Question: Please Help! Smith, Inc. uses a predetermined overhead allocation rate of 30% of direct labor costs. In January, Smith completed Job 22, which had direct

Please Help!

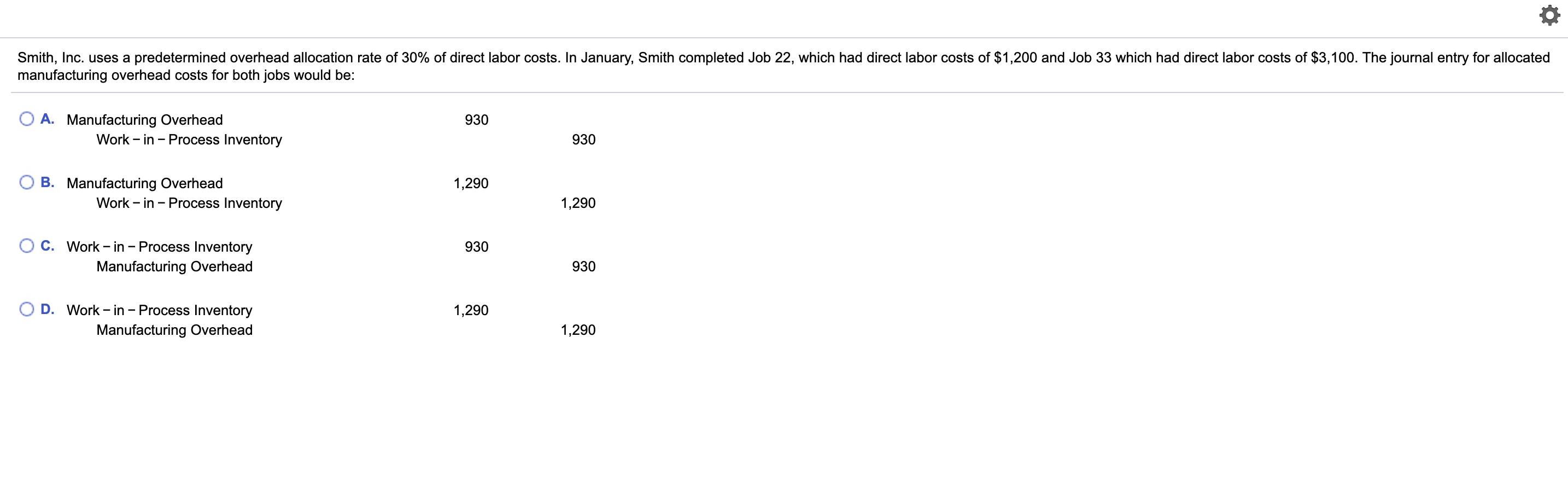

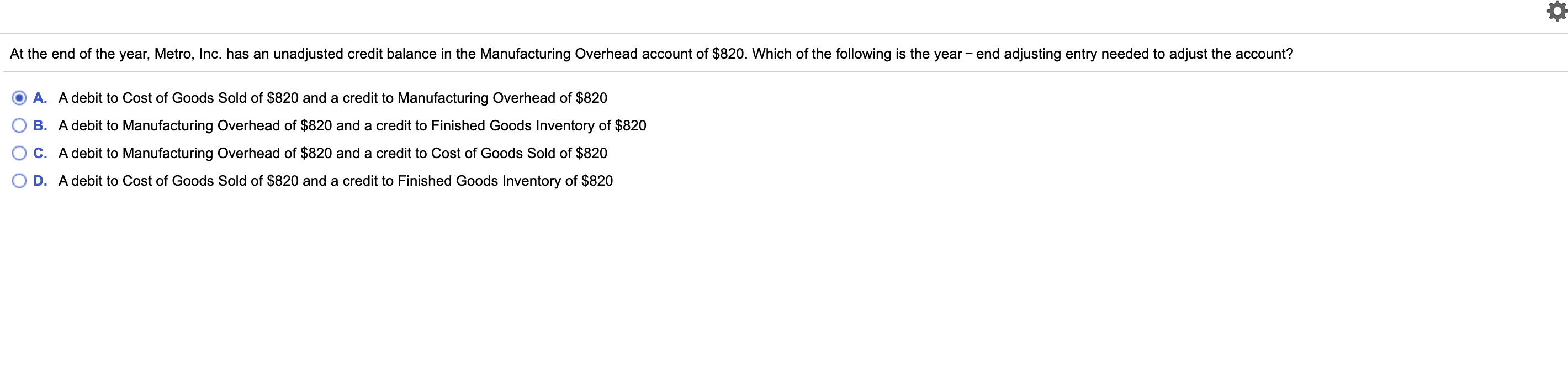

Smith, Inc. uses a predetermined overhead allocation rate of 30% of direct labor costs. In January, Smith completed Job 22, which had direct labor costs of $1,200 and Job 33 which had direct labor costs of $3,100. The journal entry for allocated manufacturing overhead costs for both jobs would be: 930 A. Manufacturing Overhead Work in - Process Inventory 930 1,290 B. Manufacturing Overhead Work in - Process Inventory 1,290 930 C. Work-in - Process Inventory Manufacturing Overhead 930 1,290 D. Work - in - Process Inventory Manufacturing Overhead 1,290 0 At the end of the year, Metro, Inc. has an unadjusted credit balance in the Manufacturing Overhead account of $820. Which of the following is the year-end adjusting entry needed to adjust the account? A. A debit to Cost of Goods Sold of $820 and a credit to Manufacturing Overhead of $820 B. A debit to Manufacturing Overhead of $820 and a credit to Finished Goods Inventory of $820 C. A debit to Manufacturing Overhead of $820 and a credit to Cost of Goods Sold of $820 D. A debit to Cost of Goods Sold of $820 and a credit to Finished Goods Inventory of $820

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts