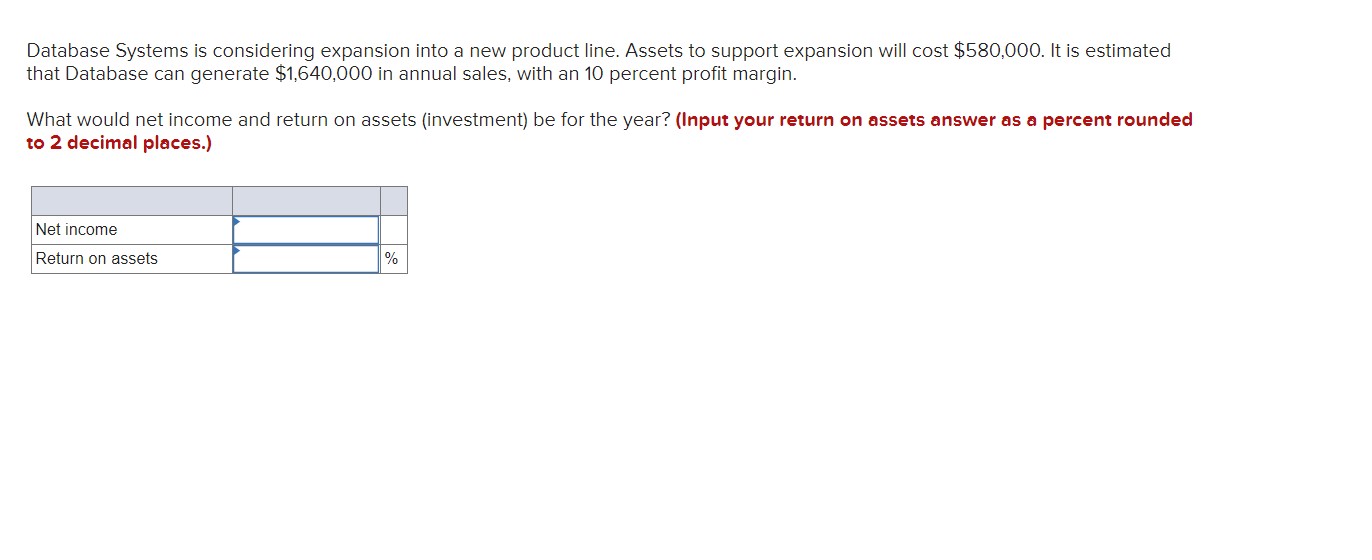

Question: Please help solve Database Systems is considering expansion into a new product line. Assets to support expansion will cost $580,000. It is estimated that Database

Please help solve

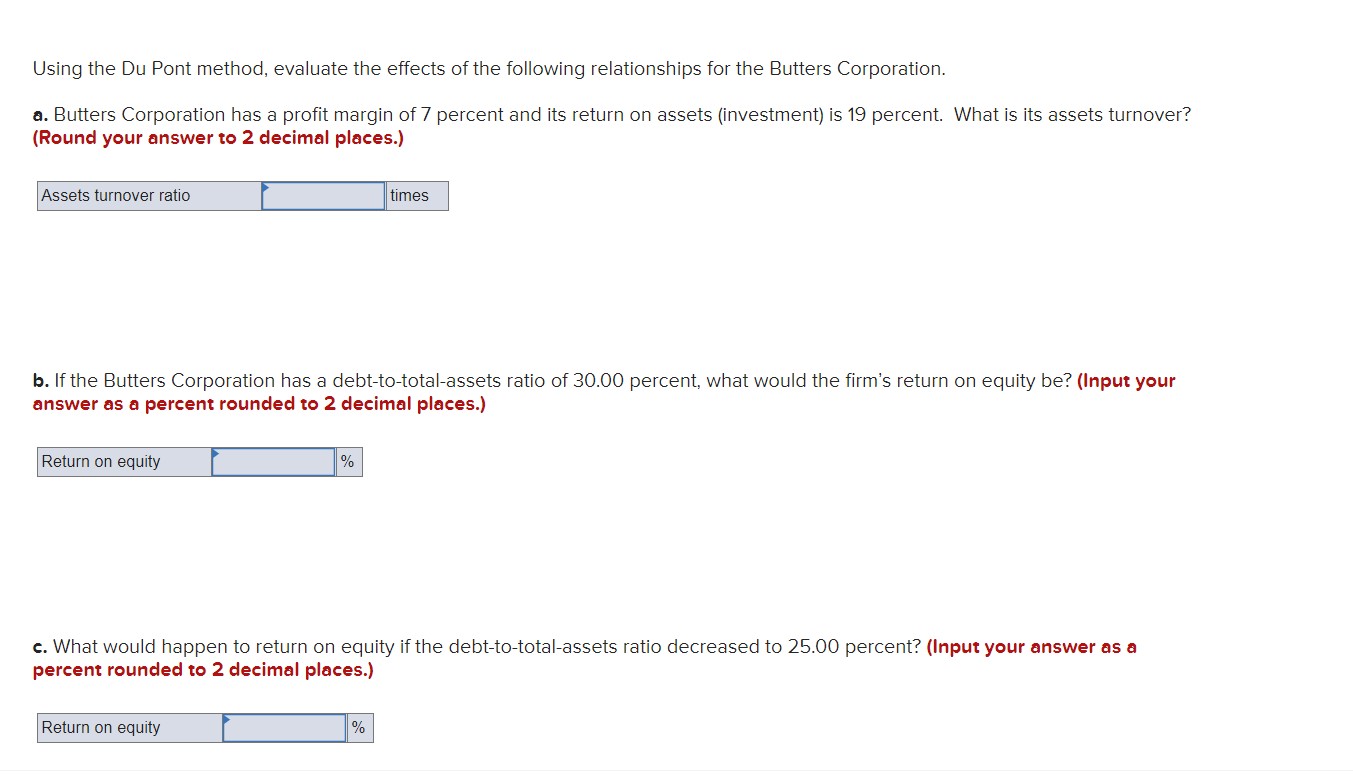

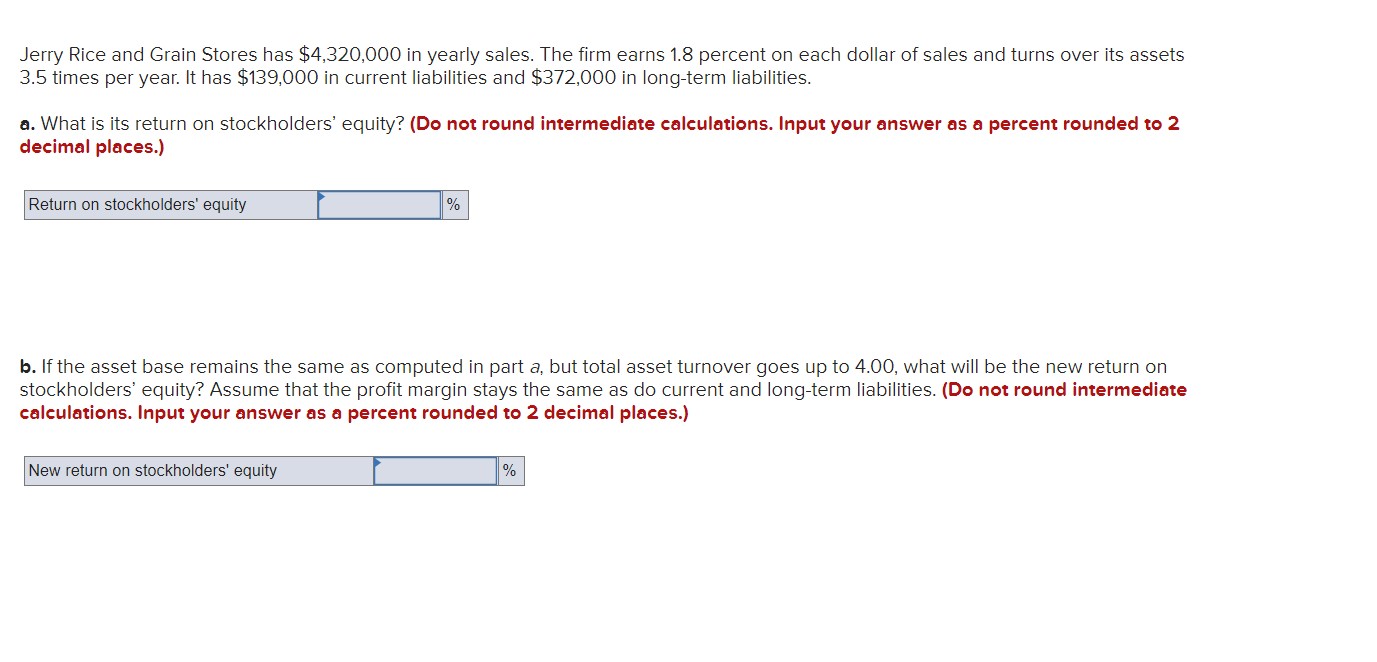

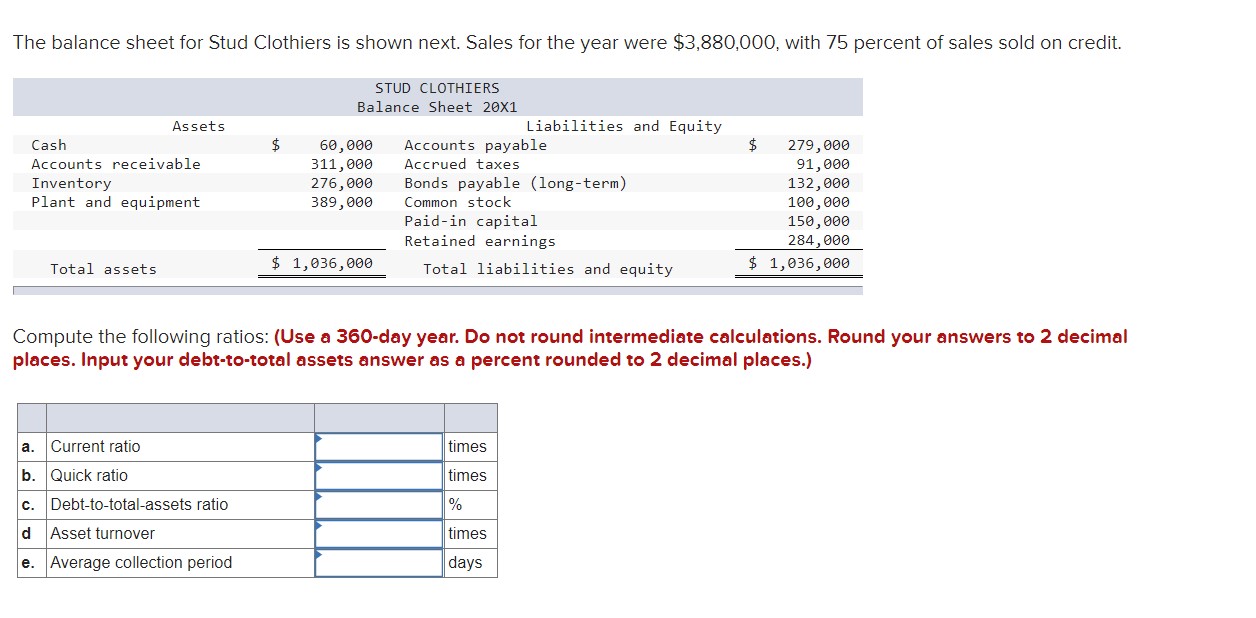

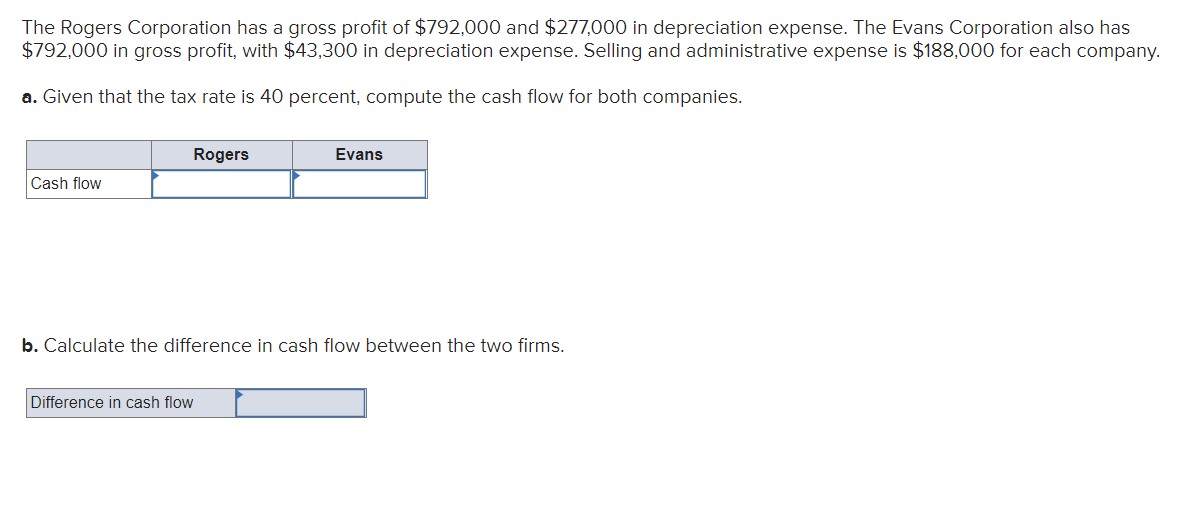

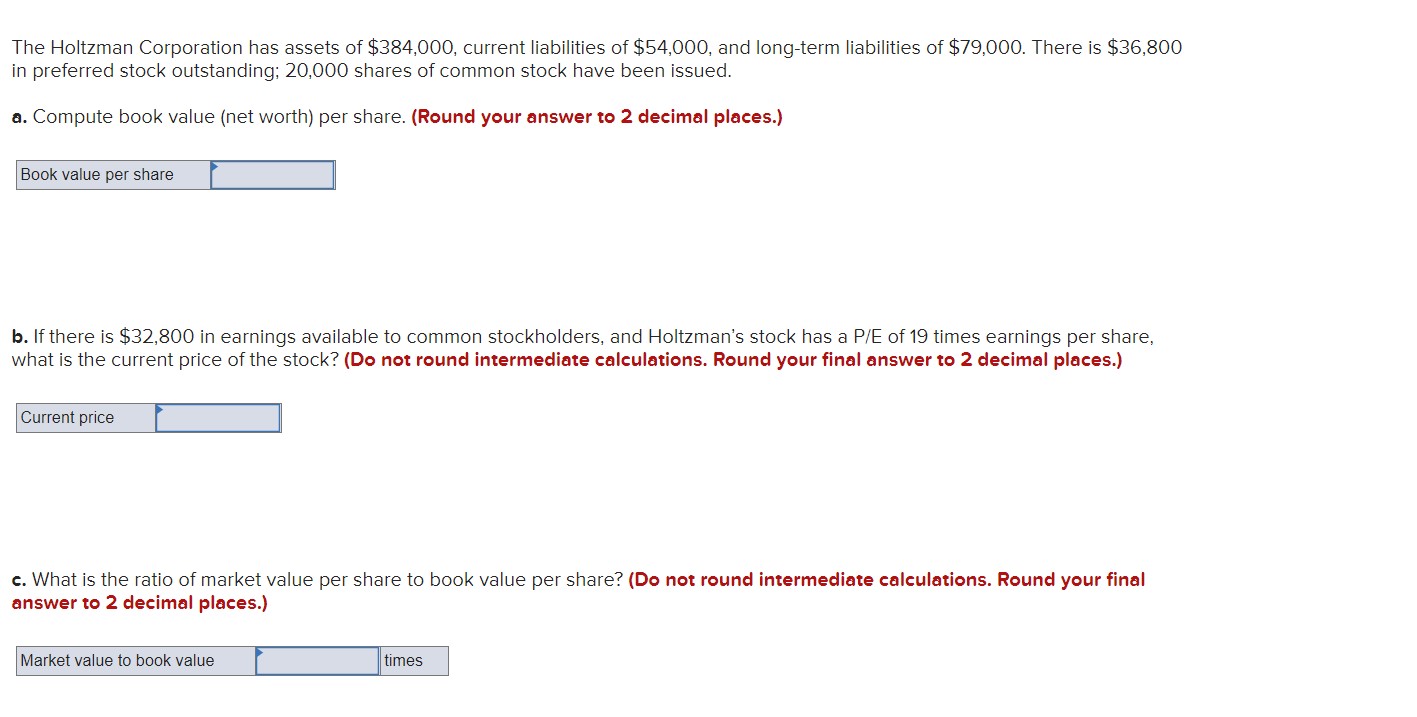

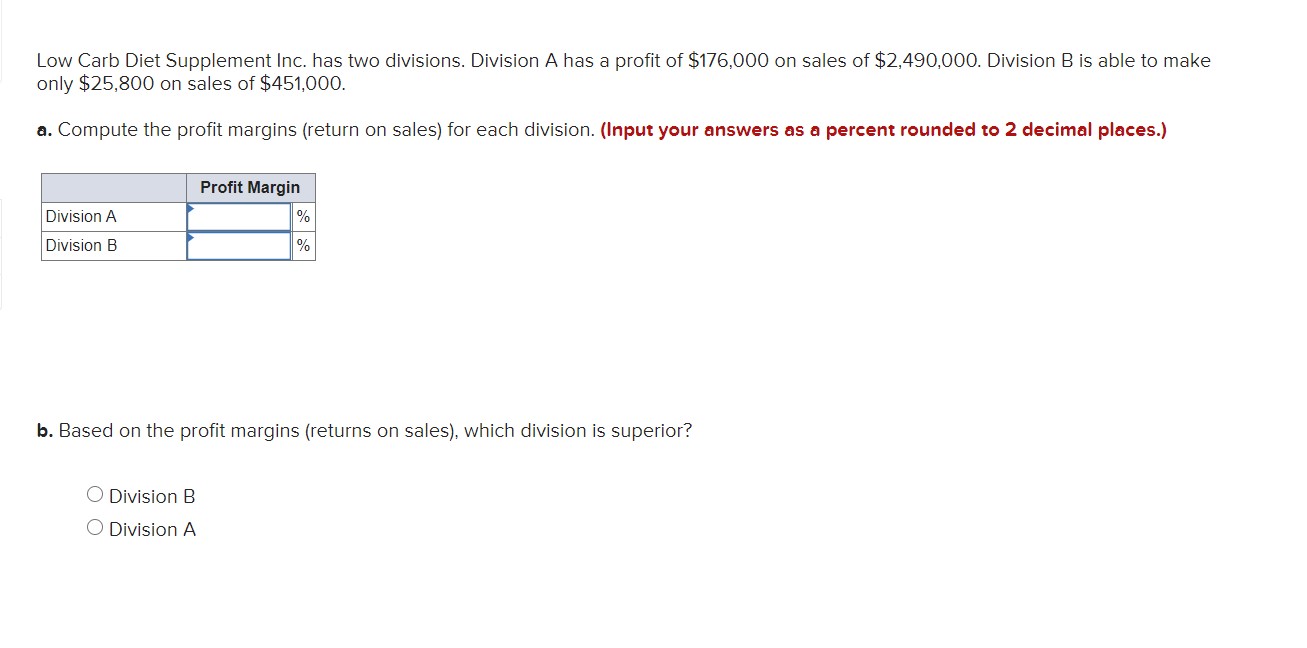

Database Systems is considering expansion into a new product line. Assets to support expansion will cost $580,000. It is estimated that Database can generate $1,640,000 in annual sales, with an 10 percent prot margin. What would net income and return on assets (investment) be for the year? (Input your return on assets answer as a percent rounded to 2 decimal places.) Net income Return on assets % Using the Du Pont method, evaluate the effects of the following relationships for the Butters Corporation. a. Butters Corporation has a prot margin of? percent and its return on assets (investment) is 19 percent. What is its assets turnover? (Round your answer to 2 decimal places.) Assets tumove r ra o I times b. If the Butters Corporation has a debttototalassets ratio of 30.00 percent, what would the rm's return on equity be? (Input your answer as a percent rounded to 2 decimal places.) Return on equity '36 c. What would happen to return on equity ifthe debttototalassets ratio decreased to 25.00 percent? (Input your answer as a percent rounded to 2 decimal places.) Relmn on equity 'M: Jerry Rice and Grain Stores has $4,320,000 in yearly sales. The rm earns 1.8 percent on each dollar of sales and turns over its assets 3.5 times per year. It has $139,000 in current liabilities and $372,000 in longeterm liabilities. a. What is its return on stockholders' equity? {Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Return on stockholders' equity '96 b. lfthe asset base remains the same as computed in part a. but total asset turnover goes up to 4.00, what will be the new return on stockholders' equity? Assume that the prot margin stays the same as do current and longterm liabilities. {Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) New return on stockholders equity E '95 The balance sheet for Stud Clothiers is shown next. Sales for the year were $3,880,000. with 75 percent of sales sold on credit. STUD CLUTHI E R5 Balance Sheet 29X1 Assets Liabilities and Equity Cash $ 69,993 Accounts payable $ 279,933 Accounts receivable 311,999 Accrued taxes 91,999 Inventory 276,999 Bonds payable (long-term) 132,999 Plant and equipment 389,999 Common stock 199,999 Paid-in capital 159,999 Retained earnings 284,999 Total liabilities and equity $ 118351663 Compute the following ratios: (Use a 360-day year. Do not round intermediate calculations. Round your answers to 2 decimal places. Input your debt-to-total assets answer as a percent rounded to 2 decimal places.) a. Current ratio times b. Quick ratio times c. DebttototaIassets ratio \"A: d Asset turnover times e. Average collection period days The Rogers Corporation has a gross prot of $792,000 and $277,000 in depreciation expense. The Evans Corporation also has $792,000 in gross profit, with $43,300 in depreciation expense. Selling and administrative expense is $188,000 for each company. a. Given that the tax rate is 40 percent, compute the cash ow for both companies. Rogers Evans Cash ow b. Calculate the difference in cash flow between the two firms. Difference in cash ow I I The Holtzman Corporation has assets of $384,000, current liabilities of $54,000, and longeterm liabilities of $79,000. There is $36,800 in preferred stock outstanding; 20,000 shares of common stock have been issued. a. Compute book value (net worth) per share. (Round your answer to 2 decimal places.) Book value per share I b. If there is $32,800 in earnings available to common stockholders, and Holtzman's stock has a PIE of19 times earnings per share, what is the current price of the stock? (Do not round intermediate calculations. Round your nal answer to 2 decimal places.) Current price I c. What is the ratio of market value per share to book value per share? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Ma met value to book value I times Low Carb Diet Supplement Inc. has two divisions. Division A has a prot of $176,000 on sales of $2,490,000. Division B is able to make only $25,800 on sales of $451,000. :1. Compute the prot margins (return on sales) for each division. (Input your answers as a percent rounded to 2 decimal places.) Prot Margin Division A % DiviSion B % b. Based on the prot margins (returns on sales), which division is superior? 0 Division B 0 Division A