Question: PLEASE HELP! SOLVE AND SHOW PROCESS PLEASE 1. Suppose that the economy is described by three growth states: strong, moderate, and weak. The probabilities of

PLEASE HELP! SOLVE AND SHOW PROCESS PLEASE

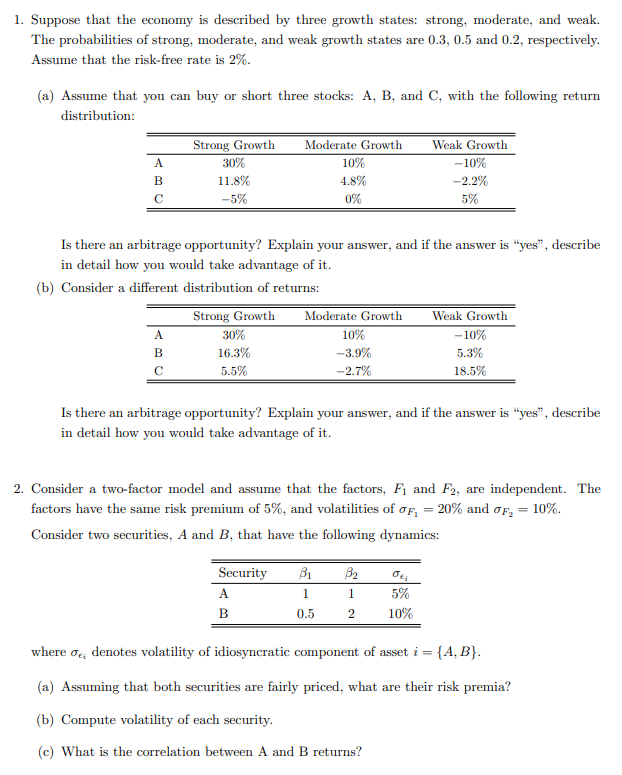

1. Suppose that the economy is described by three growth states: strong, moderate, and weak. The probabilities of strong, moderate, and weak growth states are 0.3,0.5 and 0.2 , respectively. Assume that the risk-free rate is 2%. (a) Assume that you can buy or short three stocks: A, B, and C, with the following return distribution: Is there an arbitrage opportunity? Explain your answer, and if the answer is "yes", describe in detail how you would take advantage of it. (b) Consider a different distribution of returns: Is there an arbitrage opportunity? Explain your answer, and if the answer is "yes", describe in detail how you would take advantage of it. 2. Consider a two-factor model and assume that the factors, F1 and F2, are independent. The factors have the same risk premium of 5%, and volatilities of F1=20% and F2=10%. Consider two securities, A and B, that have the following dynamics: where i denotes volatility of idiosyncratic component of asset i={A,B}. (a) Assuming that both securities are fairly priced, what are their risk premia? (b) Compute volatility of each security. (c) What is the correlation between A and B returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts