Question: Please help solve Design a spreadsheet similar to the one below to compute the value of a variable growth rate firm over a five-year horizon.

Please help solve

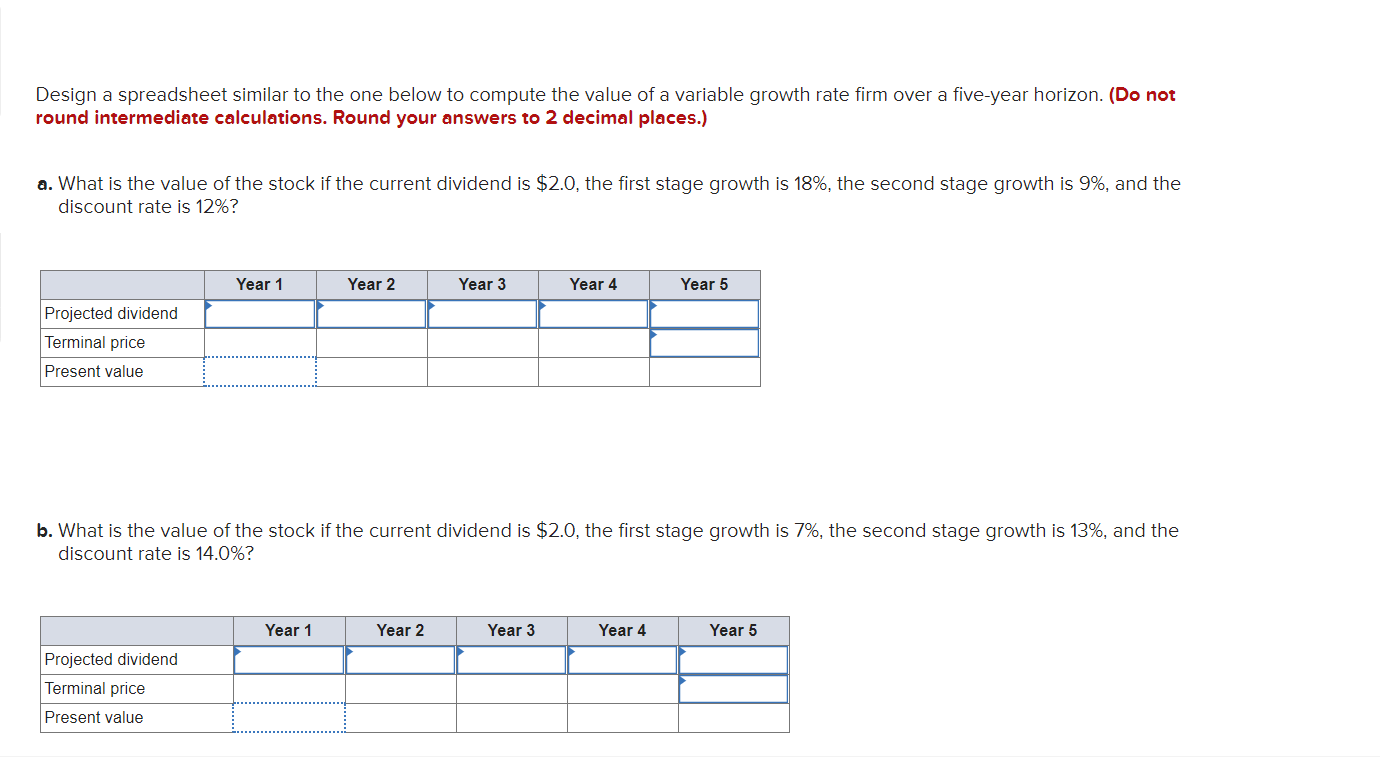

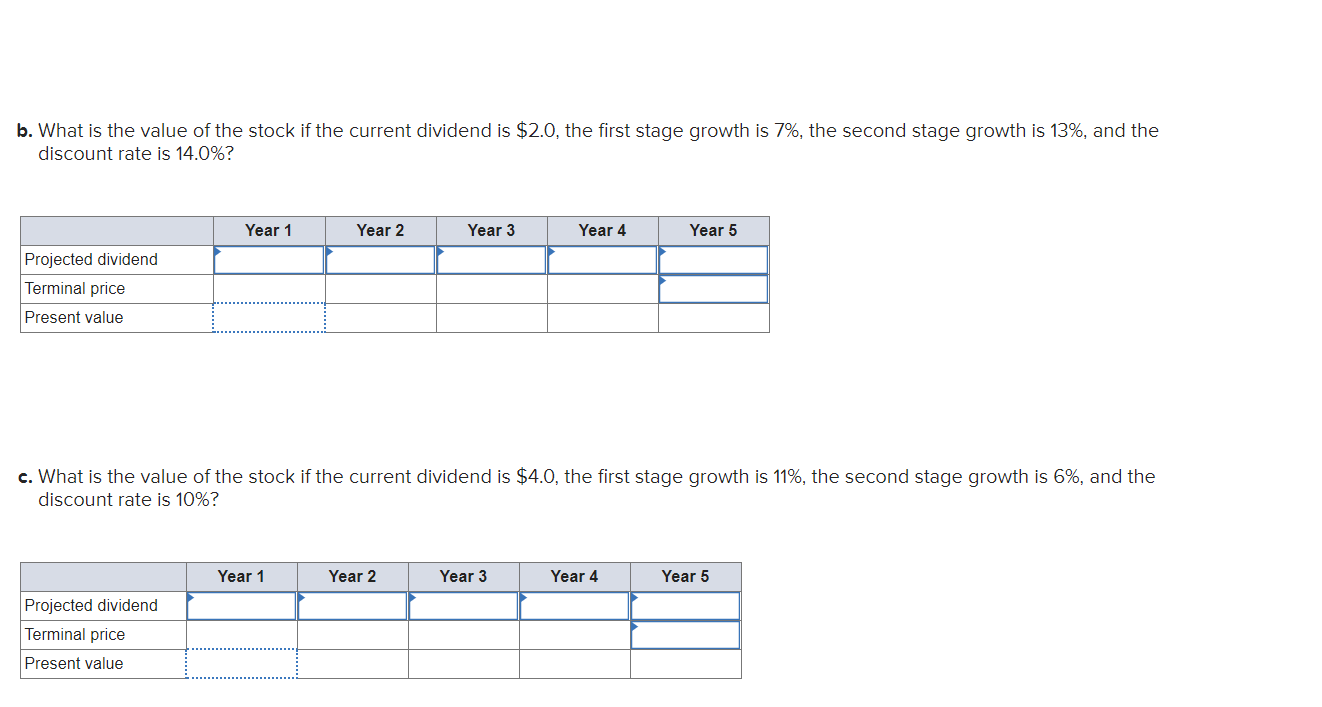

Design a spreadsheet similar to the one below to compute the value of a variable growth rate firm over a five-year horizon. (Do not round intermediate calculations. Round your answers to 2 decimal places.) a. What is the value of the stock if the current dividend is $2.0, the first stage growth is 18%, the second stage growth is 9%, and the discount rate is 12%? Year 1 Year 2 Year 3 Year 4 Year 5 Projected dividend Terminal price Present value b. What is the value of the stock if the current dividend is $2.0, the first stage growth is 7%, the second stage growth is 13%, and the discount rate is 14.0%? Year 1 Year 2 Year 3 Year 4 Year 5 Projected dividend Terminal price Present value b. What is the value of the stock if the current dividend is $2.0, the first stage growth is 7%, the second stage growth is 13%, and the discount rate is 14.0%? Year 1 Year 2 Year 3 Year 4 Year 5 Projected dividend Terminal price Present value c. What is the value of the stock if the current dividend is $4.0, the first stage growth is 11%, the second stage growth is 6%, and the discount rate is 10%? Year 1 Year 2 Year 3 Year 4 Year 5 Projected dividend Terminal price Present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts