Question: please help so lost What more information are you needing? this is all the information I have? please help asap Income statement preparation On December

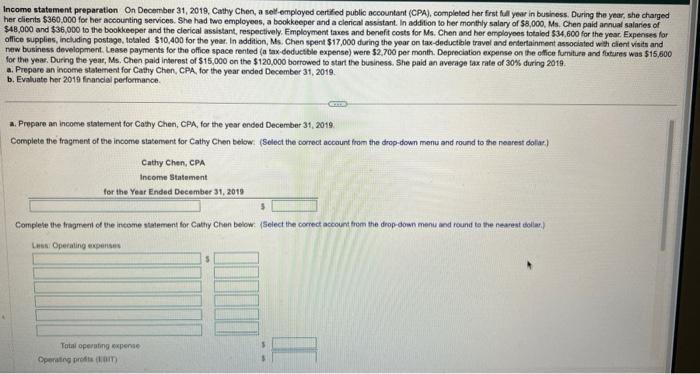

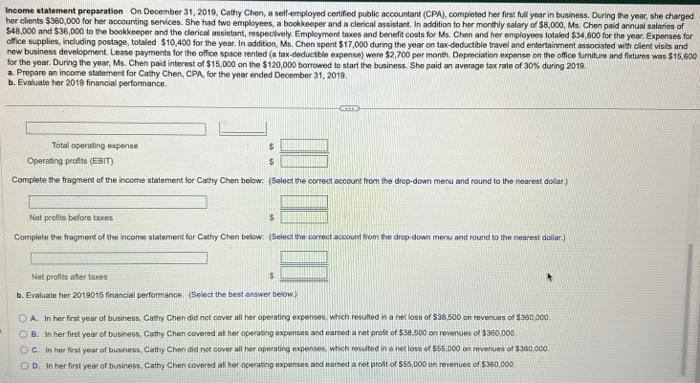

Income statement preparation On December 31, 2019, Cathy Chen, a sol-employed certifed public accountant (CPA), completed her frst full yeor in businoss. During the year, she charged her clients $360.000 for her acoounting services. She had two employeos, a bookkeeper and a clerical assistant. In addition to her monthly salary of $6,000, Ms. Chen paid annual salaries of $48,000 and $36,000 to the bookkeeper and the clerical assistant, respectively. Employment tames and benefit costs for Ms. Chen and her employoos totaled $34,600 for the year. Expenses for oflice supplies, including postage, totaled \$10,400 for the year. In addition, Ms. Chen spent $17,000 during the yoar on tax-deductale travel and entertainment associated wht client visits and new business development. Lease payments for the office space rented (a tax-deductible expense) were $2,700 per month. Depreciation expense on the office furnitura and firtures was $15,600 for the year. Durng the year, Ms. Chen pald interest of $15,000 on the $120,000 borrowed to start the business. She paid an average lax rate of 30% during 2019 . a. Prepore an inoome statement for Cathy Chen, CPA, for the year ended December 31,2019 . b. Evaluate her 2019 finandial perlormance. a. Prepare an incoene statemert for Cathy Chen, CPA, for the year endod December 31,2019 Complete the fragment of the income statement for Cathy Chen below: (Solect the oorroct account from the drop-down menu and round to the nearest dolaz) Income statement preparation On Decenber 31, 2019, Cathy Chen, a self-employed certifiod public accountant (CPA), completed her firs fill year in buainess, During the year, she charged hor clients $360,000 for her accounting services. She had two employees, a bookkeeper and a clereal assistant, In addition fo hor monthly salary of $8,000, Ms. Chen paid annual salafies of $48,000 and $36,000 to the bookkeeper and the clerical assistant, respectively Employmont taxes and benefit costs for Ms. Chen and her enployons totaled \$34,600 for the year Expenses for office supplies, including postege, totaled $10,400 for the year. In addition, Ms. Chen spent $17,000 durng the year on tax-dedictible travel and entertainment associated with client visis and new business development. Lease payments for the office spoce fented (a fax-deductole expense) wore $2,700 por month Depreciation expense on the office furniture and fixtures was $15,600 tor the year. During the year, M5. Chen paid interest of $15,060 on the $120,000 borrowed to start the business. \$he paid an average tax rate of 30% during 2019 . a. Propare an inpome stalement for Cathy Chen, CPA, for the year ended Deoomber 31,2019 . b. Evaluate her 2019 finanolal performance. Complete the fragment of the income statement for Cathy Chen bolow. (Select the correct account from the drep-down meru and tound to the nearest dollar) Nat profits before taxen 5 Complete the fragmert of the income stalement for Cathy Chen below: (Select the correct accourt trom the drep-down meru and round to the cearest dollar) Net prentis ather tanes 15 b. Evaluate her 2019015 financial performance. (Seiect the best atswer beiow. A. In her frst year of business, Cathy Chen did net cover all her opecating expenses. Which resulled in a net loss of $38,500 on tevenues of 3360;0,00. 0. In her first year of business. Cathy Chen covered at her operaing expenses and carred a net probt of $34.500 on revenues of $350.000 c. In her frat year af busnest, Catty Chen did not cover all her aperating expences, which resuted in a net loss er $55,000 on revenued or $360000. D. If kef fitst yeeg of businec5, Cathy Chen covered al her operating expensos and earsed a net profit of $55,000 an revenuer of $360,000 Income statement preparation On December 31, 2019, Cathy Chen, a sol-employed certifed public accountant (CPA), completed her frst full yeor in businoss. During the year, she charged her clients $360.000 for her acoounting services. She had two employeos, a bookkeeper and a clerical assistant. In addition to her monthly salary of $6,000, Ms. Chen paid annual salaries of $48,000 and $36,000 to the bookkeeper and the clerical assistant, respectively. Employment tames and benefit costs for Ms. Chen and her employoos totaled $34,600 for the year. Expenses for oflice supplies, including postage, totaled \$10,400 for the year. In addition, Ms. Chen spent $17,000 during the yoar on tax-deductale travel and entertainment associated wht client visits and new business development. Lease payments for the office space rented (a tax-deductible expense) were $2,700 per month. Depreciation expense on the office furnitura and firtures was $15,600 for the year. Durng the year, Ms. Chen pald interest of $15,000 on the $120,000 borrowed to start the business. She paid an average lax rate of 30% during 2019 . a. Prepore an inoome statement for Cathy Chen, CPA, for the year ended December 31,2019 . b. Evaluate her 2019 finandial perlormance. a. Prepare an incoene statemert for Cathy Chen, CPA, for the year endod December 31,2019 Complete the fragment of the income statement for Cathy Chen below: (Solect the oorroct account from the drop-down menu and round to the nearest dolaz) Income statement preparation On Decenber 31, 2019, Cathy Chen, a self-employed certifiod public accountant (CPA), completed her firs fill year in buainess, During the year, she charged hor clients $360,000 for her accounting services. She had two employees, a bookkeeper and a clereal assistant, In addition fo hor monthly salary of $8,000, Ms. Chen paid annual salafies of $48,000 and $36,000 to the bookkeeper and the clerical assistant, respectively Employmont taxes and benefit costs for Ms. Chen and her enployons totaled \$34,600 for the year Expenses for office supplies, including postege, totaled $10,400 for the year. In addition, Ms. Chen spent $17,000 durng the year on tax-dedictible travel and entertainment associated with client visis and new business development. Lease payments for the office spoce fented (a fax-deductole expense) wore $2,700 por month Depreciation expense on the office furniture and fixtures was $15,600 tor the year. During the year, M5. Chen paid interest of $15,060 on the $120,000 borrowed to start the business. \$he paid an average tax rate of 30% during 2019 . a. Propare an inpome stalement for Cathy Chen, CPA, for the year ended Deoomber 31,2019 . b. Evaluate her 2019 finanolal performance. Complete the fragment of the income statement for Cathy Chen bolow. (Select the correct account from the drep-down meru and tound to the nearest dollar) Nat profits before taxen 5 Complete the fragmert of the income stalement for Cathy Chen below: (Select the correct accourt trom the drep-down meru and round to the cearest dollar) Net prentis ather tanes 15 b. Evaluate her 2019015 financial performance. (Seiect the best atswer beiow. A. In her frst year of business, Cathy Chen did net cover all her opecating expenses. Which resulled in a net loss of $38,500 on tevenues of 3360;0,00. 0. In her first year of business. Cathy Chen covered at her operaing expenses and carred a net probt of $34.500 on revenues of $350.000 c. In her frat year af busnest, Catty Chen did not cover all her aperating expences, which resuted in a net loss er $55,000 on revenued or $360000. D. If kef fitst yeeg of businec5, Cathy Chen covered al her operating expensos and earsed a net profit of $55,000 an revenuer of $360,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts