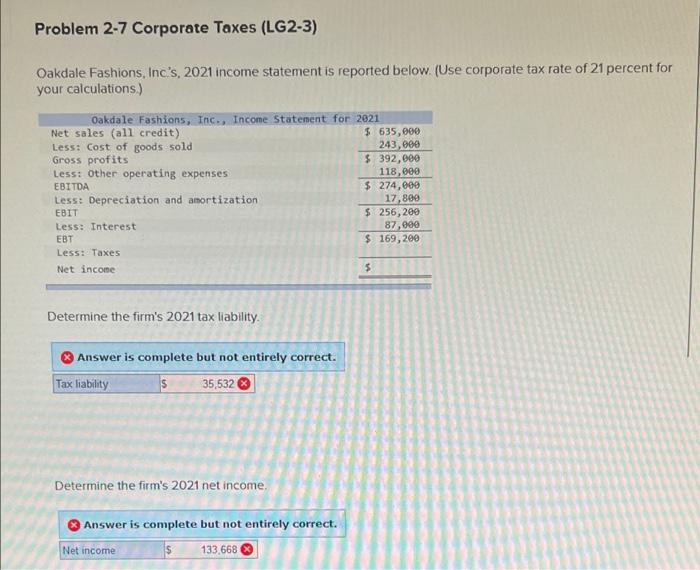

Question: please help solve and explain steps for question 1 and 2! Problem 2-7 Corporate Taxes (LG2-3) Oakdale Fashions, Inc.'s, 2021 income statement is reported below.

Problem 2-7 Corporate Taxes (LG2-3) Oakdale Fashions, Inc.'s, 2021 income statement is reported below. (Use corporate tax rate of 21 percent for your calculations.) Oakdale Fashions, Inc., Income Statement for 2021 Net sales (all credit). Less: Cost of goods sold Gross profits Less: Other operating expenses EBITDA Less: Depreciation and amortization EBIT Less: Interest EBT Less: Taxes Net income Determine the firm's 2021 tax liability. Answer is complete but not entirely correct. Tax liability S 35,532 Determine the firm's 2021 net income. Answer is complete but not entirely correct. Net income S 133,668 $ 635,000 243,000 $ 392,000 118,000 $ 274,000 17,809 $ 256,200 87,000 $ 169,200 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts