Question: please help solve all (Capital asset pricing model) Levine Manufacturing Inc. is considering several investments in the popup window: The rate on Treasury bills is

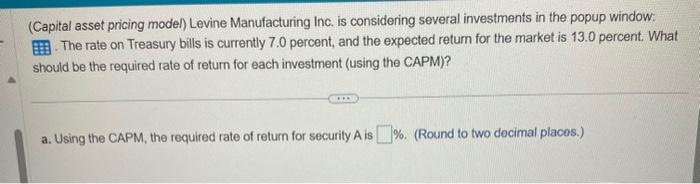

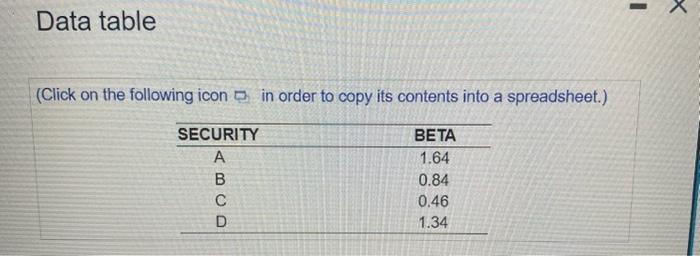

(Capital asset pricing model) Levine Manufacturing Inc. is considering several investments in the popup window: The rate on Treasury bills is currently 7.0 percent, and the expected return for the market is 13.0 percent. What should be the required rate of return for each investment (using the CAPM)? a. Using the CAPM, the required rate of return for security A is \%. (Round to two docimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts