Question: Please help showing step by step B There is a MPT security with the following anticipated cash flows (annual payments, prepayment modeled using CPR) Mortgage

Please help showing step by step B

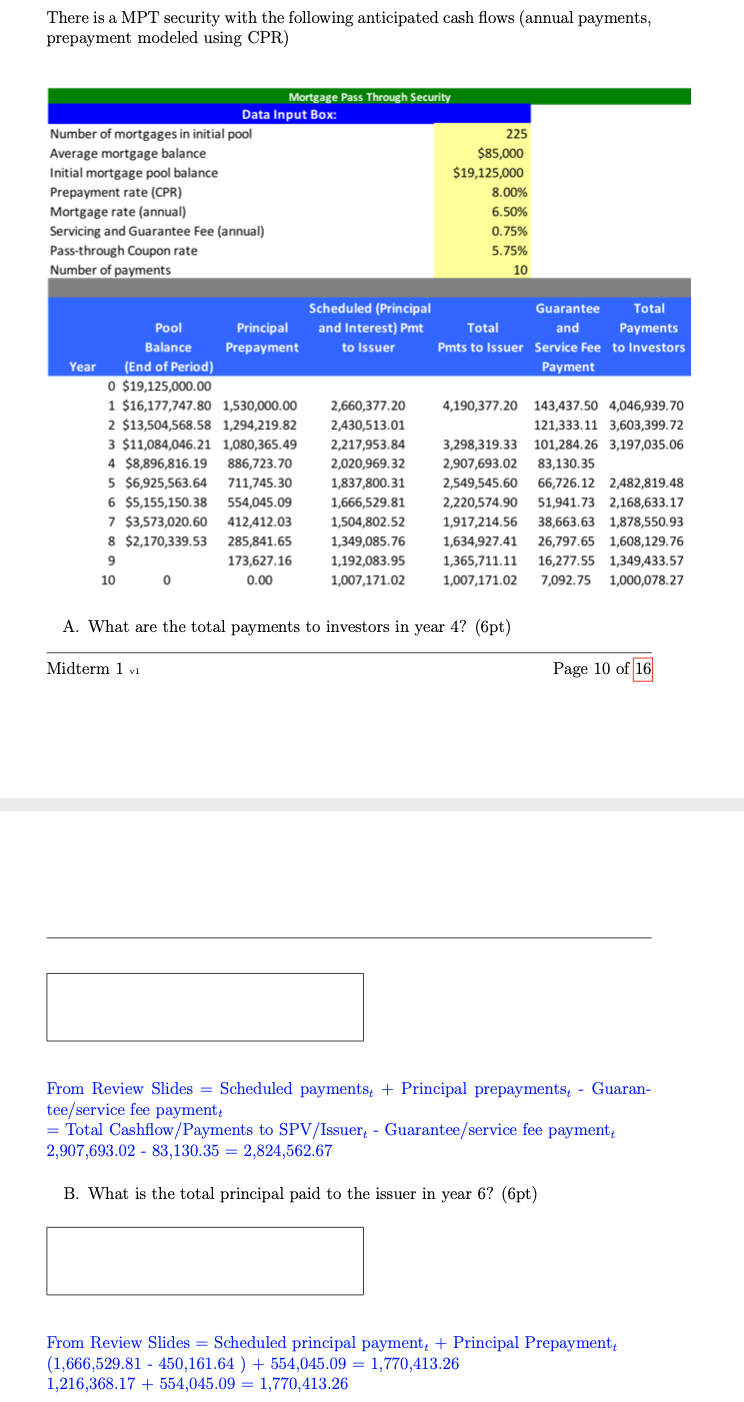

There is a MPT security with the following anticipated cash flows (annual payments, prepayment modeled using CPR) Mortgage Pass Through Security Data Input Box: Number of mortgages in initial pool 225 Average mortgage balance $85,000 Initial mortgage pool balance $19,125,000 Prepayment rate (CPR) 8.00% Mortgage rate (annual) 6.50% Servicing and Guarantee Fee (annual) 0.75% Pass-through Coupon rate 5.75% Number of payments 10 Scheduled (Principal Guarantee Total Pool Principal and Interest) Pmt Total and Payments Balance Prepayment to Issuer Pmts to Issuer Service Fee to Investors Year (End of Period) Payment 0 $19,125,000.00 1 $16,177,747.80 1,530,000.00 2,660,377.20 4,190,377.20 143,437.50 4,046,939.70 2 $13,504,568.58 1,294,219.82 2,430,513.01 121,333.11 3,603,399.72 3 $11,084,046.21 1,080,365.49 2,217,953.84 3,298,319.33 101,284.26 3,197,035.06 4 $8,896,816.19 886,723.70 2,020,969.32 2,907,693.02 83,130.35 5 $6,925,563.64 711,745.30 1,837,800.31 2,549,545.60 66,726.12 2,482,819.48 6 $5,155,150.38 554,045.09 1,666,529.81 2,220,574.90 51,941.73 2,168,633.17 7 $3,573,020.60 412,412.03 1,504,802.52 1,917,214.56 38,663.63 1,878,550.93 8 $2,170,339.53 285,841.65 1,349,085.76 1,634,927.41 26,797.65 1,608,129.76 173,627.16 1,192,083.95 1,365,711.11 16,277.55 1,349,433.57 100 0.00 1,007,171.02 1,007,171.02 7,092.75 1,000,078.27 A. What are the total payments to investors in year 4? (pt) Midterm 1 v1 Page 10 of 16 From Review Slides = Scheduled payments + Principal prepayments - Guaran- tee/service fee payment = Total Cashflow/Payments to SPV/Issuer - Guarantee/service fee payment 2,907,693.02 - 83,130.35 = 2,824,562.67 B. What is the total principal paid to the issuer in year 6? (pt) From Review Slides = Scheduled principal paymenty + Principal Prepayment (1,666,529.81 - 450,161.64 ) + 554,045.09 = 1,770,413.26 1,216,368.17 + 554,045.09 = 1,770,413.26 There is a MPT security with the following anticipated cash flows (annual payments, prepayment modeled using CPR) Mortgage Pass Through Security Data Input Box: Number of mortgages in initial pool 225 Average mortgage balance $85,000 Initial mortgage pool balance $19,125,000 Prepayment rate (CPR) 8.00% Mortgage rate (annual) 6.50% Servicing and Guarantee Fee (annual) 0.75% Pass-through Coupon rate 5.75% Number of payments 10 Scheduled (Principal Guarantee Total Pool Principal and Interest) Pmt Total and Payments Balance Prepayment to Issuer Pmts to Issuer Service Fee to Investors Year (End of Period) Payment 0 $19,125,000.00 1 $16,177,747.80 1,530,000.00 2,660,377.20 4,190,377.20 143,437.50 4,046,939.70 2 $13,504,568.58 1,294,219.82 2,430,513.01 121,333.11 3,603,399.72 3 $11,084,046.21 1,080,365.49 2,217,953.84 3,298,319.33 101,284.26 3,197,035.06 4 $8,896,816.19 886,723.70 2,020,969.32 2,907,693.02 83,130.35 5 $6,925,563.64 711,745.30 1,837,800.31 2,549,545.60 66,726.12 2,482,819.48 6 $5,155,150.38 554,045.09 1,666,529.81 2,220,574.90 51,941.73 2,168,633.17 7 $3,573,020.60 412,412.03 1,504,802.52 1,917,214.56 38,663.63 1,878,550.93 8 $2,170,339.53 285,841.65 1,349,085.76 1,634,927.41 26,797.65 1,608,129.76 173,627.16 1,192,083.95 1,365,711.11 16,277.55 1,349,433.57 100 0.00 1,007,171.02 1,007,171.02 7,092.75 1,000,078.27 A. What are the total payments to investors in year 4? (pt) Midterm 1 v1 Page 10 of 16 From Review Slides = Scheduled payments + Principal prepayments - Guaran- tee/service fee payment = Total Cashflow/Payments to SPV/Issuer - Guarantee/service fee payment 2,907,693.02 - 83,130.35 = 2,824,562.67 B. What is the total principal paid to the issuer in year 6? (pt) From Review Slides = Scheduled principal paymenty + Principal Prepayment (1,666,529.81 - 450,161.64 ) + 554,045.09 = 1,770,413.26 1,216,368.17 + 554,045.09 = 1,770,413.26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts