Question: Please help solve both problems! Thank you! Brief Exercise 14-7 On January 1, 2017, Cheyenne Corporation issued S 50 000 o 9% on s, due

Please help solve both problems! Thank you!

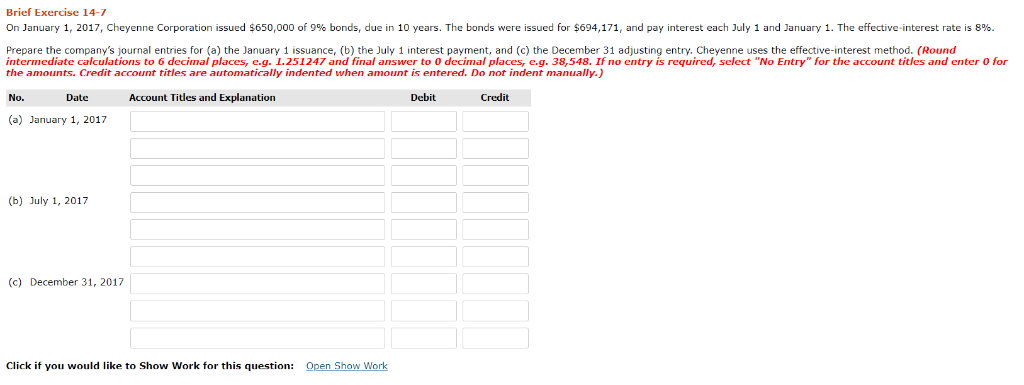

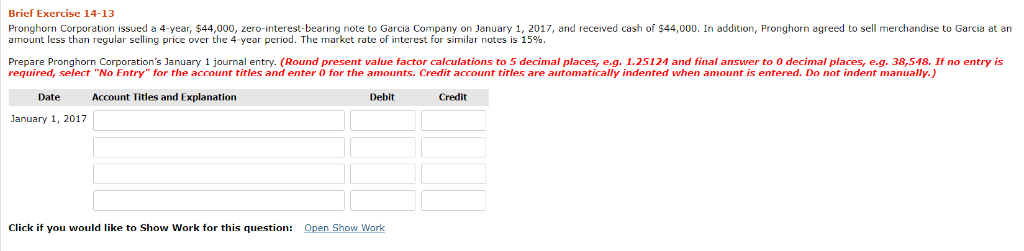

Brief Exercise 14-7 On January 1, 2017, Cheyenne Corporation issued S 50 000 o 9% on s, due in 10 years. The o s were s sued or S 94 171 and pay interest each July 1 and January 1 The effective-interest rate is Prepare the company's journal entries for (a) the January 1 issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry. Cheyenne uses the effective-interest method. (Round intermediate calculations to 6 decimal places, e.g. 1.251247 and final answer to 0 decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are autaically indented when amount is entered. Do not indent manually. Date Account Titles and Explanation Debit hoolii (a) January 1, 2017 b) July 1, 2017 (c) December 31, 2017 Click if you would like to Show Work for this question: Open Show Work Brief Exercise 14-13 Pronghorn Corporation issued a 4-year, $44,000, zero-interest-bearing note to Garcia Company on January 1, 2017, and received cash of $44,000. In addition, Pronghorn agreed to sell merchandise to Garcia at an amount less than regular selling price over the 4-year period. The market rate of interest for similar notes is 15% Prepare Pronghorn Corporation's January 1 journal entry. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit anuary 1, 2017 Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts