Question: PLEASE HELP SOLVE ALL 5!! thank you for your time, will rate clearer image here: new images below: please answer all 4 as I need

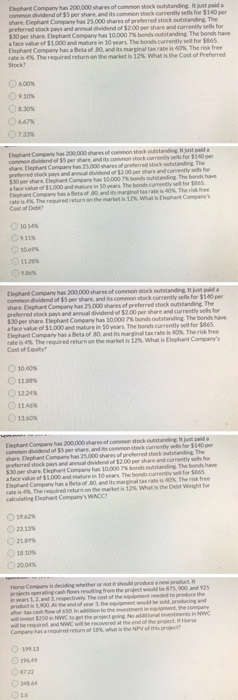

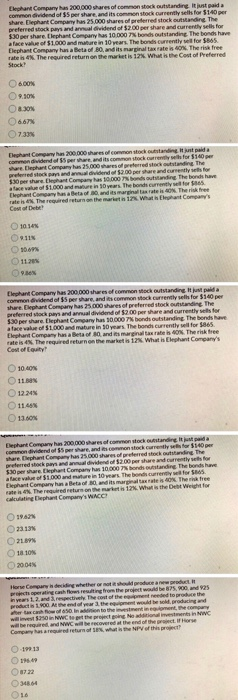

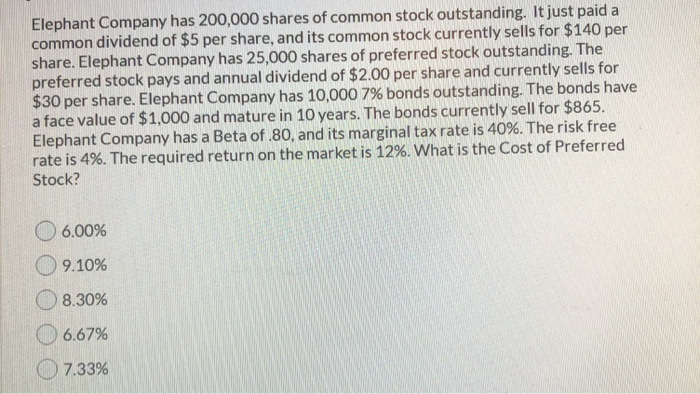

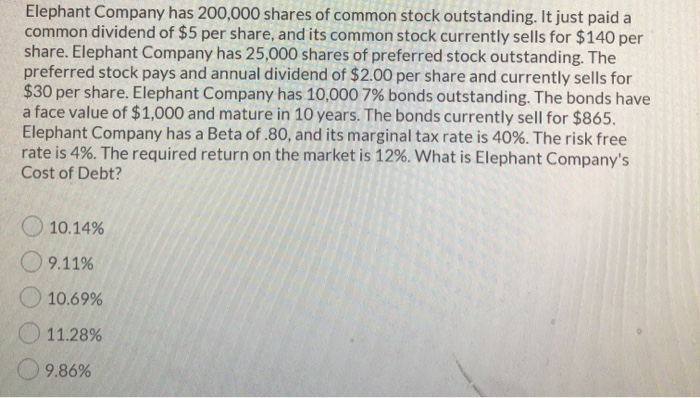

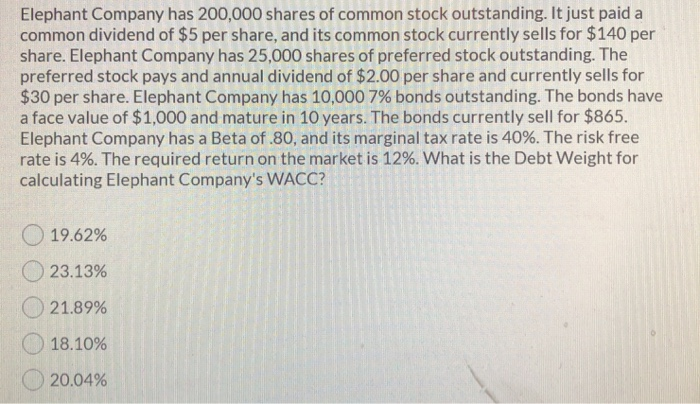

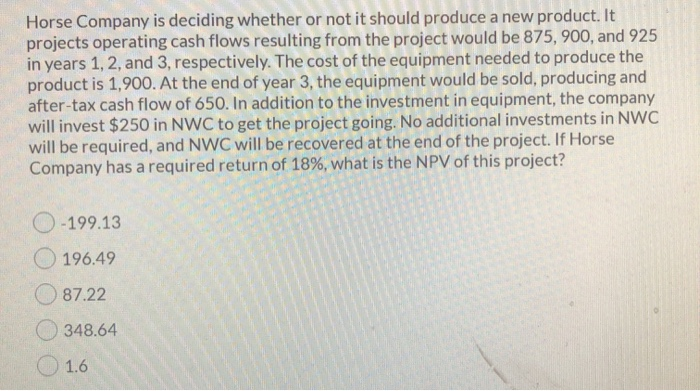

Elegant Company has 2000 Shares of common stock outstandin g cor d e pershare and shock currently $140 per share phant Comp us 25.000 shares of referred stock outstanding The preferred to as an a idend of $200 per hendre ses for $30 arsheleph a ny as 10 standing The band have toward the bones currently well for $865 y habandalate These rab Thereuredireturn on the marketis 12 Whateco Preferred 6.00% 9. 730 d a so Elegant Com 200.000hares of common stock an and contro are tant Company has 25.000 her red stock de care and C ant Company has 10.000 bostanding a few of $1.000 and in 10 years. The bonds currency Tlephant Company has a Bet of 10 and its 10.14% 11 100% 112 Elephant Company has 200.000 shares of common och outstanding pada Con dividend of p hare, and its common stock currently sells for $100 per share phant Company has 25.000 shares of preferred stock i ng The preferred to as an annual dividendo $2.00 per share and currently for $30 per share. Elephant Company has 10.000 bonds outstanding. The bonds have a face value of $1.000 and mature in 10 years. The band currently well for $865. Elephant Company has a Beta of 30 and marginal tax rates The risk free rates 4. The required return the markets 12%. What is t hat company's 100% 11.30 13.00 da Elephant Company has 200.000 shares of common stock utandine dividend e share and stock warehou 250 g the a aces ndre 1.000 and in 10 ws. The bondscene for hohet its marginal taxta iso. The free 18 10% 2004 whether or not it should produce r -19913 116.49 Elephant Company has 200.000 hrs of common stock utanding pada Commonwidend of 15 pershare and its.common stock currently sets for $140 per share phant Cor as 25.000 shares oferred och utanding the preferred Guidend of 200 dere s for per share phant Company 10.000 Nonstanding. The bondshaw face of $1.000 and abre in 10 years. The bonds currently for 85 Elephant Companyateta od 0 and its marginal tax rate the risk free en The r mom is 12 Watt Cost Preferred S CON . Thephant 000 hrscommons preferred to pay and w i ndor 2.00 per share and currently we 530 per share. Clean Company has 10.000 bonds outstandingThe band have thephone Come n taris ON There as the return on What Com 101 11 100 O1120 lephant Coah 200 000 reso con un a there that com e s 15.000 hores of preferred to in the preferred to pay and annual dividend of $200 p are and currently waits for 5.30 per here tlephant Company has 10.000 bondhoutstanding. The bonds have a face $1.000 metrin years. The band currently well for Departme n t . There rates. Theredeturn on the market is what is that organ's Cost of 11.00 12.22 13. ephant Company has 200000 shares of const a condividend waren ess whare. Dephant Corpus 25.000 sures of preferred to andre the 380 per company has 10.000 s tanding. The bonds alace of $1.000 urinews.The crew s Elephant Comhan Betao 30 and its mar a is The requires What is the best Weight for 2013 18.10 2004 The cost to produce the willing will be required and we will be recovered at the end of the tin NC Horse -19913 14.40 34.4 16 Elephant Company has 200,000 shares of common stock outstanding. It just paid a common dividend of $5 per share, and its common stock currently sells for $140 per share. Elephant Company has 25,000 shares of preferred stock outstanding. The preferred stock pays and annual dividend of $2.00 per share and currently sells for $30 per share. Elephant Company has 10,000 7% bonds outstanding. The bonds have a face value of $1,000 and mature in 10 years. The bonds currently sell for $865. Elephant Company has a Beta of.80, and its marginal tax rate is 40%. The risk free rate is 4%. The required return on the market is 12%. What is the Cost of Preferred Stock? 06.00% 09.10% 08.30% 6.67% O 7.33% Elephant Company has 200,000 shares of common stock outstanding. It just paid a common dividend of $5 per share, and its common stock currently sells for $140 per share. Elephant Company has 25,000 shares of preferred stock outstanding. The preferred stock pays and annual dividend of $2.00 per share and currently sells for $30 per share. Elephant Company has 10,000 7% bonds outstanding. The bonds have a face value of $1,000 and mature in 10 years. The bonds currently sell for $865. Elephant Company has a Beta of.80, and its marginal tax rate is 40%. The risk free rate is 4%. The required return on the market is 12%. What is Elephant Company's Cost of Debt? 10.14% 09.11% 10.69% 11.28% 9.86% Elephant Company has 200,000 shares of common stock outstanding. It just paid a common dividend of $5 per share, and its common stock currently sells for $140 per share. Elephant Company has 25,000 shares of preferred stock outstanding. The preferred stock pays and annual dividend of $2.00 per share and currently sells for $30 per share. Elephant Company has 10,000 7% bonds outstanding. The bonds have a face value of $1,000 and mature in 10 years. The bonds currently sell for $865. Elephant Company has a Beta of.80, and its marginal tax rate is 40%. The risk free rate is 4%. The required return on the market is 12%. What is the Debt Weight for calculating Elephant Company's WACC? 19.62% 23.13% O 21.89% 18.10% 20.04% Horse Company is deciding whether or not it should produce a new product. It projects operating cash flows resulting from the project would be 875, 900, and 925 in years 1, 2, and 3, respectively. The cost of the equipment needed to produce the product is 1,900. At the end of year 3, the equipment would be sold, producing and after-tax cash flow of 650. In addition to the investment in equipment, the company will invest $250 in NWC to get the project going. No additional investments in NWC will be required, and NWC will be recovered at the end of the project. If Horse Company has a required return of 18%, what is the NPV of this project? 0-199.13 196.49 87.22 348.64 O 1.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts