Question: please help SECTION A - Answer ONE question from Section A. QUESTION ONE Soyota is an automobile manufacturing, which uses an actual-costing system that determines

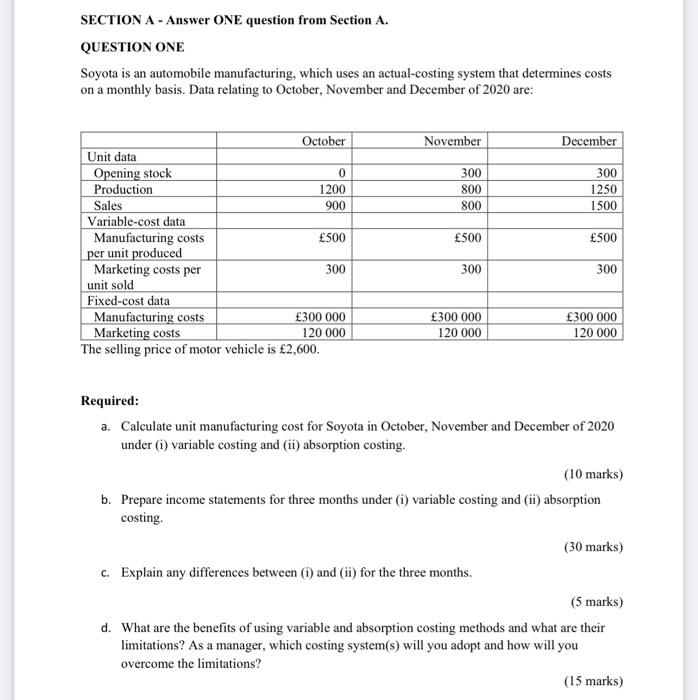

SECTION A - Answer ONE question from Section A. QUESTION ONE Soyota is an automobile manufacturing, which uses an actual-costing system that determines costs on a monthly basis. Data relating to October, November and December of 2020 are: ine seung price or motor venicie is ,000. Required: a. Calculate unit manufacturing cost for Soyota in October, November and December of 2020 under (i) variable costing and (ii) absorption costing. (10 marks) b. Prepare income statements for three months under (i) variable costing and (ii) absorption costing. (30 marks) c. Explain any differences between (i) and (ii) for the three months. (5 marks) d. What are the benefits of using variable and absorption costing methods and what are their limitations? As a manager, which costing system(s) will you adopt and how will you overcome the limitations? (15 marks) SECTION A - Answer ONE question from Section A. QUESTION ONE Soyota is an automobile manufacturing, which uses an actual-costing system that determines costs on a monthly basis. Data relating to October, November and December of 2020 are: ine seung price or motor venicie is ,000. Required: a. Calculate unit manufacturing cost for Soyota in October, November and December of 2020 under (i) variable costing and (ii) absorption costing. (10 marks) b. Prepare income statements for three months under (i) variable costing and (ii) absorption costing. (30 marks) c. Explain any differences between (i) and (ii) for the three months. (5 marks) d. What are the benefits of using variable and absorption costing methods and what are their limitations? As a manager, which costing system(s) will you adopt and how will you overcome the limitations? (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts