Question: please help show steps just nees to see the steps please 01 12. appropriate discount rate is 8.45 percent? Calculating Future Values Your coin collection

please help show steps

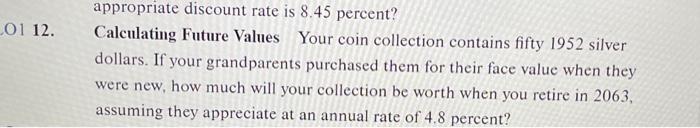

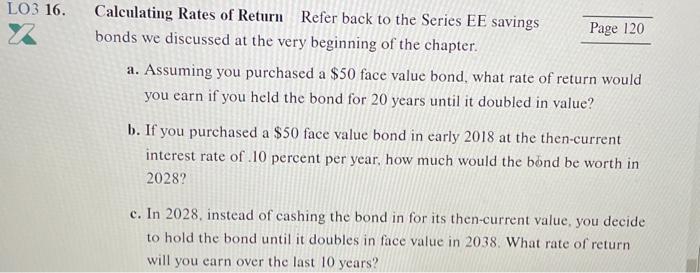

please help show steps 01 12. appropriate discount rate is 8.45 percent? Calculating Future Values Your coin collection contains fifty 1952 silver dollars. If your grandparents purchased them for their face value when they were new, how much will your collection be worth when you retire in 2063, assuming they appreciate at an annual rate of 4.8 percent? LO3 16. x Calculating Rates of Return Refer back to the Series EE savings Page 120 bonds we discussed at the very beginning of the chapter. a. Assuming you purchased a $50 face value bond, what rate of return would you earn if you held the bond for 20 years until it doubled in value? b. If you purchased a $50 face value bond in early 2018 at the then-current interest rate of 10 percent per year, how much would the bond be worth in 2028? c. In 2028. instead of cashing the bond in for its then-current value, you decide to hold the bond until it doubles in face value in 2038. What rate of return will you carn over the last 10 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts