Question: Please help solve correctly with explanations. Questions 22-26 are based on the following information. CAPM and stock valuation. Your aunt, Beth, plans to invest in

Please help solve correctly with explanations.

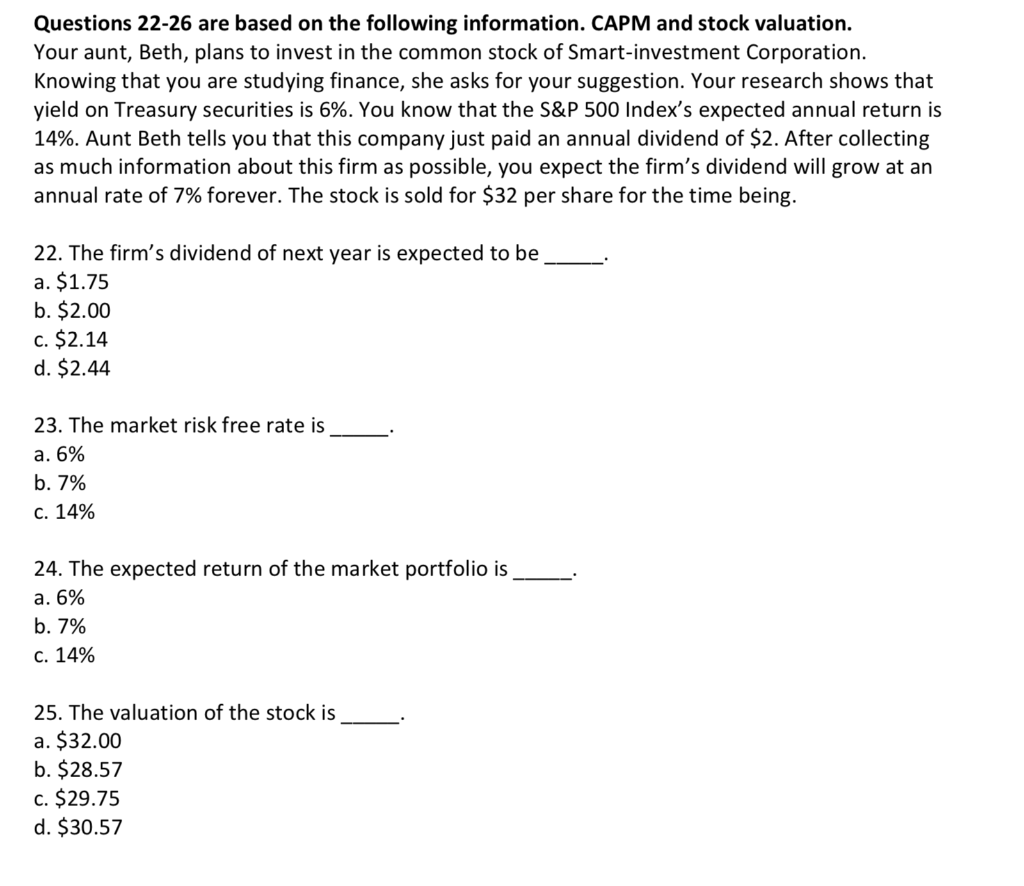

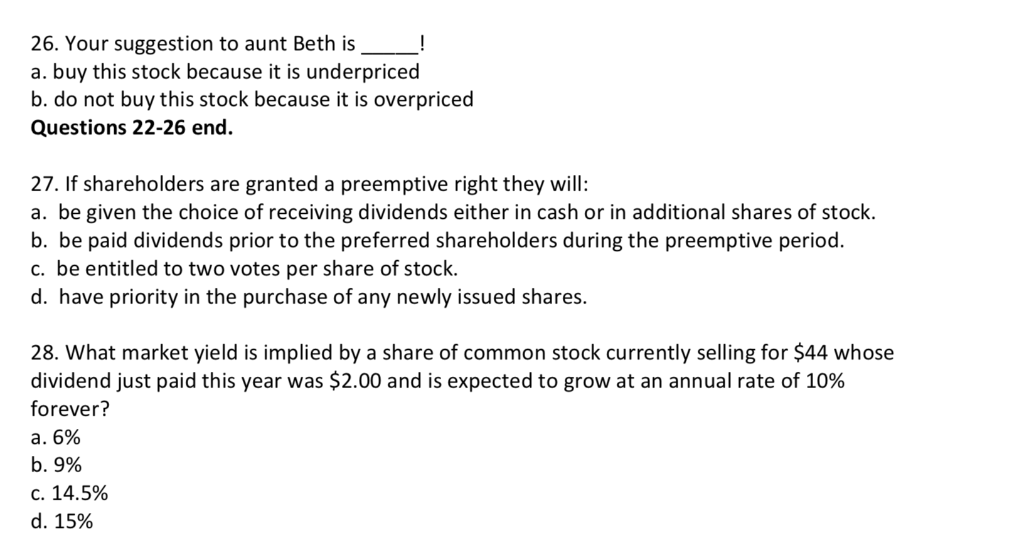

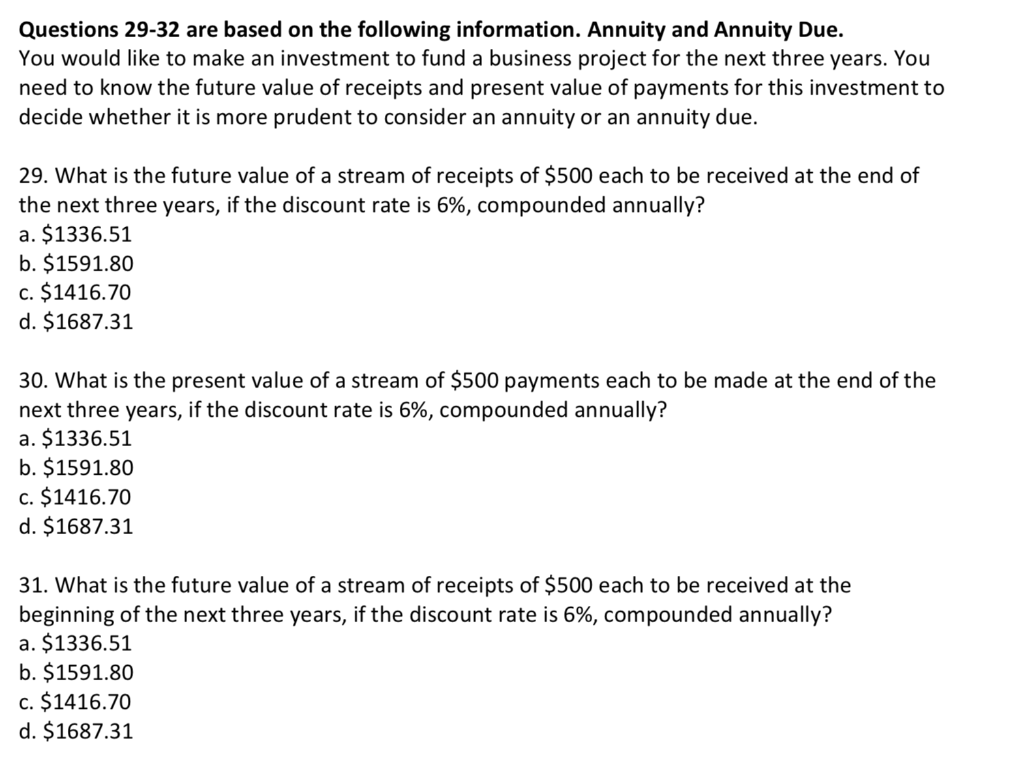

Questions 22-26 are based on the following information. CAPM and stock valuation. Your aunt, Beth, plans to invest in the common stock of Smart-investment Corporation. Knowing that you are studying finance, she asks for your suggestion. Your research shows that yield on Treasury securities is 6%. You know that the S&P 500 Index's expected annual return is 14%. Aunt Beth tells you that this company just paid an annual dividend of $2. After collecting as much information about this firm as possible, you expect the firm's dividend will grow at arn annual rate of 7% forever. The stock is sold for $32 per share for the time being 22. The firm's dividend of next year is expected to be a. $1.75 b. $2.00 c. $2.14 d. $2.44 23. The market risk free rate is a. 6% b. 7% C. 14% 24. The expected return of the market portfolio is a. 6% b. 7% c. 14% 25. The valuation of the stock is a. $32.00 b. $28.57 c. $29.75 d. $30.57 26. Your suggestion to aunt Beth is ! a. buy this stock because it is underpriced b. do not buy this stock because it is overpriced Questions 22-26 end 27. If shareholders are granted a preemptive right they will: a. be given the choice of receiving dividends either in cash or in additional shares of stock b. be paid dividends prior to the preferred shareholders during the preemptive period. c. be entitled to two votes per share of stock. d. have priority in the purchase of any newly issued shares. 28. What market yield is implied by a share of common stock currently selling for $44 whose dividend just paid this year was $2.00 and is expected to grow at an annual rate of 10% forever? a. 6% b. 9% C. 14.5% d. 15% Questions 29-32 are based on the following information. Annuity and Annuity Due. You would like to make an investment to fund a business project for the next three years. You need to know the future value of receipts and present value of payments for this investment to decide whether it is more prudent to consider an annuity or an annuity due. 29. What is the future value of a stream of receipts of $500 each to be received at the end of the next three years, if the discount rate is 6%, compounded annually? a. $1336.51 b. $1591.80 c. $1416.70 d. $1687.31 30. What is the present value of a stream of $500 payments each to be made at the end of the next three years, if the discount rate is 6%, compounded annually? a. $1336.51 b. $1591.80 c. $1416.70 d. $1687.31 31. What is the future value of a stream of receipts of $500 each to be received at the beginning of the next three years, if the discount rate is 6%, compounded annually? a. $1336.51 b. $1591.80 c. $1416.70 d. $1687.31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts