Question: please help solve all part. i am really struggling Long-question Q1: Consider two mutually exclusive projects with the following cash flows: Project A B C/F0

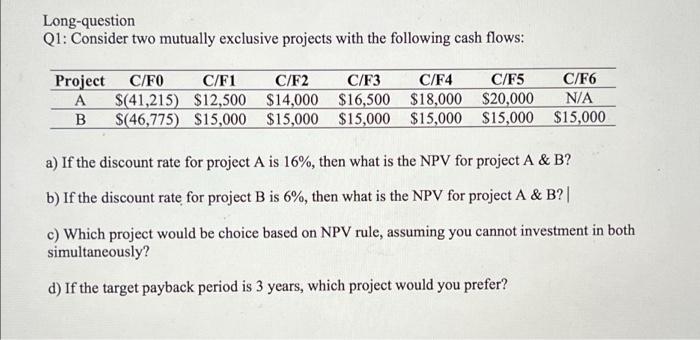

Long-question Q1: Consider two mutually exclusive projects with the following cash flows: Project A B C/F0 C/F1 $(41,215) $12,500 $(46,775) $15,000 C/F2 C/F3 C/F4 C/F5 C/F6 $14,000 $16,500 $18,000 $20,000 N/A $15,000 $15,000 $15,000 $15,000 $15,000 a) If the discount rate for project A is 16%, then what is the NPV for project A & B? b) If the discount rate for project B is 6%, then what is the NPV for project A & B?| c) Which project would be choice based on NPV rule, assuming you cannot investment in both simultaneously? d) If the target payback period is 3 years, which project would you prefer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts