Question: please help! show work also please The dividend (DIV) growth per share of CBS, Inc. is expected to be 10% per year for the next

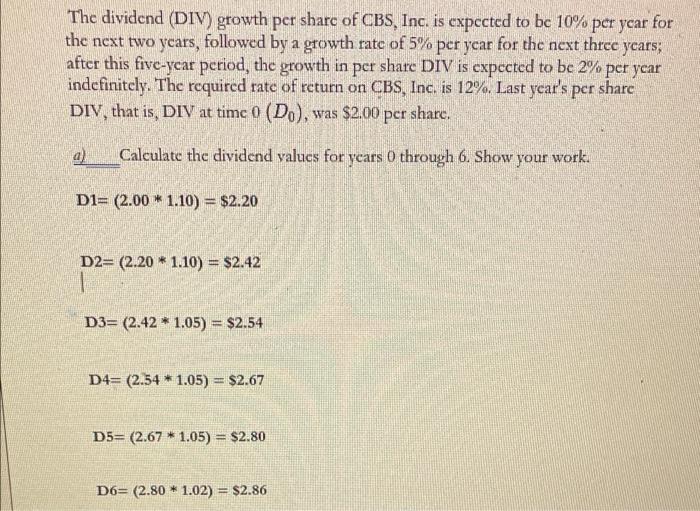

The dividend (DIV) growth per share of CBS, Inc. is expected to be 10% per year for the next two years, followed by a growth rate of 5% per year for the next threc years; after this five-ycar period, the growth in per share DIV is cxpected to be 2% per year indefinitely. The required rate of return on CBS, Inc. is 12%. Last year's per share DIV, that is, DIV at time 0(D0), was $2.00per share. a) Calculate the dividend values for ycars 0 through 6. Show your work. D1=(2.001.10)=$2.20 D2=(2.201.10)=$2.42 D3=(2.421.05)=$2.54 D44(2.541.05)=$2.67 D5=(2.671.05)=$2.80 D6=(2.801.02)=$2.86 b) At the end of year 5 , calculate the terminal price P5. (Show your calculations)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts