Question: please help solve correctly. (Related to Checkpoint 6.5) (Present value of a growing perpetuity) What is the present value of a perpetual stream of cash

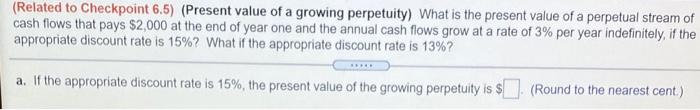

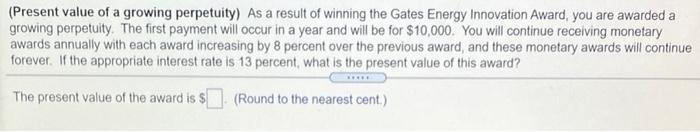

(Related to Checkpoint 6.5) (Present value of a growing perpetuity) What is the present value of a perpetual stream of cash flows that pays $2,000 at the end of year one and the annual cash flows grow at a rate of 3% per year indefinitely, if the appropriate discount rate is 15%? What if the appropriate discount rate is 13%? a. If the appropriate discount rate is 15%, the present value of the growing perpetuity is $ (Round to the nearest cent) (Present value of a growing perpetuity) As a result of winning the Gates Energy Innovation Award, you are awarded a growing perpetuity. The first payment will occur in a year and will be for $10,000. You will continue receiving monetary awards annually with each award increasing by 8 percent over the previous award, and these monetary awards will continue forever. If the appropriate interest rate is 13 percent, what is the present value of this award? The present value of the award is $(Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts