Question: Please help! Show work! 1500 points awarded! You can select one of the two options below. $ 5,000 at the end of year 1. $

Please help! Show work! 1500 points awarded!

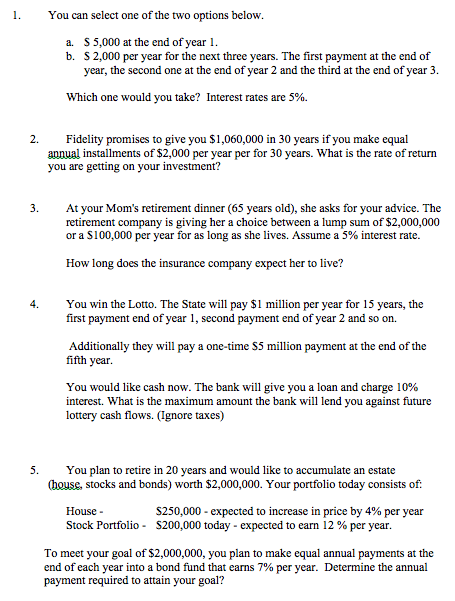

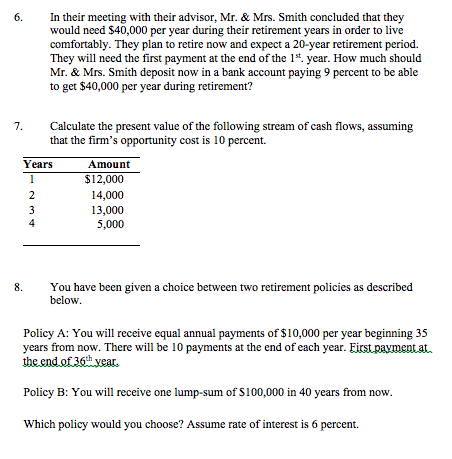

You can select one of the two options below. $ 5,000 at the end of year 1. $ 2.000 per year for the next three years. The first payment at the end of year, the second one at the end of year 2 and the third at the end of year 3. Which one would you take? Interest rates are 5%. Fidelity promises to give you $1,060,000 in 30 years if you make equal annual installments of $52,000 per year per for 30 years. What is the rate of return you are getting on your investment? At your Mom's retirement dinner (65 years old), she asks for your advice. The retirement company is giving her a choice between a lump sum of $2,000,000 or a $100,000 per year for as long as she lives. Assume a 5% interest rate. How long does the insurance company expect her to live? You win the Lotto. The State will pay $1 million per year for 15 years, the first payment end of year 1, second payment end of year 2 and so on. Additionally they will pay a one-time $5 million payment at the end of the fifth year. You would like cash now. The bank will give you a loan and charge 10% interest. What is the maximum amount the bank will lend you against future lottery cash flows. (Ignore taxes) You plan to retire in 20 years and would like to accumulate an estate (house, stocks and bonds) worth $2,000,000. Your portfolio today consists of: House S250, 000 - expected to increase in price by 4% per year Stock Portfolio - $200,000 today - expected to earn 12 % per year. To meet your goal of $2,000,000, you plan to make equal annual payments at the end of each year into a bond fund that cams 7% per year. Determine the annual payment required to attain your goal? In their meeting with their advisor, Mr. & Mrs. Smith concluded that they would need $40,000 per year during their retirement years in order to live comfortably. They plan to retire now and expect a 20-year retirement period. They will need the first payment at the end of the 1st. year. How much should Mr. & Mrs. Smith deposit now in a bank account paying 9 percent to be able to get S40.000 per year during retirement? Calculate the present value of the following stream of cash flows, assuming that the firm's opportunity cost is 10 percent. You have been given a choice between two retirement policies as described below. Policy A: You will receive equal annual payments of $10,000 per year beginning 35 years from now. There will be 10 payments at the end of each year. First payment at the end36th year. Policy B: You will receive one lump-sum of S100, 000 in 40 years from now. Which policy would you choose? Assume rate of interest is 6 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts