Question: please help solve each section listed in excel with formulas! thank you! Question 2: The top management team of a firm purchased the company with

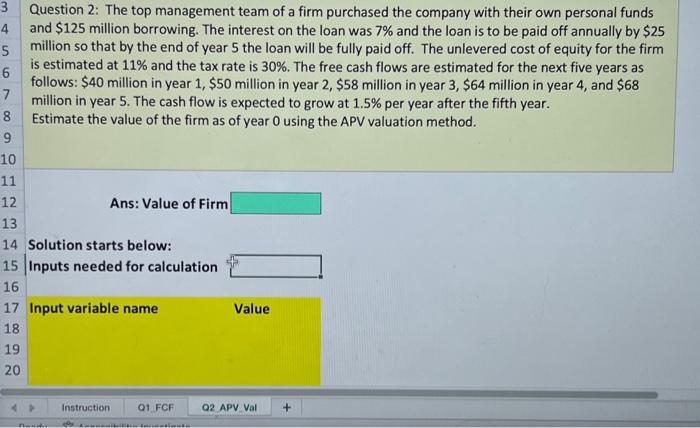

Question 2: The top management team of a firm purchased the company with their own personal funds and $125 million borrowing. The interest on the loan was 7% and the loan is to be paid off annually by $25 million so that by the end of year 5 the loan will be fully paid off. The unlevered cost of equity for the firm is estimated at 11% and the tax rate is 30%. The free cash flows are estimated for the next five years as follows: $40 million in year 1,$50 million in year 2,$58 million in year 3,$64 million in year 4 , and $68 million in year 5 . The cash flow is expected to grow at 1.5% per year after the fifth year. Estimate the value of the firm as of year 0 using the APV valuation method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts