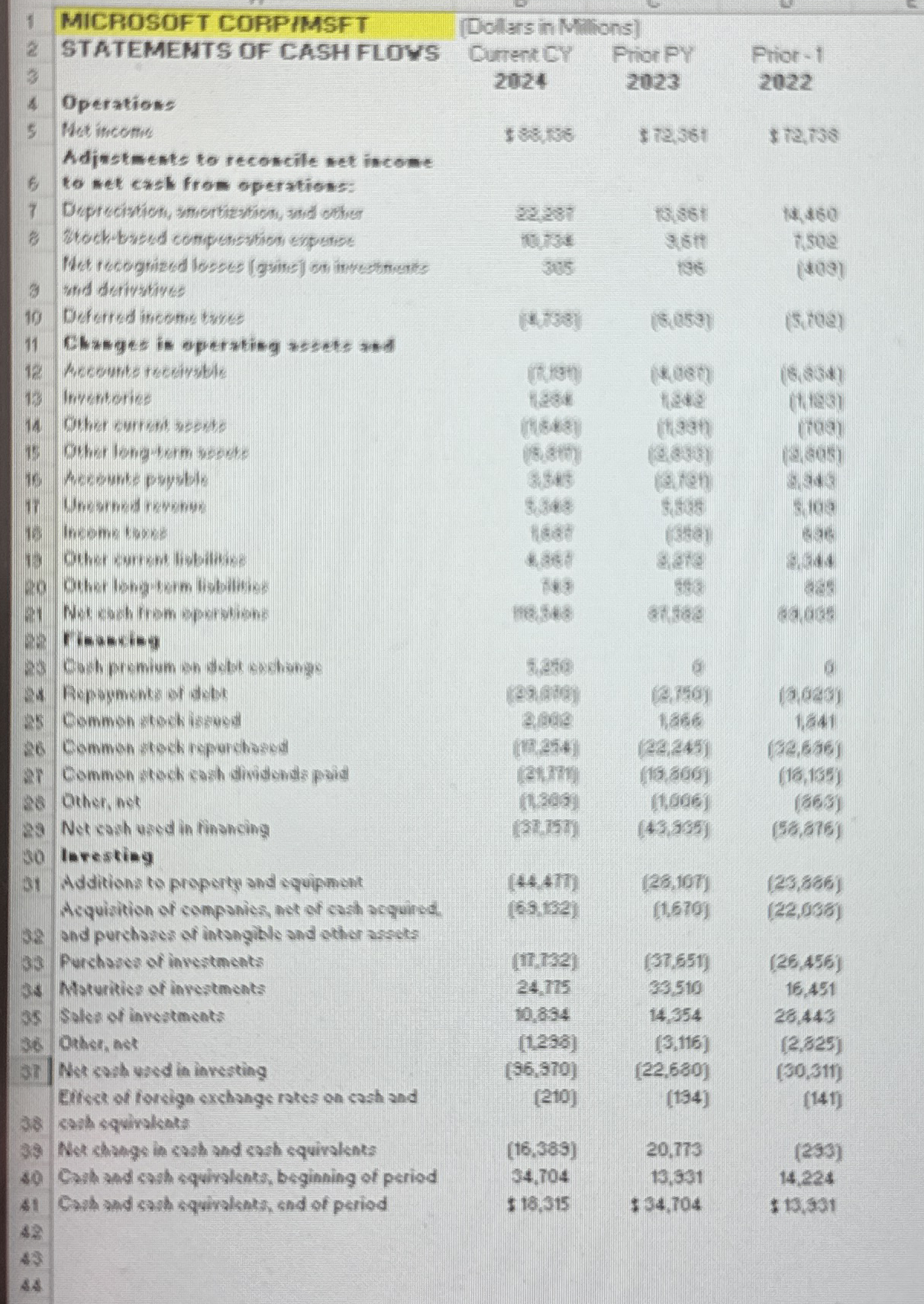

Question: Please help Show excel cell work for cash flows from operations, cash flows from investing, capital expenditures, cash flow from financing, new debt issued, debt

Please help Show excel cell work for cash flows from operations, cash flows from investing, capital expenditures, cash flow from financing, new debt issued, debt repaid, new stock issued, stock repurchased, dividends repaid, and end fiscal year share price Add one column to the right of your CY data use column F on the income statement and balance sheet. Label it CommonSizeCY. Add one column to the right of your PY data and label it CommonsizePY use column G You do not have to calculate common size percentages for PY or for the cash flow statement.

In the CommonSize columns on the income statement and balance sheet worksheets, calculate the common size percentages for your company's CY and PY Show your answers as percentages to one decimal place, ie

Calculate or answer all items for your company for both years in "Template and analysis" sheet Whenever you are asked to compare with another company, do a CY and PY comparison instead.

Market Capitalization calculations are required for both CY and PY Therefore, you need the stock price that was posted on the closing day of your CY and your PY Do NOT use today's stock price. The historical stock prices may be included on your downloaded income statement, or you may have to find them online.

In a Word document, answer the following questions: a Was the company more or less profitable as a of sales when compared with the prior year? b Add a one sentence explanation to Market Capitalization: What does your company's market cap tell you about its CY versus PYtableCach flows from oper stionsCash flows from invertityCapltal expendituresCash flows from finamiayNew delbt isosuedDebt

repaidNew stock issuedStock repurshasedDividends paidInd of ISCAL year share prios

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock