Question: Please help show work for number 1, 2, or 3 You have been hired to value the stock of a privately-held chain of grocery stores,

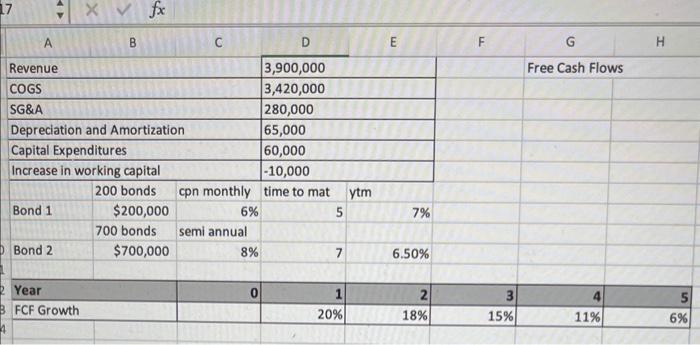

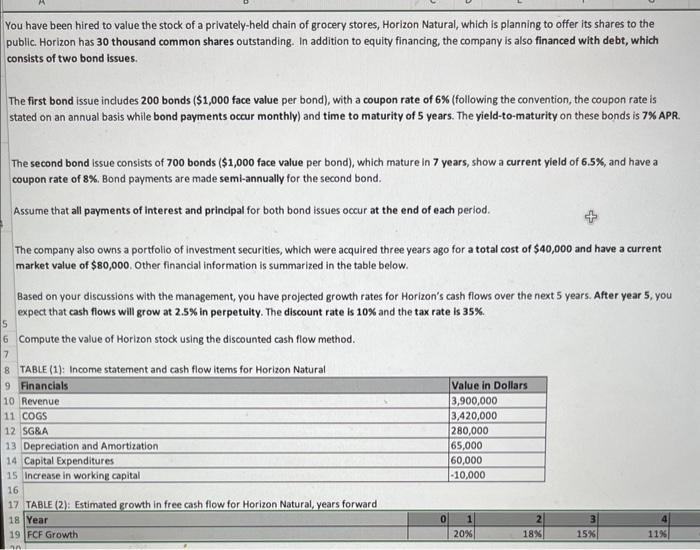

You have been hired to value the stock of a privately-held chain of grocery stores, Horizon Natural, which is planning to offer its shares to the public. Horizon has 30 thousand common shares outstanding. In addition to equity financing, the company is also financed with debt, which consists of two bond issues. The first bond issue includes 200 bonds ( $1,000 face value per bond), with a coupon rate of 6% (following the convention, the coupon rate is stated on an annual basis while bond payments occur monthly) and time to maturity of 5 years. The yield-to-maturity on these bonds is 7% APR. The second bond issue consists of 700 bonds ( $1,000 face value per bond), which mature in 7 years, show a current yield of 6.5%, and have a coupon rate of 8%. Bond payments are made semi-annually for the second bond. Assume that all payments of interest and principal for both bond issues occur at the end of each period. The company also owns a portfolio of investment securities, which were acquired three years ago for a total cost of $40,000 and have a current market value of $80,000. Other financial information is summarized in the table below. Based on your discussions with the management, you have projected growth rates for Horizon's cash flows over the next 5 years. After year 5 , you expect that cash flows will grow at 2.5% in perpetulty. The discount rate is 10% and the tax rate is 35%. Compute the value of Horizon stock using the discounted cash flow method. Using the information in the attached file, find 1) Total value of debt for Horizon Natural (that is, the total value of the first and second bonds) (5 points) 2) Free cash flows in years 1 to 6 (5 points) 3) Price per share of Horizon Natural, using FCFF analysis (10 points) Please upload your Excel file that shows your calculation for each part

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts