Question: please help solve for DY3 and CGY3 Goodwin Technologies, a relatively young company, has been wildly successful but has yet to pay a dividend. An

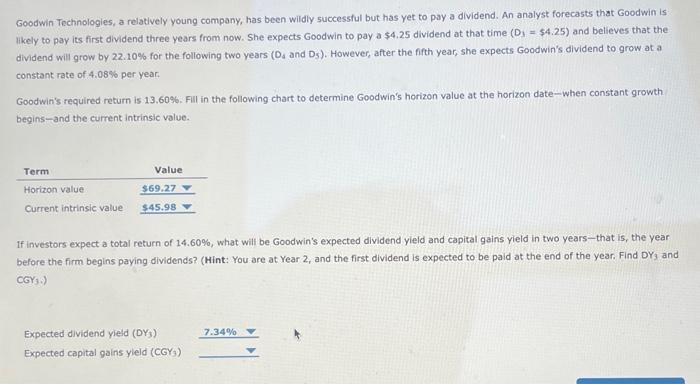

Goodwin Technologies, a relatively young company, has been wildly successful but has yet to pay a dividend. An analyst forecasts that Goodwin is likely to pay its first dividend three years from now. She expects Goodwin to pay a $4.25 dividend at that time (D) =$4.25 ) and believes that the dividend will grow by 22.10% for the following two years ( D4 and D5 ). However, after the fifth year, she expects Goodwin's dividend to grow at a constant rate of 4.08% per year. Goodwin's required return is 13.60\%. Fill in the following chart to determine Goodwin's horizon value at the horizon date-when constant growth begins-and the current intrinsic value. If investors expect a total return of 14.60%, what will be Goodwin's expected dividend yield and capital gains yield in two years-that is, the year before the firm begins paying dividends? (Hint: You are at Year 2, and the first dividend is expected to be paid at the end of the year. Find DY, and CGY3.) Goodwin Technologies, a relatively young company, has been wildly successful but has yet to pay a dividend. An analyst forecasts that Goodwin is likely to pay its first dividend three years from now. She expects Goodwin to pay a $4.25 dividend at that time (D) =$4.25 ) and believes that the dividend will grow by 22.10% for the following two years ( D4 and D5 ). However, after the fifth year, she expects Goodwin's dividend to grow at a constant rate of 4.08% per year. Goodwin's required return is 13.60\%. Fill in the following chart to determine Goodwin's horizon value at the horizon date-when constant growth begins-and the current intrinsic value. If investors expect a total return of 14.60%, what will be Goodwin's expected dividend yield and capital gains yield in two years-that is, the year before the firm begins paying dividends? (Hint: You are at Year 2, and the first dividend is expected to be paid at the end of the year. Find DY, and CGY3.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts