Question: Please help solve if the answers are correct and how to get the value of tax shield and value of operations: Merger analysis - Adjusted

Please help solve if the answers are correct and how to get the value of tax shield and value of operations:

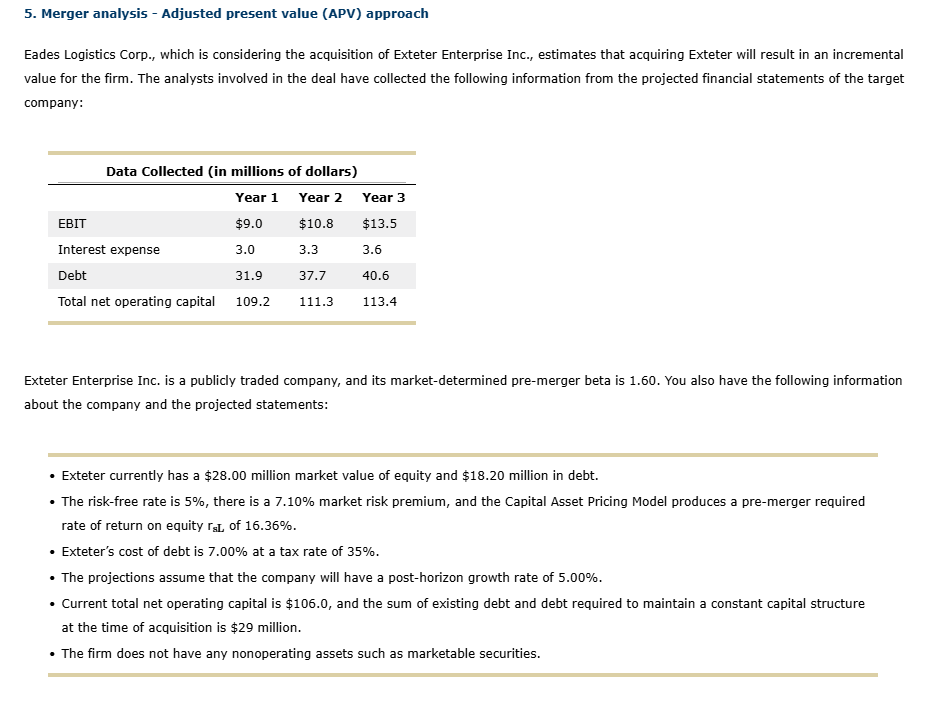

Merger analysis Adjusted present value APV approach

Eades Logistics Corp., which is considering the acquisition of Exteter Enterprise Inc., estimates that acquiring Exteter will result in an incremental

value for the firm. The analysts involved in the deal have collected the following information from the projected financial statements of the target

company:

Exteter Enterprise Inc. is a publicly traded company, and its marketdetermined premerger beta is You also have the following information

about the company and the projected statements:

Exteter currently has a $ million market value of equity and $ million in debt.

The riskfree rate is there is a market risk premium, and the Capital Asset Pricing Model produces a premerger required

rate of return on equity rsL of

Exteter's cost of debt is at a tax rate of

The projections assume that the company will have a posthorizon growth rate of

Current total net operating capital is $ and the sum of existing debt and debt required to maintain a constant capital structure

at the time of acquisition is $ million.

The firm does not have any nonoperating assets such as marketable securities Given this information, use the adjusted present value APV approach to calculate the following values involved in merger analysis. Note: Only round intermediate calculations when entering them as a final answer.

Thus, the total value of Exteter's equity is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock