Question: please help solve each question Ethics Case 11-6 Earnings management and accounting changes; impairment [ LO11-5, [ LO11-6, [C] LO11-8 Companies often are under pressure

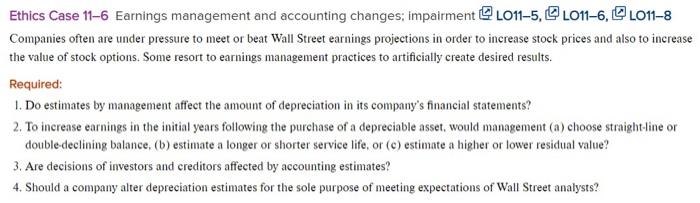

Ethics Case 11-6 Earnings management and accounting changes; impairment [ LO11-5, [ LO11-6, [C] LO11-8 Companies often are under pressure to meet or beat Wall Street earnings projections in order to increase stock prices and also to increase the value of stock options. Some resort to earnings management practices to artificially create desired results. Required: 1. Do estimates by management affect the amount of depreciation in its company's financial statements? 2. To increase earnings in the initial years following the purchase of a depreciable asset, would management (a) choose straight-line or double-declining balance, (b) estimate a longer or shorter service life, or (c) estimate a higher or lower residual value? 3. Are decisions of investors and creditors affected by accounting estimates? 4. Should a company alter depreciation estimates for the sole purpose of meeting expectations of Wall Street analysts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts