Question: Please help Show all your work, write your answers in your handwriting and submit the homework in class or to instructor's office. The instructor does

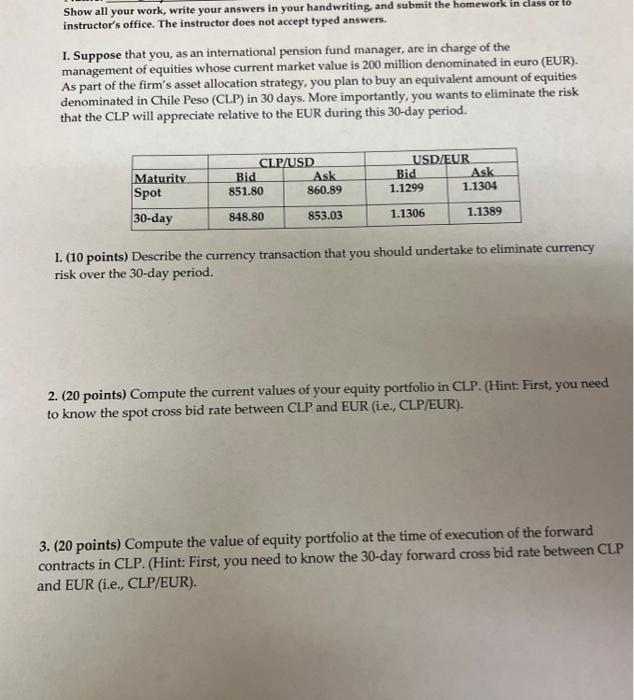

Show all your work, write your answers in your handwriting and submit the homework in class or to instructor's office. The instructor does not accept typed answers. 1. Suppose that you, as an international pension fund manager, are in charge of the management of equities whose current market value is 200 million denominated in euro (EUR). As part of the firm's asset allocation strategy, you plan to buy an equivalent amount of equities denominated in Chile Peso (CLP) in 30 days. More importantly, you wants to eliminate the risk that the CLP will appreciate relative to the EUR during this 30-day period. Maturity Spot CLP/USD Bid Ask 851.80 860.89 USD/EUR Bid Ask 1.1299 1.1304 30-day 848.80 853.03 1.1306 1.1389 1. (10 points) Describe the currency transaction that you should undertake to eliminate currency risk over the 30-day period. 2. (20 points) Compute the current values of your equity portfolio in CLP. (Hint: First, you need to know the spot cross bid rate between CLP and EUR (i.e., CLP/EUR). 3. (20 points) Compute the value of equity portfolio at the time of execution of the forward contracts in CLP. (Hint: First, you need to know the 30-day forward cross bid rate between CLP and EUR (i.e., CLP/EUR)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts