Question: please help solve 139 Calibri (Body) Paste B I 11 2 Asset Utilization Ratios - Accounts Recelvable Tumover = Sales (Credit)/Accounts Recelvable (X) - Averaze

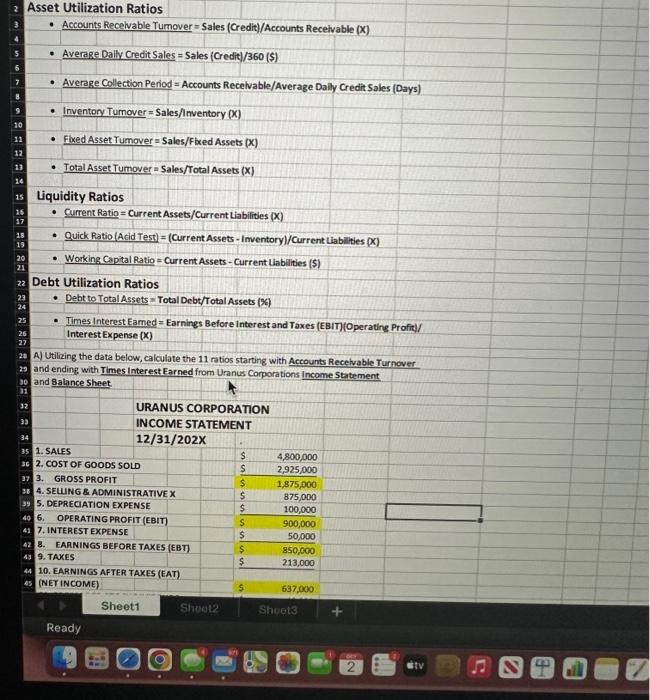

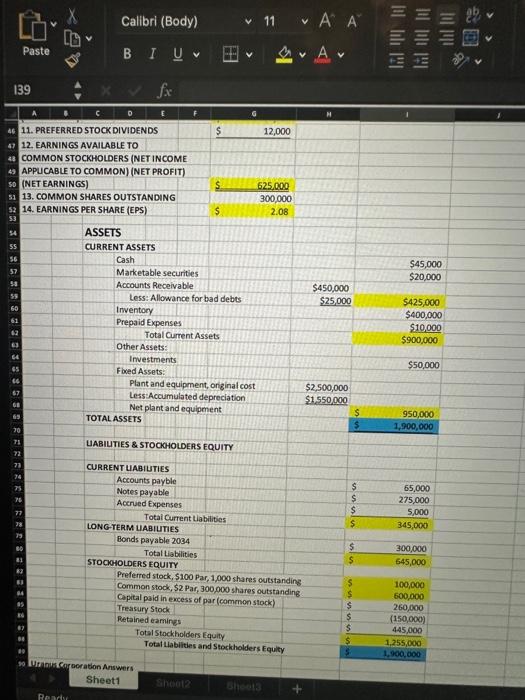

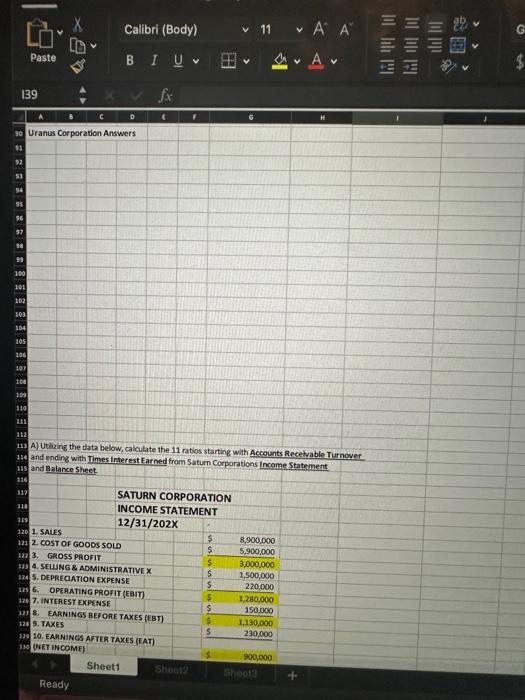

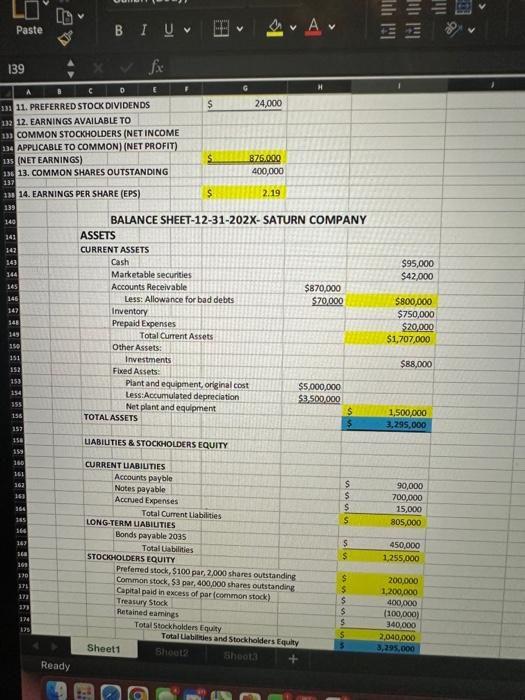

139 Calibri (Body) Paste B I 11 2 Asset Utilization Ratios - Accounts Recelvable Tumover = Sales (Credit)/Accounts Recelvable (X) - Averaze Dally Credit Sales = Sales (C redit )/360 (\$) - Average Collection Period = Accounts Recelvable/Average Dally Credit Sales (Days) - Inventory Turnover = Sales / Inventory (x) - Fbxed Asset Tumover = Sales/Fiked Assets (X) - Iotal Asset Tumover = Sales/Total Assets (x) Liquidity Ratios - Current Ratio = Current Assets/Current Liabilities (X) - Quick Ratio (Acid Test) =( Current Assets - Imventory) / Current Liabilities (X) - Working Capital Ratio = Current Assets - Current Liabilities (\$) Debt Utilization Ratios - Debt to Total Assets = Total Debt/Total Assets ( (6) - Times Interest Eamed = Earnings Before interest and Taxes (EBIT)(Operating Profin)/f Interest Expense (X) A) Utilizing the data below, calculate the 11 ratios starting with Accounts Recelvable Turnover and ending with Times Interest Farned from Uranus Corporations income Statement and Balance sheet. 32 URANUS CORPORATION 33 INCOME STATEMENT 34 12/31/202X 35 1. SALES 2. COST OF GOODS SOLD 3. GROSS PROFIT 4. SEUNG \& ADMINISTRATIVE X 5. DEPRECIATION EXPENSE 6. OPERATING PROFIT (EBIT) 1. 7.INTEREST EXPENSE 42. 8. EARNINGS BEFORE TAKES (EBT) 9. TAKES 10. EARNINGS AFTER TAXES (EAT) (NET INCOME) \begin{tabular}{|rr|} \hline$ & 4,800,000 \\ \hline$ & 2,925,000 \\ \hline$ & 1,875,000 \\ $ & 875,000 \\ \hline 5 & 100,000 \\ \hlineS & 900,000 \\ \hline$ & 50,000 \\ \hline$ & 850,000 \\ \hline & 213,000 \\ \hline 5 & 637,000 \\ \hline \end{tabular} Sheet1 Ready A) Uthizing the data below, calculate the 11 rabos starting with Accounts Recelvable Turnover. and ending with Times Interest Earned from Saturn Corporations income Statement and Balance Sheet 139 11. PREFERRED STOCKDIVIDENDS 132. EARNINGS AVAILABLE TO 19. COMMON STOCKHOLDERS (NET INCOME 134 APPUCABLE TO COMMON) (NET PROFIT) 135 (NET EARNINGS) 196. 13. COMMON SHARES OUTSTANDING 137 14. 14. EARNINGS PER SHARE (EPS) f BALANCE SHEET-12-31-202X-SATURN COMPANY ASSETS CURRENT ASSETS Cash Marketable securities $95,000 Accounts Receivable Less: Allowance for bad debts Inventory Prepaid Expenses Total Current Assets Other Assets: Investments Fbed Assets: 876,0000 400,000 Plant and equipment, original cost Less:Accumulated depreciation Net plant and equipment TOTAL ASSETS is UABIUTIES \& STOCKOHOLDERS EQUITY CURRENT UABIUTES Accounts payble Notes payable Accrued Expenses Total Cument Ulabilities LONG-TERM UABIUTIES Bonds payable 2035 Total tabilities STOCKOHOLOERS EQUITY Preferred stock, $100 par, 2,000 shares outstanding Common stock, $3 par, 400,000 shares outstanding Capital paid in excess of par (common stock) Treasury stock Retained earnings 124 Total 5tockholders Equity Total Labilivies and Stockholders Equity Sheet1 $5,000,000 $42,000 $870,000 $70,000 $800,000 $750,000 $20,000 $1,707,000 $88,000 $3,500,000 \begin{tabular}{ll} $ & 1,500,000 \\ $ & 3,295,000 \\ \hline \end{tabular} \begin{tabular}{ll} $ & 1,500,000 \\ $ & 3,295,000 \\ \hline \end{tabular} \begin{tabular}{|rr|} \hline$ & 90,000 \\ $ & 700,000 \\ \hline$ & 15,000 \\ \hline$ & 805,000 \\ \hline \end{tabular} \begin{tabular}{lr} $ & 450,000 \\ \hline$ & 1,255,000 \end{tabular} 200000 1,200,000 400,000 (100,000) 340,000 2,040,000 3,295,000 Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts