Question: please help solve in excel share the formula please Sales for 2020 are projected to grow by 20 percent Interest expense and depreciation expense will

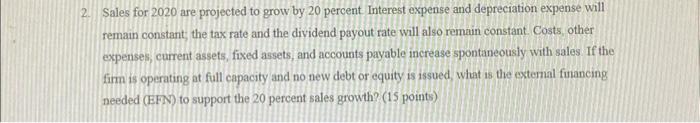

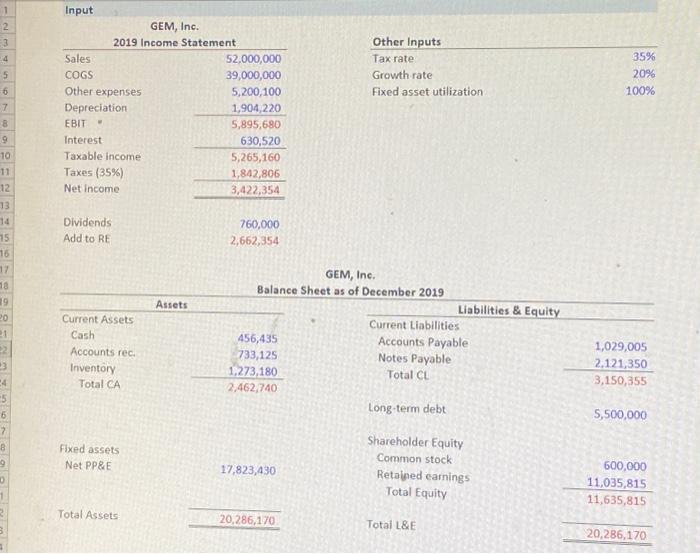

Sales for 2020 are projected to grow by 20 percent Interest expense and depreciation expense will remain constant the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no new debt or equity is issued, what is the external fuancing needed (EFN) to support the 20 percent sales growth? (15 points) GEM, Inc. 2019 Income Statement \begin{tabular}{lr} \hline Sales & 52,000,000 \\ COGS & 39,000,000 \\ Other expenses & 5,200,100 \\ Depreciation & 1,904,220 \\ EBIT - & 5,895,680 \\ Interest & 630,520 \\ Taxable income & 5,265,160 \\ Taxes (35\%) & 1,842,806 \\ Net income & 3,422,354 \\ \hline \end{tabular} Other Inputs Taxrate Growth rate Fixed asset utilization 760,000 2,662,354 GEM, Ine. Balance Sheet as of December 2019 Asrets Current Assets Cash Accounts rec. Inventory Total CA Fixed assets Net PP\&E 17,823,430 Total Assets Current Liabilities Accounts Payable Notes Payable Total CL Long-term debt 5,500,000 Shareholder Equity Common stock Retained earnings Total Equity Totai L\&E Liabilities \& Equity 1,029,005 3,150,3552,121,350 5,500,000 600,00011,035,81511,635,815 20,286,170

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts