Question: please help solve for a thumbs up! really appreciate the help! Ty (Annuity payments) To pay for your education, you've taken out $20,000 in student

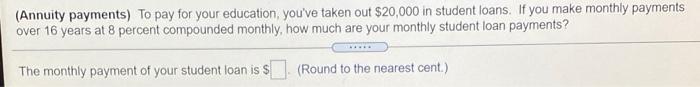

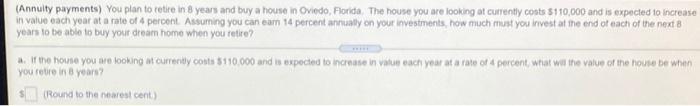

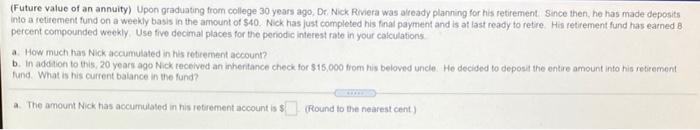

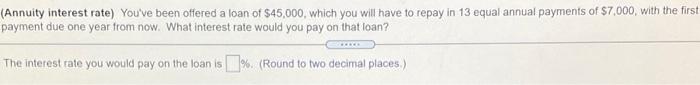

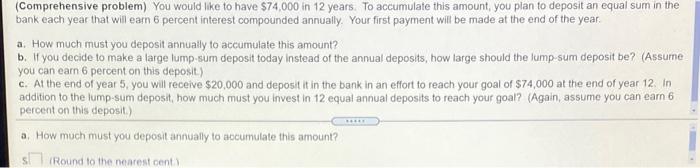

(Annuity payments) To pay for your education, you've taken out $20,000 in student loans. If you make monthly payments over 16 years at 8 percent compounded monthly, how much are your monthly student loan payments? The monthly payment of your student loan is $(Round to the nearest cent.) (Annuity payments) You plan to retire in 8 years and buy a house in Oviedo, Florida. The house you are looking at currently costs $110,000 and is expected to increase in value each your at a rate of a percent. Assuming you can eam 14 percent annually on your investments, how much must you invest at the end of each of the next 8 years to be able to buy your dream home when you retire? 3. Ir the home you are looking at currently costs $110.000 and is expected to increase in vas each year at a rate of percent, what wil the value of the house be won you retire in 8 years (Round to the nearest Cent) (Future value of an annuity) Upon graduating from college 30 years ago, Dr. Nick Riviera was already planning for his retirement. Since then, he has made deposits into a retirement fund on a weekly basis in the amount of $40. Nick has just completed his final payment and is at last ready to retire His retirement fund has earned B percent compounded weekly. Use five decimal places for the periodic interest rate in your calculations a How much has Nick accumulated in his rebrement account? b. In addition to this 20 years ago Nick received an inheritance check for $15,000 from his beloved uncle. He decided to deposit the entire amount into his retirement fund. What is his current balance in the fund? The amount Nick has accumulated in his retirement account is (Round to the nearest cent) (Annuity interest rate) You've been offered a loan of $45,000, which you will have to repay in 13 equal annual payments of $7,000, with the first payment due one year from now. What interest rate would you pay on that loan? The interest rate you would pay on the loan is 1%. (Round to two decimal places.) (Comprehensive problem) You would like to have $74.000 in 12 years. To accumulate this amount, you plan to deposit an equal sum in the bank each year that will earn 6 percent interest compounded annually. Your first payment will be made at the end of the year. a. How much must you deposit annually to accumulate this amount? b. If you decide to make a large lump sum deposit today instead of the annual deposits, how large should the lump-sum deposit be? (Assume you can earn 6 percent on this deposit.) c. At the end of year 5, you will receive $20,000 and deposit it in the bank in an effort to reach your goal of $74,000 at the end of year 12 in addition to the lump sum deposit, how much must you invest in 12 equal annual deposits to reach your goal? (Again, assume you can earn 6 percent on this deposit a. How much must you deposit annually to accumulate this amount? 1 sl (Round to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts