do you want to continue working wh A3 Update Available We've made some fixes and improvements. To complete the process, the app need 1 fx *** Instructions for this workbook *** AB D 4 5 7 9 10 There are 3 tabs (worksheets) in this workbook. They should be completed in reverse order. Start with tab 3 and calculate amounts there. Some amounts will need to transfer to other tabs, then move to tab 2, and so on. BE CAREFUL NOT TO ENTER AMOUNTS IN CELLS THAT ALREADY CONTAIN FORMULAS. 5 1. Reconciliation Sheet This is the entire individual income tax formula where everything comes together. Alot of the information for this worksheet will come from the other worksheets. 8 3. Gross Income & Deductions This is the where you will enter amounts for all the items of gross income and deductions (both above the-line and below.the-line) 11 2. Self-Employment Income 12 This is the where you will enter and calculate amounts related to the taxpayer's self-employment 13 income. The bolded line items will transfer to the other tab(s). 14 15 Other Instructions 16 - If you would like feedback on your reconciliation prior to submitting in Connect, email this file to me before. the due date. I will respond with comments as soon as possible. Enter your name on the "Reconciliation Sheet' tab where indicated. 20 Where to look for information Below is an idea of where to look in the textbook for information related to each line item of the individual 21 income tax formula. Chapter 4 contains an overview of the entire individual income tax return Chapters 5-8 cover specific area(s) in depth. Examples of completed tax forms are in every chapter listed below. 23 (1) Gross income (Chapters 5 and 7] (2) For A deductions (Chapter 6) 25 (3) Adjusted gross income (4) Standard deduction (5) itemized deductions (Chapter 6] (6) Greater of standard or itemized deductions 29 (7) Deduction for qualified business income (Chapter 61 30 (8) Taxable income (9) income tax liability (Chapter 8] 32 (10) Other Taxes (Chapter 8] 33 (11) Total Tax 34 (12) Credits (Chapter 8 (13) Prepayments (Chapter 81 Taxes due or refund) 17 18 19 22 74 26 27 28 31 35 36 37 > Instructions Reconciliation Shoot Gross Income & Deductions Self-Employment Ready D Amount Mema 183.000 18,150 650 250 10,500 3,750 From Self Employment in tab 1 Use the space below to enter items of gross income and deductions 2 3 Description 4 GROSS INCOME 5 Wages 6. Interest Income 7 Dividend Income 8 State Tax Refund 9 Alimony Received 10 Business Income or (Loss) 11 Capital Gain (Losses) 12 Other Gains (Losses) 13 IRA Distributions 14 Pensions and Annuities 15 Rental Income or (Loss) 16 Royalties 17 Flow-Through Entities (partnerships, Scorps, trust) 18 Farm Income or (Loss) 19 Unemployment Compensation 20 Social Security 21 Other Income 22 TOTAL GROSS INCOME 23 24 ORAGLIAthenel DDUCTIONS 25 IRA Deduction 26 Self Emploved Health Insurance Deduction 27 Selfemoloyed SEP SIMPLE, and Qual. Plans 28 One Half of Self Employment Tax 25 Penalty on Early Withdrawal of Savings 30 Student Loan Interest Deduction 31 Alimony Paid 32 TOTAL FOR AGI DEDUCTIONS 3) 34 MED DEBUTONS 35 Medical 36 State and Local Property Tax 37 State Income Tax 38 State Sales Tax Usher of two 29 Home Mortas interest 40 Investment interest 41 Contributions.cat 12 Contribution-NonCash 4) Casualty and Theft tous 44 Other itemized Deductions 45 TOTALITEMIZED DEDUCTIONS 46 216,300 25ployment ab 10.500 10.525 EVALUE Sub formation S10,000 15.000 3.250 15.500 500 EVALUE! 48 score on work to date 24.1150 Point 48.22 Comprehensive Problem 8-85 (O 8-1, LO 8-2, LO 8-3, LO 84. LO 8-5) Algo) The following information applies to the questions displayed below! John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha in 2021 worked as a computer technician a local university earning asal of $153.000, and Sandy worked part time as a receptionist for a law firm earning asalary of $30.000. John so does some Web design work on the side and reported revenues of $5,00 and associated expenses of $1250. The Fergusons received $1000 in qualified dividends and a $250 refund of the state income taxes. The Fergusons where their deductions and their itemized deductions were well over the standard deduction amount last year. Assume the Fergusons did not receive an advance payment for the 2021 individual recovery cred because they are not eligible for the credit Use Ext. Tax Rate Schede Dividends and Contains the Rates 2021 ANT on for reference The Fergusons reported making the following payments during the year State income taxes of $4,650. Federal tax withholding of $21000 Alimony payments to John's former wife of $10,500 divorced 12/3/2014) Child support payments for John's child with his former wife of $4200 512 300 of real property taxes Sandy was reimbursed $650 for employee business expenses she incurred. She was required to provide documentation for her expenses to her employer $3,600 to Kid Care day care center for Samantha's care while John and Sandy worked $15,000 interest on their home mortgage (5400,000 acquisition debit) $3,150 interest on a $42.000 home-equity loan. They used the loan to pay for a family vacation and new car $15,500 cash charitable contributions to qualified charities Donation of used furniture to Goodwill. The furniture had a fair market value of $500 and cost $2.500 rev 10.21.20210C CS-282339, 1103 202LOC_CS-284015. 12_09_2021 OC_CS-207406 References Section Break Comprehensive Problem 8-85 (LO 8-1, LO 8-2, LO 8-3, LO 84,LO 8-5) [Algol Open recovered workbooks? Your recent changes were saved. Do you want to continue working wh A3 Update Available We've made some fixes and improvements. To complete the process, the app need 1 fx *** Instructions for this workbook *** AB D 4 5 7 9 10 There are 3 tabs (worksheets) in this workbook. They should be completed in reverse order. Start with tab 3 and calculate amounts there. Some amounts will need to transfer to other tabs, then move to tab 2, and so on. BE CAREFUL NOT TO ENTER AMOUNTS IN CELLS THAT ALREADY CONTAIN FORMULAS. 5 1. Reconciliation Sheet This is the entire individual income tax formula where everything comes together. Alot of the information for this worksheet will come from the other worksheets. 8 3. Gross Income & Deductions This is the where you will enter amounts for all the items of gross income and deductions (both above the-line and below.the-line) 11 2. Self-Employment Income 12 This is the where you will enter and calculate amounts related to the taxpayer's self-employment 13 income. The bolded line items will transfer to the other tab(s). 14 15 Other Instructions 16 - If you would like feedback on your reconciliation prior to submitting in Connect, email this file to me before. the due date. I will respond with comments as soon as possible. Enter your name on the "Reconciliation Sheet' tab where indicated. 20 Where to look for information Below is an idea of where to look in the textbook for information related to each line item of the individual 21 income tax formula. Chapter 4 contains an overview of the entire individual income tax return Chapters 5-8 cover specific area(s) in depth. Examples of completed tax forms are in every chapter listed below. 23 (1) Gross income (Chapters 5 and 7] (2) For A deductions (Chapter 6) 25 (3) Adjusted gross income (4) Standard deduction (5) itemized deductions (Chapter 6] (6) Greater of standard or itemized deductions 29 (7) Deduction for qualified business income (Chapter 61 30 (8) Taxable income (9) income tax liability (Chapter 8] 32 (10) Other Taxes (Chapter 8] 33 (11) Total Tax 34 (12) Credits (Chapter 8 (13) Prepayments (Chapter 81 Taxes due or refund) 17 18 19 22 74 26 27 28 31 35 36 37 > Instructions Reconciliation Shoot Gross Income & Deductions Self-Employment Ready D Amount Mema 183.000 18,150 650 250 10,500 3,750 From Self Employment in tab 1 Use the space below to enter items of gross income and deductions 2 3 Description 4 GROSS INCOME 5 Wages 6. Interest Income 7 Dividend Income 8 State Tax Refund 9 Alimony Received 10 Business Income or (Loss) 11 Capital Gain (Losses) 12 Other Gains (Losses) 13 IRA Distributions 14 Pensions and Annuities 15 Rental Income or (Loss) 16 Royalties 17 Flow-Through Entities (partnerships, Scorps, trust) 18 Farm Income or (Loss) 19 Unemployment Compensation 20 Social Security 21 Other Income 22 TOTAL GROSS INCOME 23 24 ORAGLIAthenel DDUCTIONS 25 IRA Deduction 26 Self Emploved Health Insurance Deduction 27 Selfemoloyed SEP SIMPLE, and Qual. Plans 28 One Half of Self Employment Tax 25 Penalty on Early Withdrawal of Savings 30 Student Loan Interest Deduction 31 Alimony Paid 32 TOTAL FOR AGI DEDUCTIONS 3) 34 MED DEBUTONS 35 Medical 36 State and Local Property Tax 37 State Income Tax 38 State Sales Tax Usher of two 29 Home Mortas interest 40 Investment interest 41 Contributions.cat 12 Contribution-NonCash 4) Casualty and Theft tous 44 Other itemized Deductions 45 TOTALITEMIZED DEDUCTIONS 46 216,300 25ployment ab 10.500 10.525 EVALUE Sub formation S10,000 15.000 3.250 15.500 500 EVALUE! 48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts